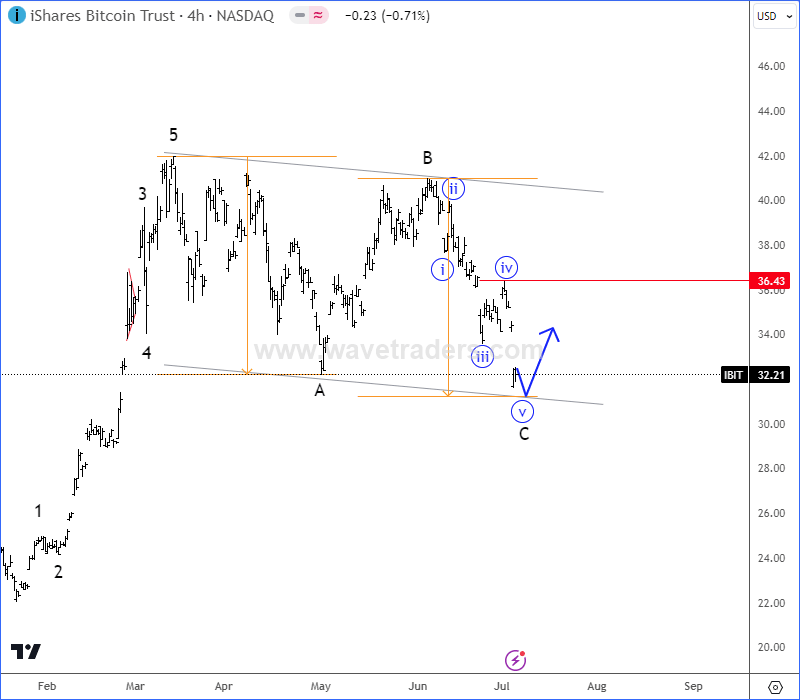

BlackRock Bitcoin ETF could be finishing a correction

BlackRock Bitcoin ETF with ticker IBIT looks like a nice and clean A-B-C correction in the 4-hour chart that is right now sitting at interesting support area for A=C, but to confirm support in place and bulls back in the game, we need to see sharp or impulsive recovery back above 36,43 level.

The main reason why Bitcoin ETFs can see more gains after current correction is also GrayScale Bitcoin Investment Trust with ticker GBTC, which is on the scene much longer than Blackrock's ETF - IBIT. As you can see, GBTC can be just slowing down after testing all-time highs and it can be now already potentially finishing a higher degree A-B-C correction in wave 4 that can resume the bullish trend for the 5th wave.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.