BNB Price Forecast: BNB sell-off intensifies as developers launch new token standard for AI-driven assets

- BNB remains below $750 after erasing gains accrued since early August amid widespread crypto market sell-off.

- BNB Chain developers introduce BAP-578, a new token standard for AI-driven assets that act autonomously on-chain.

- The BAP-578 ushers in a future where AI agents hold assets, execute logic and can predictably interact with decentralized applications.

BNB (BNB) is extending losses below $750 at the time of writing on Wednesday, after erasing almost all the gains accrued since early August. The exchange native token hovers 46% below its record high of $1,375 amid structural weakness and weak sentiment in the broader crypto market.

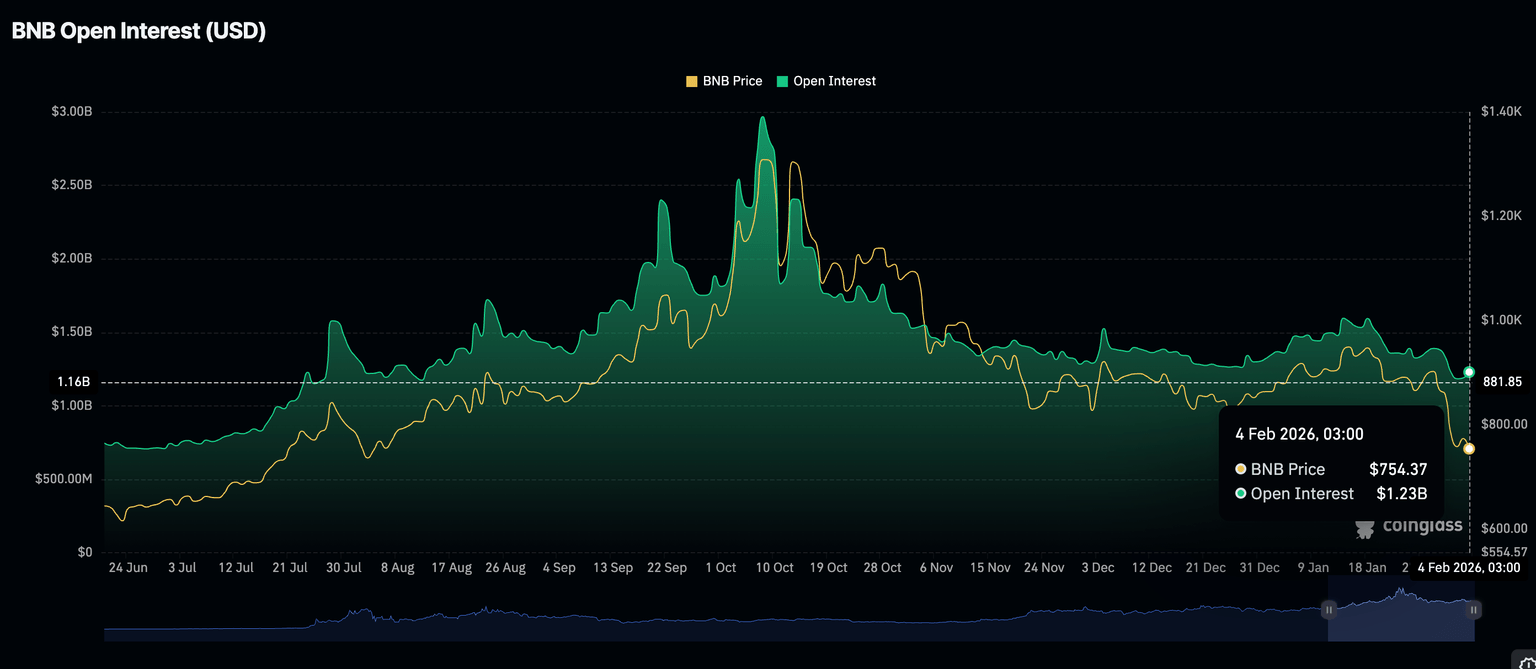

Retail interest in BNB remains relatively low despite a slight increase to $1.23 billion on Wednesday, from $1.19 billion the previous day. In contrast, futures Open Interest (OI) soared to $2.97 billion on October 8 ahead of BNB hitting its historical high on October 13.

BNB Chain introduces BAP-578 token standard for AI-driven assets

BNB Chain developers have announced the launch of BAP-578, the first official “BNB Application Proposal (BAP).” The launch ushers in a new token standard for Non-Fungible Agents (NFAs), AI-driven assets that act autonomously on-chain.

BNB developed stated that BAP is “a design document that lets the community propose standards for how applications on BNB Chain communicate and interact.”

BAPs do not alter how the core network operates, but standardise how decentralized applications (dApps) interact and work with each other across elements such as interfaces, wallets, identity conventions, token standards, and app-to-app interoperability.

An NFA is an AI-powered asset that can own a wallet, execute transactions, maintain a history of its actions and operate across multiple dApps. The new token enables NFAs to hold assets, execute logic, interact with other protocols and be bought, sold or even hired.

Binance developers are confident that the BAP-578 is the initial step toward the agent economy. This is a future where “AI agents can move between dApps, follow shared standards, and operate predictably across the ecosystem.”

Technical outlook: BNB bears tighten grip amid Death Cross pattern setup

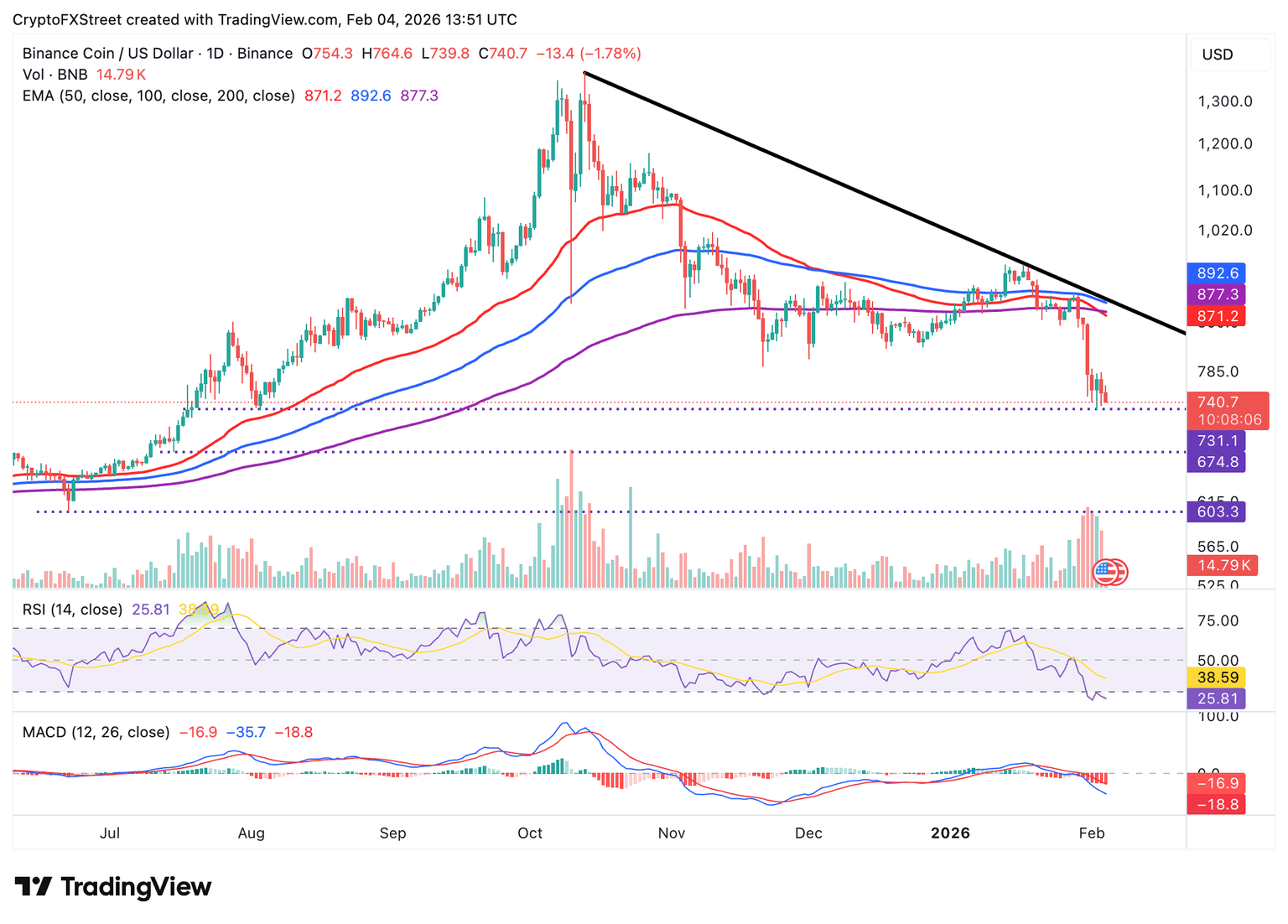

BNB is extending its decline below $750, weighed down by low retail activity as mentioned above and a weak technical structure. The 50-day Exponential Moving Average (EMA) at $871 has recently crossed below the 200-day EMA at $877, forming a Death Cross Pattern, which emphasises the bearish outlook.

Meanwhile, the Relative Strength Index (RSI) at 25 on the daily chart is falling further into oversold territory, suggesting bearish momentum may continue to build.

The Moving Average Convergence Divergence (MACD) indicator on the same chart is extending its decline below the signal line, while red histogram bars expand, prompting investors to sell BNB and reduce risk exposure.

If the next key support at $731 fails to hold, BNB may accelerate below $700 in search of more liquidity. The demand zone at $675 is in line to absorb the selling pressure. Still, aggressive buying at current levels may lead to a reversal toward the $785 resistance.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren