Breaking: Over $50 million in Bitcoin leave OKEx as the exchange re-opens withdrawals

OKEx, one of the world's largest cryptocurrency exchanges, unlocked the withdrawal functionality ahead of the scheduled time. According to the official blog information, users' funds have been unlocked at 8:00 (UTC) on November 26, 2020.

The development led to a massive BTC outflow from the exchange. As on-chain data provider CryptoQuant reports, users took away 2,822 BTC worth of over $50 million, which is the most significant one-time withdrawal amount in the company's history.

The cryptocurrency exchange platform users were deprived of access to their funds for over a month as one of the company's top executives and a holder of private keys was under investigation.

Read the full story of what happened with OKEx here.

OKEx withdrawals unleashed market volatility

As FXStreet previously reported, the event might have resulted in a spike in market volatility. Traders started taking out their coins and cashing them out to book profits. Thus, Bitcoin gained over 30% in less than a month, meaning that some users might have wanted to benefit from the rally.

While the Bitcoin's sell-off started before the platform users got a chance to get their coins back, the OKEx move might have increased the bearish pressure on the cryptocurrency market.

Bitcoin drops below $17,000

The pioneer digital asset dropped below $17,000 and retested $16,200, losing over 12% of its value from the recent peak of $19,500. At the time of writing, BTC/USD is changing hands at $17,200, with the first strong resistance located on the approach to $18,000.

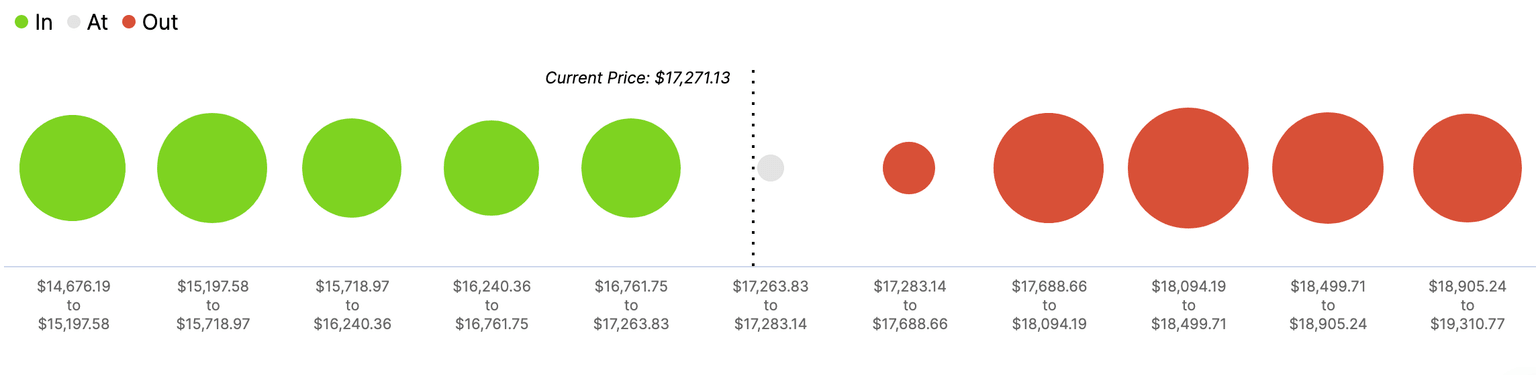

Bitcoin's In/Out of the Money Around Price" (IOMAP)

IntoTheBlock's "In/Out of the Money Around Price" (IOMAP) model reveals that nearly 350,000 Bitcoin addresses previously purchased about 250,000 BTC between $17,600 and $18,000. Once this area is cleared, the recovery may be extended towards $18,500. However, the road to the upside is now cluttered with barriers that go all the way up to $19,000. A rejection at $18,000 may push the price back to $17,000. This support is followed by the intraday low of $16,200.

Author

Tanya Abrosimova

Independent Analyst