BTC/USD due for a Fibonacci retracement

Market news

Billions of U.S dollars were lost from the entire cryptocurrency exchange following Tesla's CEO Elon Musk's statement on tweeter that the electric vehicle giant would reject any car purchases utilizing bitcoin for now.

According to data from Coinmarketcap.com early today, while Tesla's CEO delivered the news, the value of the entire cryptocurrency market was at about $2.43 trillion.

About 8:45 a.m. the crypto market capitalization had fallen to approximately $2.06 trillion, washing off about $365.85 billion.

Last Tesla stated in an administrative filing that it had bought $1.5 billion worth of bitcoin and intended to allow the cryptocurrency for payments.

Technical analysis

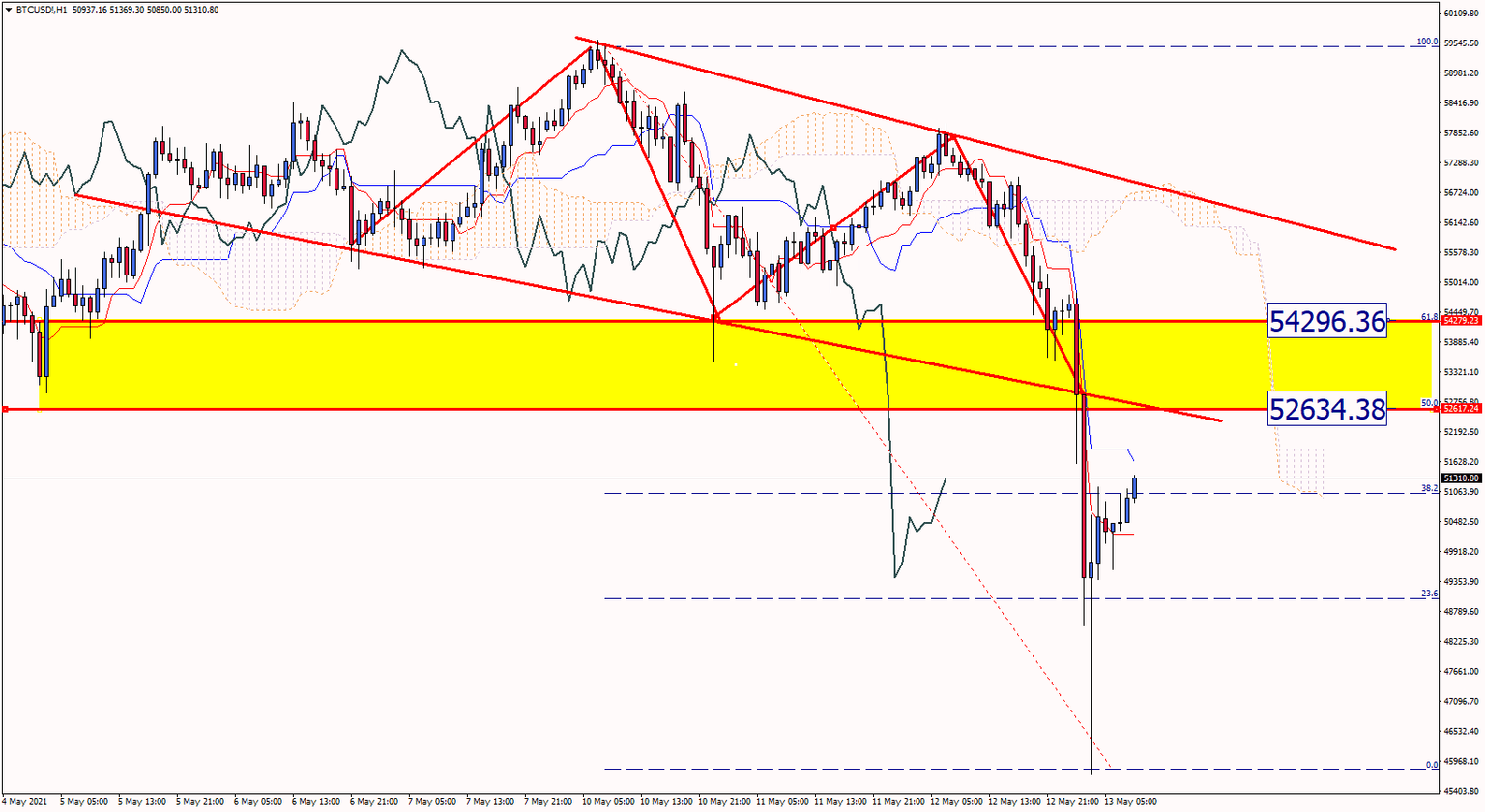

Now on the technical side as we can see on the BTCUSD 1H timeframe the price has initiated a confirmed Kumo break-out signal because the price is under the cloud and Tenkan sen, Kijun sen, and Chikou span are under the cloud as well.

Taking that into consideration our bias, for now, should be on the bearish side because of the Ichimoku bear signal, and some key resistance areas worth watching.

Fibonacci levels between 61.8 and 50 should be on our list. If the price reach between the 2 levels we can consider taking a short position after the completion of the next bear candle.

"Another factor should be the market news because negative news tends to be more active rather than positive news."

Author

Marios Athinodorou

Independent Analyst

Marios Athinodorou is a seasoned Market Analyst and Trading Tutor. With a passion for financial markets, Marios started his journey in Forex trading in 2012.