BNB price freefall is unstoppable after bearing the weight of a $100 million hack

- Binance Coin price pullback from $299 to a target at $268.

- Investors react to the $100 million hack attack on the BSC protocol, selling in droves.

- Overhead pressure from the weekend validates a rising wedge pattern, hinting at extended declines.

Binance Coin price is seeking relief from a sell-off after reports of a hack attack on the BSC (Binance Smart Chain) protocol. Before the hacker made away with $100 million worth of BNB on October 6, Binance Coin price rallied, almost brushing shoulders with $300. Meanwhile, BNB exchanges hands 7.96% below its monthly high ($299) and amidst risks of extending its down leg to $268.

Binance Coin holders push for lower BNB prices

The CEO of Binance exchange, Changpeng Zhao (CZ), confirmed an exploit on a cross-chain bridge – BSC Token Hub, which led to the loss of $100 million worth of BNB tokens. The attacker targeted approximately $570 million of the token but only made away with $100 million.

Despite CZ assuring the community that no users lost funds, selling pressure continues to mount on the token, which has plunged from $299 to trade at $274 on Monday. Attacks on DeFi (decentralized finance) platforms have intensified amid concerns about the lack of proper regulations in the sector. CZ asked developers to be vigilant and learn from such incidents, keeping in mind that creating a bug-free code is challenging.

Selling activities are still on the roof several days after the hack attack. According to Santiment’s Negative Social Sentiment line graph, investors are not happy with the news of the attack. As observed, Binance Coin price plummeted as the on-chain metric spiked to 278.

Binance Coin Negative Sentiment (total)

The pressure on BNB price is unlikely to shrink, especially with its negative sentiment rising again at 78.16 from Sunday’s low at 7.35. Moreover, bulls may have seized the moment to push for lower prices to favor ‘discounted’ entries for sidelined investors.

BNB price decline eyes $268

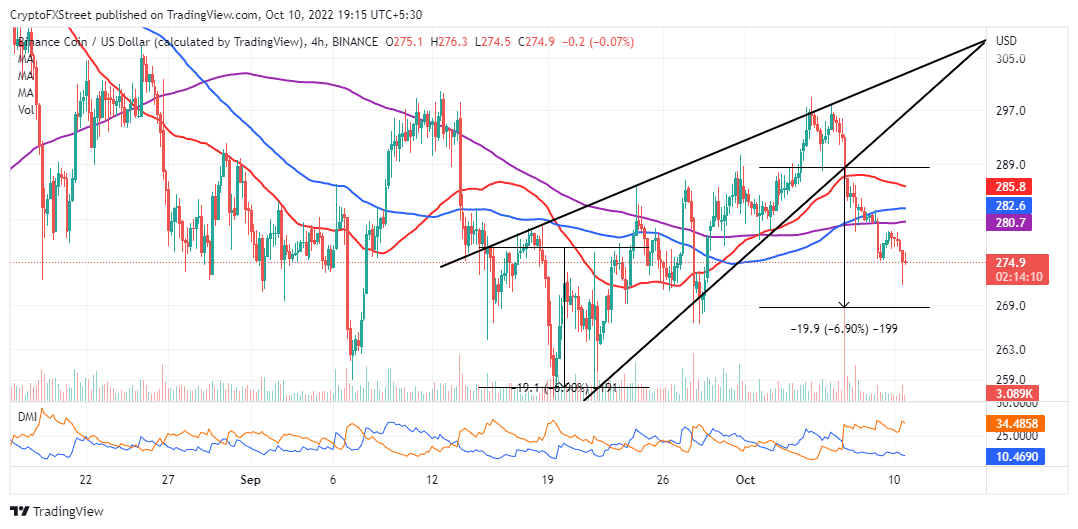

A rising wedge pattern formed on the 12-hour chart as Binance Coin rallied to $299. The native exchange token needed a little push above $300 to activate its next recovery phase to $400. However, negative market forces have not stopped beating the token to the extent of triggering a breakout below the rising wedge.

BNB/USD four-hour chart

Rising wedges are bearish – and often referred to as continuation patterns. In other words, the asset’s preceding trend tends to carry on upon its breakout. Traders always wait for the price to slide beneath the lower-rising trend line before activating their sell orders.

Binance Coin price is already halfway through its 6.90% breakout target – representing the distance between the wedge’s widest points extrapolated from the breakout point down. The region at $268 will come in handy and cushion investors from incurring more losses. However, if push comes to shove, market participants should acclimatize to Binance Coin price, eventually revisiting its September demand area at $258.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B18.08.37%2C%2010%20Oct%2C%202022%5D-638010145961173459.png&w=1536&q=95)