BNB hits new high as Binance partners with Franklin Templeton to develop digital asset products

- Binance and Franklin Templeton have partnered to begin developing digital asset products for global markets.

- The partnership seeks to deliver blockchain-based solutions tailored to investor needs.

- BNB hit an all-time high of $907 following the announcement.

Binance announced a partnership with asset manager Franklin Templeton on Wednesday to develop digital asset products for capital markets.

Binance and Franklin Templeton team up to boost adoption of tokenized products

Binance is collaborating with Franklin Templeton, a $1.6 trillion asset manager, to begin rolling out innovative blockchain-based traditional products, according to a statement on Wednesday.

The initiative aims to leverage Binance's large crypto network together with Franklin Templeton's expertise in tokenizing securities to "bring greater efficiency, transparency, and accessibility to capital markets."

Binance added that the move will help strengthen the relationship between traditional finance and blockchain technology by delivering solutions tailored to investors' needs.

"Our strategic collaboration with Franklin Templeton to develop new products and initiatives furthers our commitment to bridge crypto with traditional capital markets and open up greater possibilities," said Catherine Chen, Head of VIP & Institutional at Binance.

Franklin Templeton's Head of Innovation, Sandy Kaul, emphasized the significance of the partnership in accelerating adoption as tokenization goes mainstream.

"By working with Binance, we can harness tokenization to bring institutional-grade solutions like our Benji Technology Platform to a wider set of investors and help bridge the worlds of traditional and decentralized finance," she said.

Franklin Templeton is among the earliest firms to initiate the tokenization trend, having launched the Franklin OnChain US Government Money Fund (FOBXX) in 2021. It became the first US-registered mutual fund to record transactions and share ownership on a public blockchain.

The partnership comes as more firms are shifting toward tokenized products, including the Nasdaq, which has applied to the US Securities and Exchange Commission (SEC) to permit the trading of tokenized securities alongside traditional stocks.

Likewise, policymakers are advancing a crypto market structure framework — dubbed the CLARITY Act — that sets regulatory guidelines for blockchain-based assets and decentralized finance (DeFi).

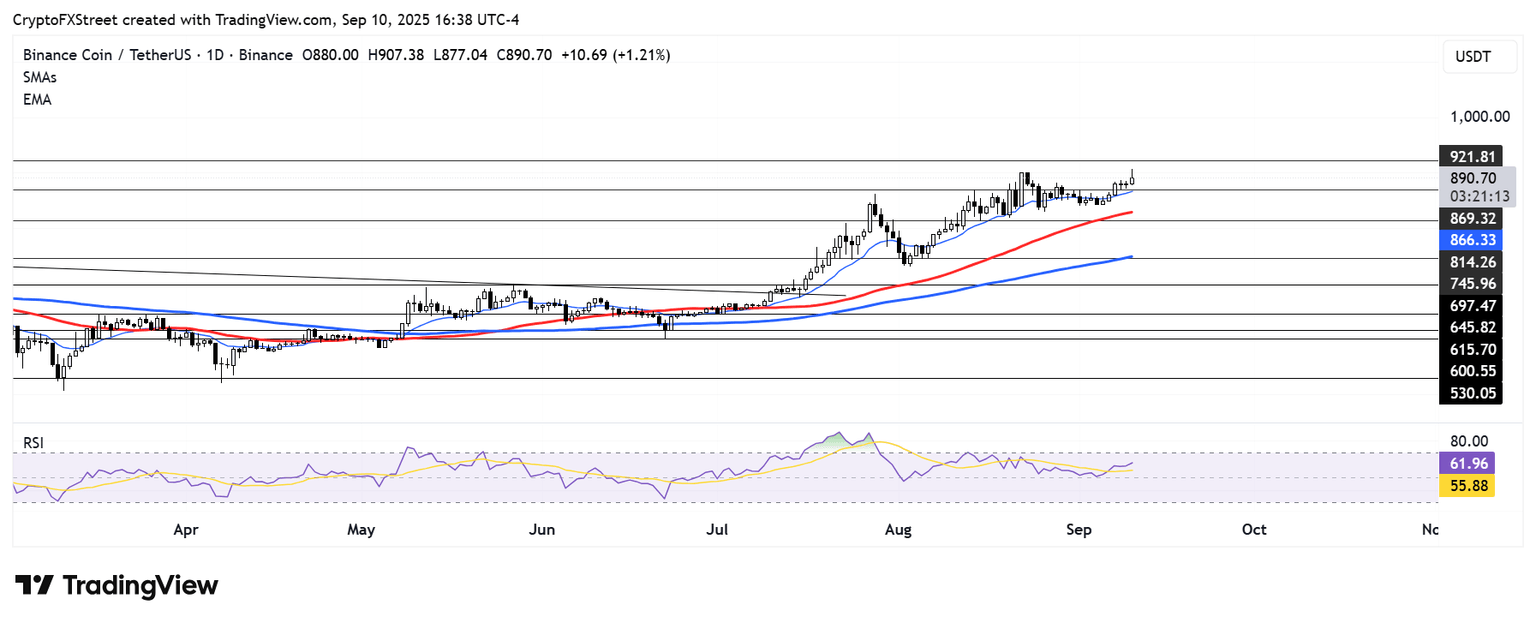

BNB/USDT daily chart

Binance's native token BNB surged to a new all-time high of $907 on Wednesday before retracing below $900 following the announcement.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi