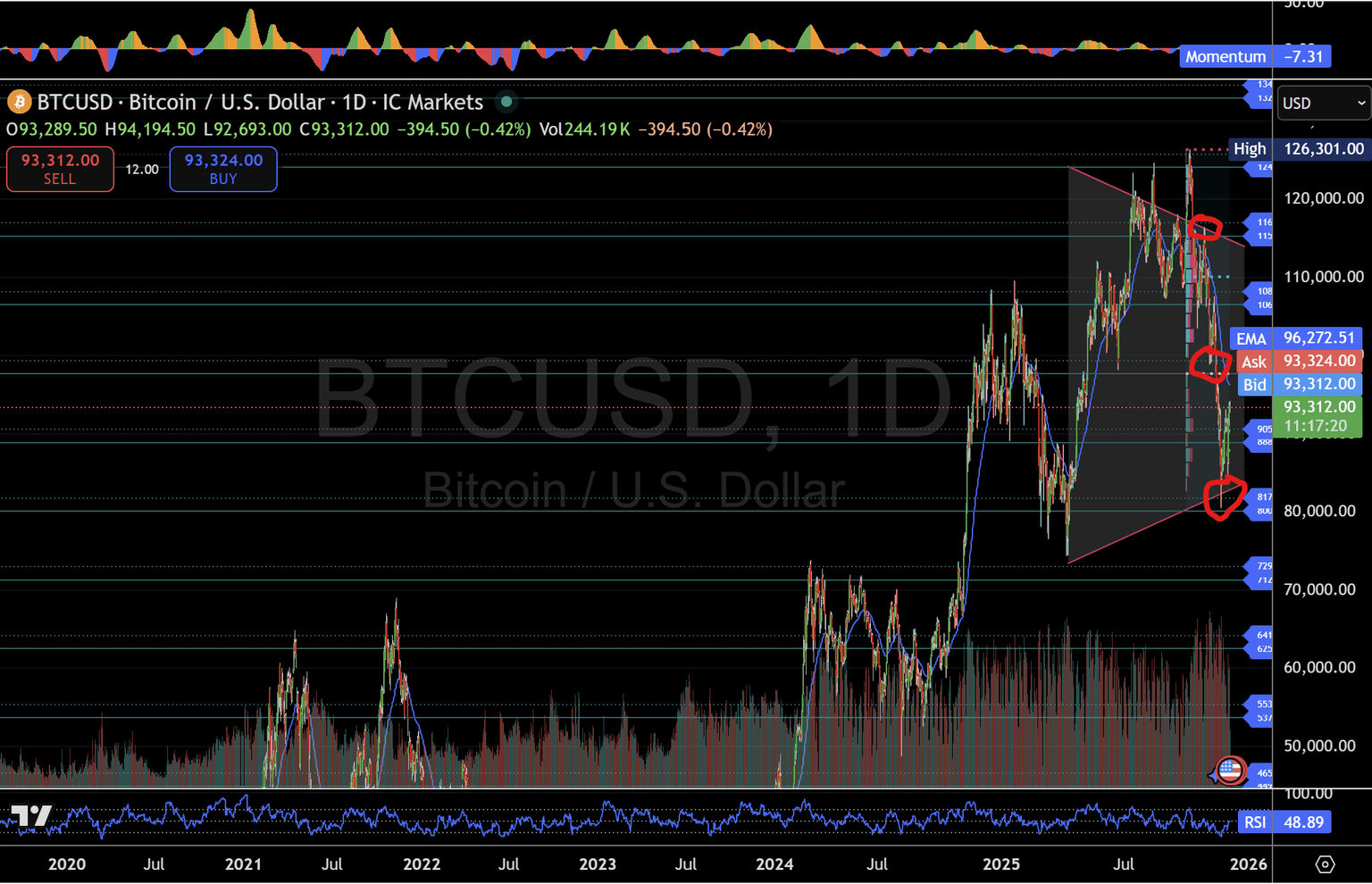

BTC recovery stalls below 93,470 as macrostructure maps the next major turning point

Bitcoin forms another higher low, but failure at the 87,824 pivot risks a deeper retest of the lower intraday Structure.

In our December 4 analysis, we highlighted the challenges Bitcoin (BTC/USD) faces in attempting a recovery while trading below major daily HTF supply zones. In today's update, we zoom in on the 1-hour MacroStructure map to analyse how the broader daily trend is expressing itself through short-term rotations.

At the time of our previous update, Bitcoin traded near 93,300. As of December 7, BTC trades around 88,900, down approximately $4,400 — a move fully aligned with the expected pullback from the upper intraday pivots.

Daily structure – Intraday structure: How they connect

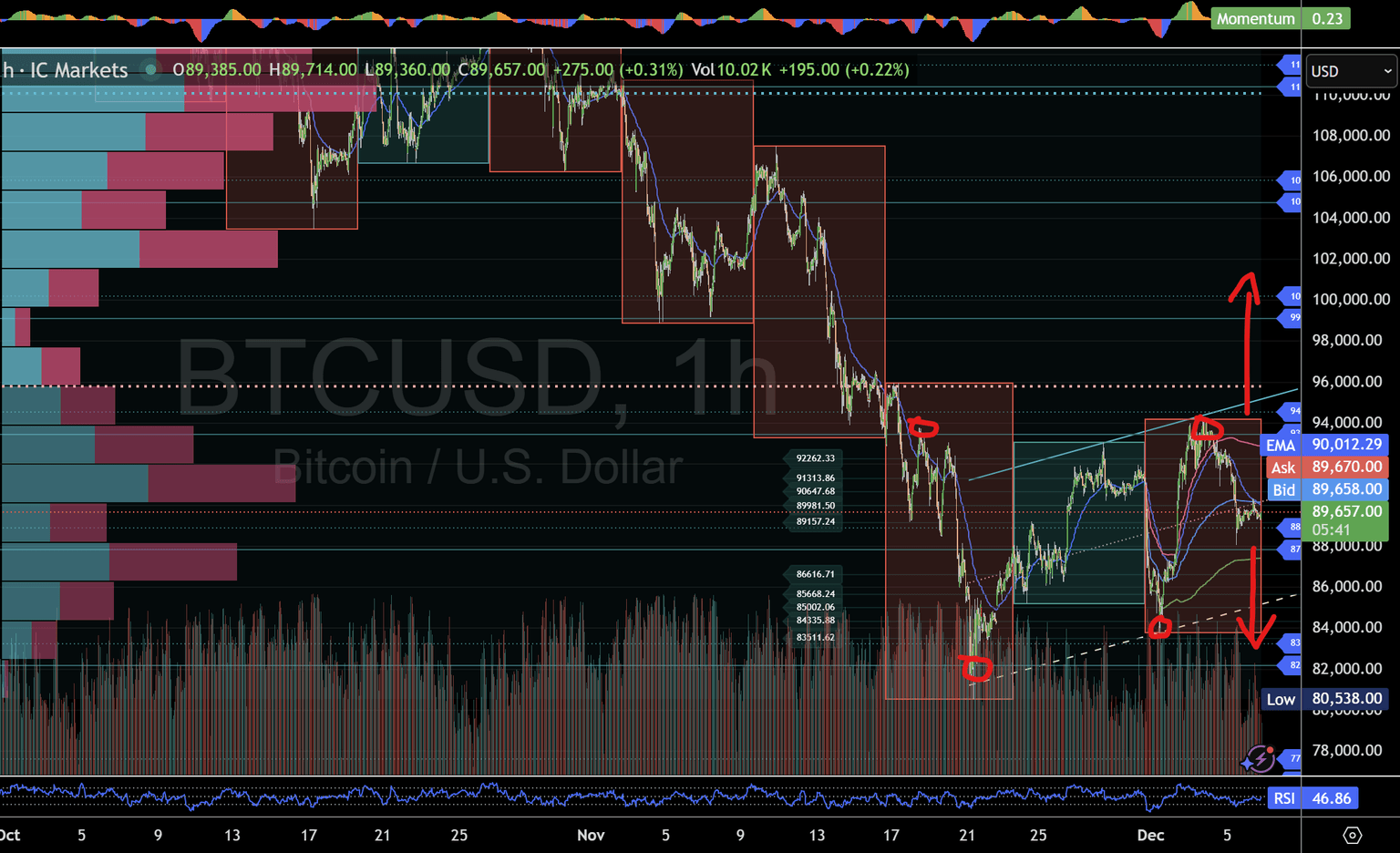

Our December 4 analysis showed that Bitcoin's recovery remains restricted under heavy daily supply (97k–99k). The 1-hour Chart now confirms how that daily resistance has cascaded into intraday behaviour:

- BTC was rejected precisely at 93,470, the same pivot identified on November 18.

- Intraday micro 5 (92,262) delivered the expected sell zone.

- Micro 1 (89,157) was the corrective target.

- A new higher low has now formed inside the rising channel.

- But buyers continue to struggle at the same structural ceilings.

This is a perfect continuation of the MacroStructure thesis:

The daily frame sets the direction; the intraday frame shows the mechanics.

Weekly price block (Dec 1–7): Microstructure leads the rotation

Bitcoin's reversal began at the micro 2 level (84,335), forming a strong AVP block on the left of the Chart. From there:

- BTC hit micro 5 (86,616).

- Cleared the 87,834 pivot.

- Extended into the micro 1–5 upper range (89,157–92,262).

- Retested 93,470, the pivotal November high.

This rotation followed the MacroStructure pathway precisely.

The failure at 93,470 triggered the expected downward rotation back into 89,157, completing a clean microcycle.

BTC now trades near 89,500, forming another higher low but still trapped inside a tightening channel.

Where bears are defending

Bears remain active at:

- 92,262 (intraday micro 5 ceiling).

- 93,470 (multi-week pivot rejection point).

- Downtrend diagonal from the November structure

These levels continue to cap upward momentum — a direct reflection of the broader HTF resistance.

Where bulls must hold

BTC is now sitting inside a crucial structural confluence:

- Micro 1 (89,157).

- Micro 2 (89,981).

- 87,824 pivot.

- AVP demand block.

A breakdown here risks shifting the entire intraday trend.

MacroStructure scenarios (Dec 7–10)

Bullish scenario — Hold above 87,824

Holding above 87,824 opens:

- Return to 92,262 (micro 5).

- Retest of 93,470.

- Breakout – expansion toward 99,116–100,194.

This would align with the daily recovery attempt back toward 97k–99k.

Bearish scenario — Lose 87,824

Failure to hold the pivot exposes:

- 83,511 (lower micro 1 target)

- 76,533–77,611 (major liquidity pocket)

- Risk of breaking the entire higher-low Structure

This would decisively shift short-term control back to the bears.

Bottom line: BTC is coiling for its next high-energy move

Bitcoin is compressing between:

- Upper intraday supply: 92,262–93,470.

- Lower intraday demand: 89,157–87,824.

A break from this tightening structure will set the tone for the next multi-session move.

Hold demand – bulls retest 93,470.

Lose demand – deeper rotation toward 83,511 and lower.

The views expressed in this analysis are solely those of the author and should not be interpreted as investment advice. Trading involves significant risk, and individuals should evaluate their personal financial situation before trading.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.