Breaking: The largest commercial bank in Singapore launches cryptocurrency exchange

- The largest bank in Singapore launches a regulated cryptocurrency exchange.

- The platform will support four coins and four fiat currencies.

DBS, of the largest commercial banks in Singapore, announced the soft launch of the proprietary crypto-to-fiat cryptocurrency trading platforms.

At the initial stages, the users will have access to the four largest digital assets: BTC, BCH, ETH, XRP. They will be available for trading against Singapore Dollar (SGD), Hong Kong Dollar (HKD), Japanese Yen (JPY), and US Dollar (USD) with the trading fee of 10 bps.

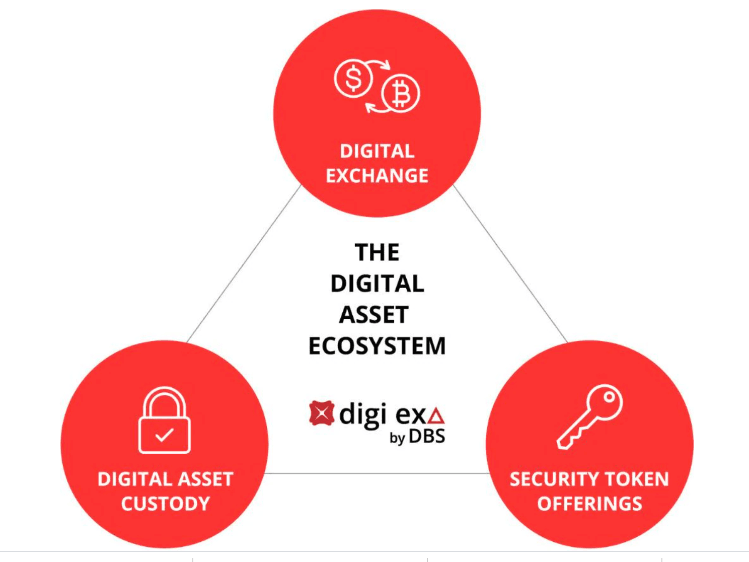

The exchange will be a part of a broader digital ecosystem that will also include digital asset custody and security token offerings. The company believes that the new platform will allow companies and investors to leverage the potential of private markets and digital currencies.

DBS Digital Exchange

Source: DBS

Through DBS Digital Exchange, SMEs and large corporates alike can also tap on a Security Token platform to raise capital efficiently through the digitization of their securities and assets, enabling issuers to reach a wider base of investors that might not traditionally have access to such tokens.

The new exchange is regulated by the Monetary Authority of Singapore. The bank also pointed out that investors in the new types of assets will be able to benefit from its vast experience in capital markets and custodial services.

The information leaked on Twitter and later on the bank took the page with the exchange offline, now only accessible through a cached website page.

Notably, the bank made a typo and stated one trading pair with ETC in its FAQ section, leading to jokes on social media.

Author

Tanya Abrosimova

Independent Analyst