Breaking: Bitcoin price bleeds with ECB's first rate hike in a decade

- Bitcoin price plummeted to $22,600 level as ECB raises interest rates by 0.5% for the first time in eleven years.

- Bitcoin, Ethereum and altcoins nearly recouped their losses from the US CPI rate hike, now hit with ECB’s decision.

- Analysts believe Bitcoin price could nosedive if it fails to climb above 200-week Moving Average.

Bitcoin price slipped below $23,000 as the European Central Bank announced its first rate hike in eleven years. Rising inflation was the bank’s primary cause of concern, the move increased pressure on Bitcoin price. Analysts have predicted a steep decline in Bitcoin price, if the asset fails to make a comeback above 200-week Moving Average.

Also read: Three reasons why Bitcoin price could witness a short squeeze

Bitcoin loses grip on $23,000 with ECB’s rate hike announcement

Bitcoin price suffered a decline below $23,000 as bears took over the reins. The European Central Bank’s rate hike announcement is the first of its kind in over a decade as the bank raises concerns of rising inflation.

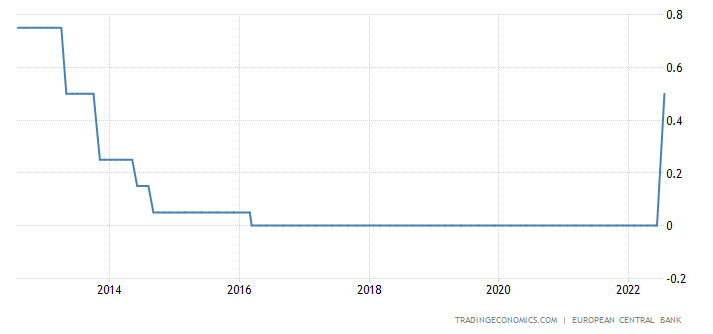

The hike of 50-basis points was higher than expected by analysts. This marks a significant move from the zero-interest rate environment nurtured by the EU since 2016. Experts predicted a 25-basis point hike, however soaring consumer prices over the past few weeks in the Eurozone is considered the cause for a 50-point hike.

The ECB issued a statement:

The Governing Council judged that it is appropriate to take a larger first step on its policy rate normalization path than signaled at its previous meeting.

The ECB will work on further normalization of interest rates at the Governing Council’s upcoming meetings. The move away from negative interest rates allowed the council to make a key transition to a meeting-by-meeting approach to interest rate decisions.

Ahead of the ECB rate hike announcement, the crypto market witnessed a bloodbath. Bitcoin, Ethereum and cryptocurrencies in the top 30 wiped out their losses from the past week. Investors turned cautious and pulled out of volatile markets, including crypto. It is important to note that the impact may be of a temporary nature as Bitcoin, Ethereum and cryptocurrencies recovered from the US CPI rate hike announcement within 48 hours.

Euro Area Interest Rate

Bitcoin price is at risk of further decline

Analysts at FXStreet evaluated the Bitcoin price trend and predicted further decline in the asset. If BTC fails to recover above 200-week Moving Average, Bitcoin could continue its downtrend. For more information and key price levels, check this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.