Bitcoin weekly forecast: Bulls wasted their chance

- Global central banks want to turn the tables on private digital money.

- Bitcoin's inside trend is losing steam as the coin moves below critical support.

Bitcoin has been oscillating in a depressingly tight range since the beginning of November. Vanishing volatility makes it harder to engineer a decisive breakthrough from the range. However, once it happens, the movements may be violent enough to create a new trend. At the time of writing, BTC/USD is changing hands at $8,700, down 5% on a day-to-day basis and down 6% since the beginning of Friday.

Central banks jump the bandwagon

The idea of central bank-issued digital coins popped out to the forefront this week.

The EU may consider creating digital euro as proposed by the document prepared the Finnish EU presidency. The proposal may be adopted at the next meeting on December 5, provided that the ministers of the member states agree on the terms of the draft document.

Europe is willing to explore the opportunities of central bank digital currencies (CBDC) and may take steps to that effect. However, the governments and regulators are will opposed to privately-issued money as they may threaten the global financial system and the sovereignty of the countries.

This position is echoed by the head of the Russian central bank Elvira Nabiulina, who said that the regulator would not allow private money to compete with the sovereign currency and put the monetary system at risk. Chine and Turkey are also among the growing list of countries that may launch public digital currency sooner rather than later.

The idea of CBDC seems to be more attractive to governments and regulators around the globe. Obviously, they are worried about the rise of privately issued stablecoins, which are considered money surrogates.

Stellar and Tezos all over the place

While bitcoin dozed quietly in a range several other digital coins demonstrated sharp movements.

Thus Stellar (XLM) jumped by over 30% in a single day amid news that Stellar Foundation burned 50 million tokens to make the network more efficient. The act of destroying coins is considered to be an anti-inflation measure that naturally leads to the price increase. However, this time Stellar gains were temporary as the community criticized Stellar Foundation for making the network way more centralized.

"50B XLMs burned were supposed to be distributed to the community. Stellar Development Foundation only burned 5B of its own 17B XLMs. This means SDF increased their percent of total coins from 16% (17/105) to 24% (12/50). And they did this without any community discussions," Litecoin's founder Charlie Lee wrote on Twitter.

As a result, XLM/USD reversed half of the gains to trade at $0.0744, off the week's high reached at $0.0887.

Read also:

Stellar (XLM) sheds 7% after eye-popping gains

Meanwhile, Tezos (XTZ) gained eye-popping 30% in a matter of hours when Coinbase announced Tezos staking support. The largest US-based cryptocurrency exchange now allows users to earn staking rewards on Tezos. The community liked the news, which resulted in a strong price increase. Unlike Stellar, the coin retreated only marginally and managed to hold the ground. At the time of writing, XTZ/USD is trading at $1.1950 from $1.3050 on Thursday.

Read also:

Tezos (XTZ) whopping 30% spike in the wake of Coinbase secure staking support

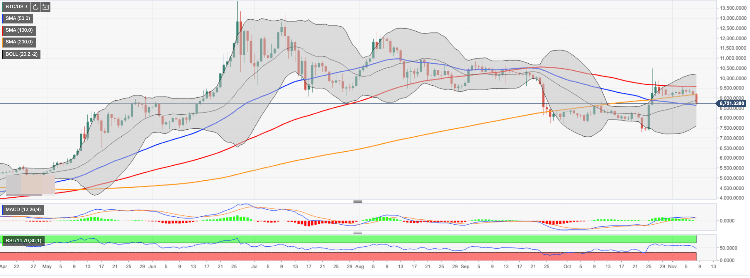

BTC/USD, the daily chart

Bitcoin has been moving in a tight range with bearish bias since the beginning of the week. During early Asian hours on Friday, the first digital coin dropped below $9,200 and extended the downside below SMA200 (Simple Moving Average) daily that kept bitcoin bears in check since the end of October. This development increased the downside pressure and took BTC/USD below $9,000 to the intraday low of $8,668.

A sustainable move below the said SMA200 bodes ill for bitcoin as it means that bears are back behind the driving wheel at least in the short run. The next critical support comes at $8,635 (SMA50 daily) and at $8,400 (the upper boundary of October channel). Psychological $8,000 is likely to slow down the sell-off; however, the real line in the sand is drawn at $7,700. That's where SMA100 weekly coincides with the lower line of the weekly Bollinger Band. A sustainable move below this barrier will bring Bitcoin back to the downside trend.

On the upside, BTC/USD is capped by $9,000 followed by SMA200 (currently at $9,170). Thus we will need to see a sustainable move above this handle for the upside to gain traction and negate the looming doomsday scenarios. Once this happens, the next critical barrier $9,600 (SMA100 daily) will come back into view, followed by $10,000 and the recent high of $10,484.

However, waning momentum and downward-looking RSI implies that the bulls are not strong enough to make it happen.

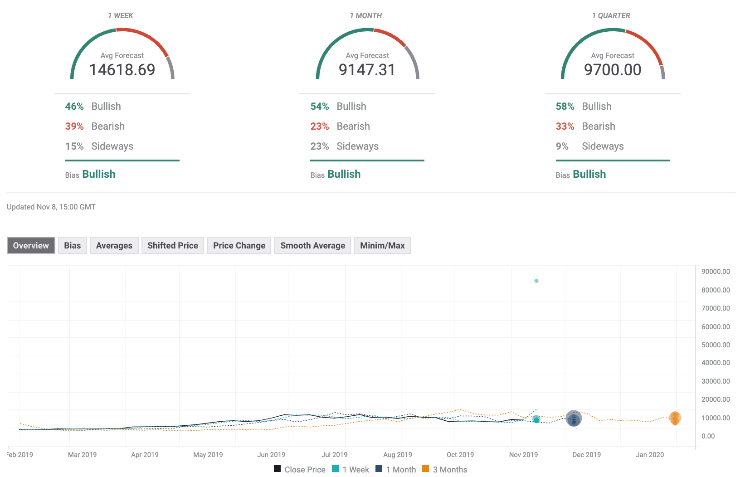

The Forecast Polls of experts have improved since the previous week. Expectations on all timeframes are mostly bullish. The average price forecasts are above 9,000. The weekly forecast implies the growth above $14,000.

Author

Tanya Abrosimova

Independent Analyst