BTC/USD outlook: Bitcoin rises above 30000 for the first time since June 2022

BTC/USD

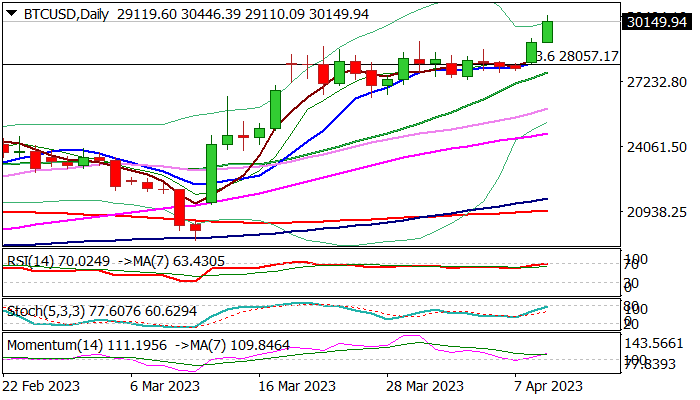

Bitcoin rose above psychological 30000 barrier on Tuesday, hitting the levels last traded in June 2022.

Fresh bullish acceleration extends into the second straight day, signaling an end of consolidation phase of past three weeks and continuation of larger uptrend.

The action is supported by firmly bullish daily studies, as positive momentum is strengthening and moving averages are in full bullish setup, though with warning from RSI and stochastic hitting the borderline of overbought territory.

Improved sentiment lifted Bitcoin and traders focus on key economic events this week, but one of key drivers is likely opening of China’s state-controlled social media for cryptos and digital assets, as Bitcoin price is now visible on China’s version of Tik Tok.

This signals that overall sentiment can improve further, as demand and liquidity are expected to rise and boost Bitcoin’s price, which gained over 80% since the beginning of the year.

Fresh bulls are on track to fill the gap of May 2022 which would firm the structure for test of next target at 31817 (50% retracement of 48197/15437 fall) and possible stronger acceleration towards 34400/35000 zone.

Weekly close above broken Fibo barrier at 28057 (23.6% of 48197/15437 is needed to keep bulls intact.

Res: 30460; 31000; 31817; 32297.

Sup: 30000; 29157; 27308; 26466.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.