Bitcoin Weekly Forecast: BTC hits $1 trillion market cap while institutional interest builds up

- Bitcoin has finally hit $1 trillion in market capitalization for the first time ever.

- The digital asset has been pushed by a myriad of positive announcements in the past week.

- On-chain metrics suggest that BTC can continue climbing even more.

Bitcoin price has been on a wild run for the past week, rising by almost 20% again and hitting a new all-time high of $55,850. The flagship cryptocurrency has reached $1 trillion in market capitalization and aims for more as interest continues increasing.

Bitcoin ETF debuts in North America

The first Bitcoin ETF in North America made its debut on February 18 and quickly reached about $165 million worth of shares exchanged in one day. This is the first Bitcoin product labeled an ETF and surpassed the typical figures seen on the first day of ETF products.

Shortly after, the second Bitcoin ETF was launched in Canada, which clearly shows that institutional interest is increasing rapidly.

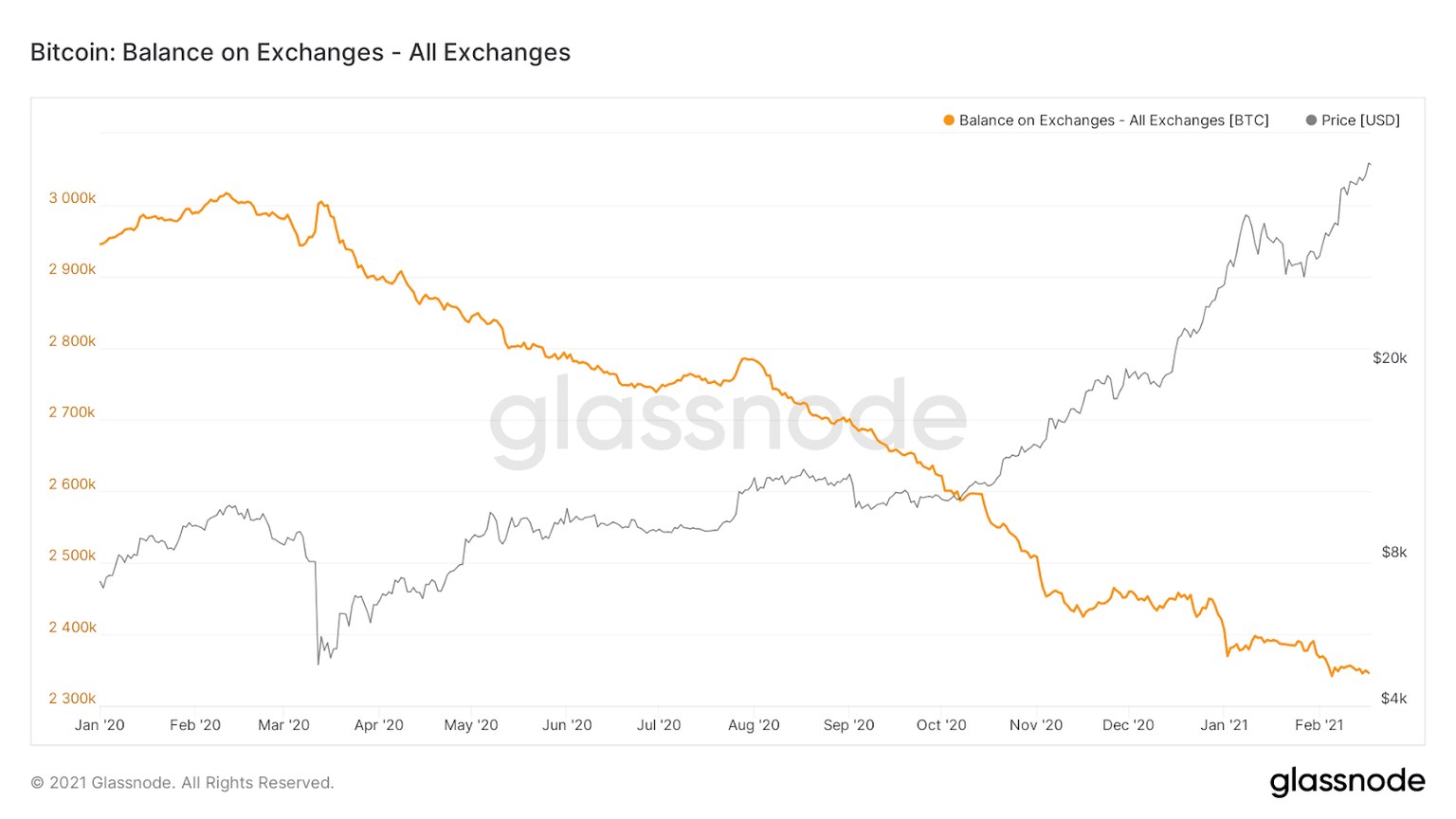

BTC Supply on Exchanges

This can also be seen by the fact that Bitcoin supply on exchanges has significantly declined in the past year. Since January 2020, the number of BTC coins inside exchanges decreased from 3 million to only about 2.3 million.

This past week we have seen a surprising move by the Motley Fool, which is a private financial and investing advice company that just invested $5 million in Bitcoin. What's funny about the recent purchase is that the platform wrote an article titled 'Why Bitcoin is Doomed to Fail' back in 2013 but has clearly changed its stance on the digital asset.

In our 10X real-money portfolio, we are recommending and buying Bitcoin. It will be a core holding in our 10X portfolio. There are 39 other stocks we believe are on a path that could potentially lead to 10x returns at some point over the next 15 years. We believe Bitcoin could deliver those returns as well.

However, not everyone is extremely bullish on Bitcoin. Bill Gates has recently stated that he is neutral on the flagship cryptocurrency. In a recent interview with CNBC Thursday, Gates noted that he doesn't own Bitcoin but his Foundation is trying to develop a way to digitize money and bring down transaction costs in developing countries.

Bitcoin Price has more gas to rise higher

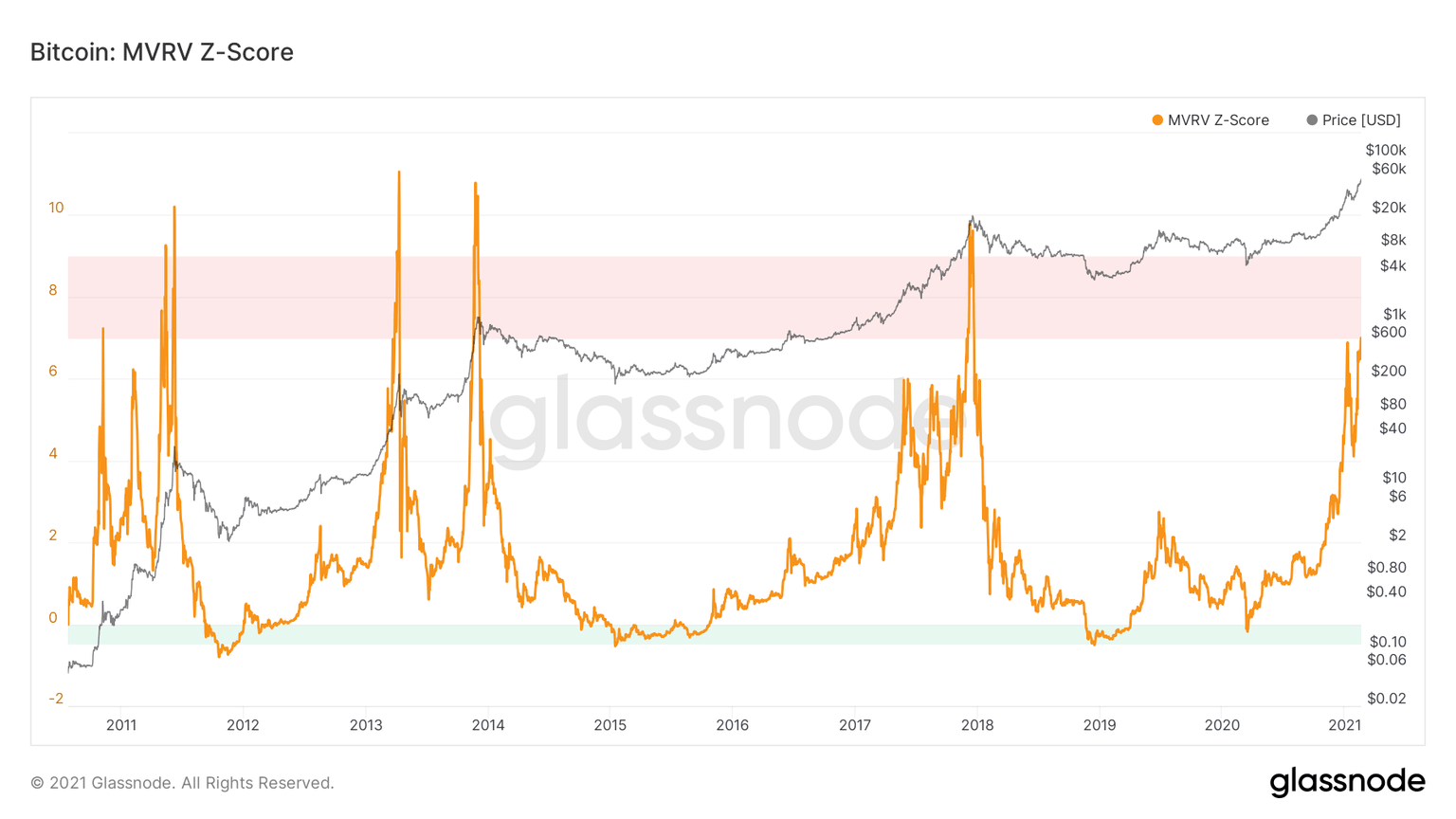

The Bitcoin MVRV-Z has crossed into red territory above 7 for the first time since December 2017. This on-chain metric basically measures the 'fair value' of Bitcoin. If the market value of BTC is higher than the realized value, the indicator will reach the red zone.

BTC MVRV-Z score

However, although BTC has just reached this zone, it is still far away from all-time highs which indicates the bull run is advanced, but there is still a lot of room for further growth.

Back in 2017, Bitcoin hit the red zone when trading around $10,000 and continued to rise even higher, hitting the all-time high then of $20,000. Similar price action can be observed in 2013 and 2014, which indicates that Bitcoin price could still hit $100,000 in the near-term.

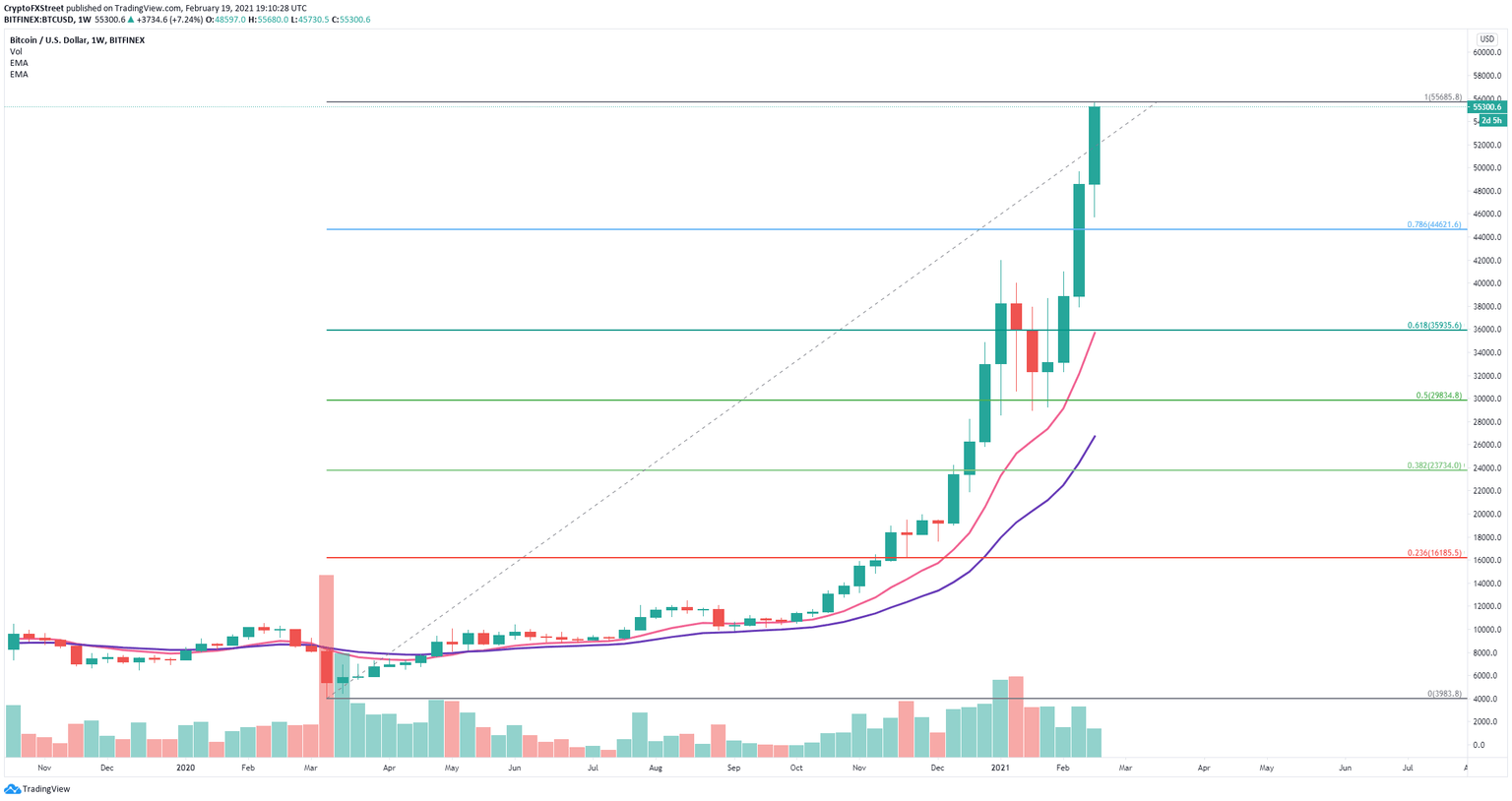

BTC/USD weekly chart

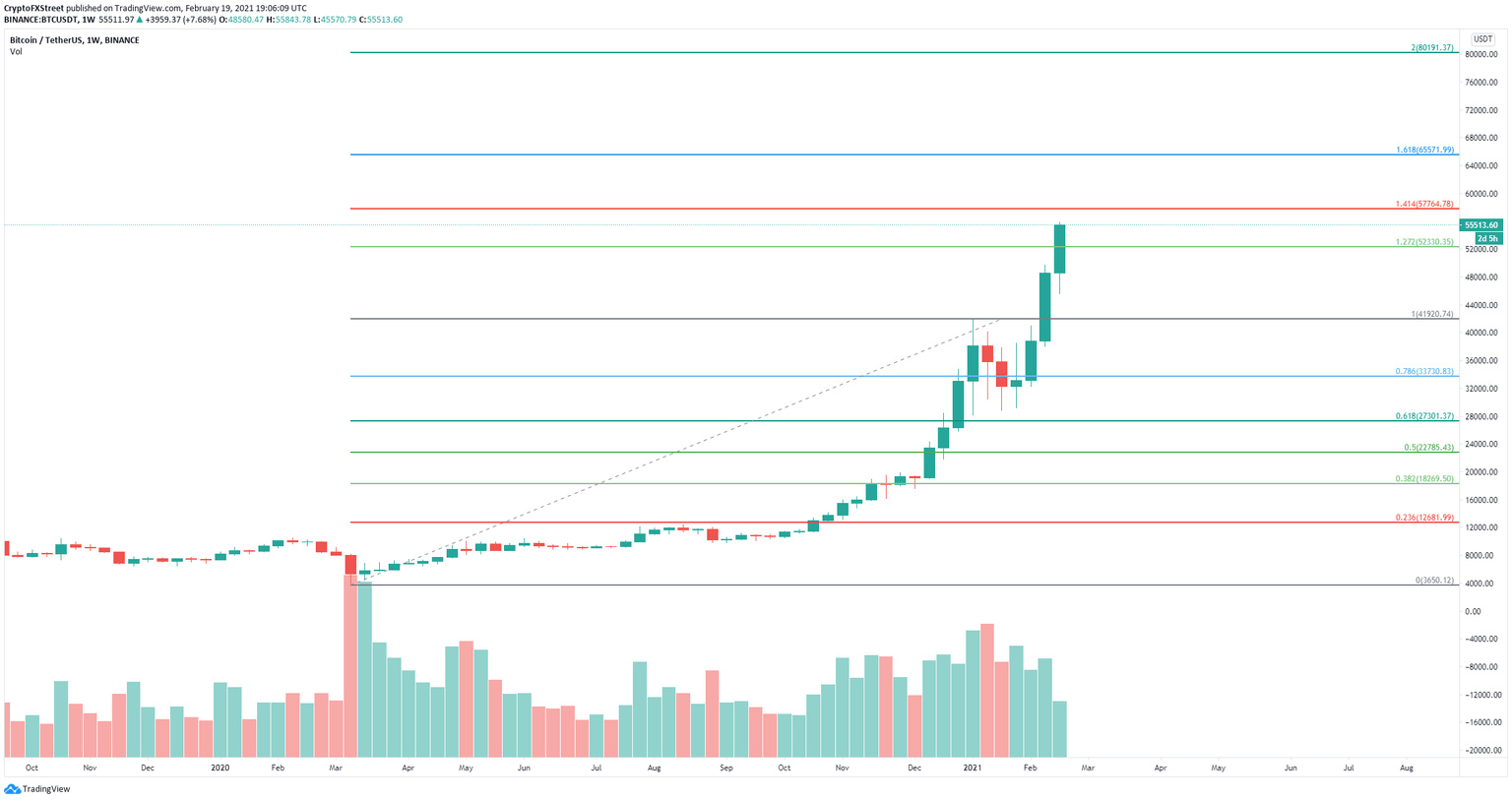

On the weekly chart, drawing Fibonacci retracement levels using the last top of $41,950, we can see that the next key resistance level is located at $57,764, which is the 141.4% level. Above this, The next price target is $65,550, followed by $80,000, the 200% Fib level.

BTC MVRV (30d)

However, the MVRV (30d) for Bitcoin is extended and in the danger zone as well. On December 31, after climbing above this risk zone, Bitcoin price had a significant correction down to $29,000. Currently, the MVRV is above 25% and hints at a potential pullback.

BTC/USD weekly chart

A correction from this point could drive Bitcoin price down to $44,621, which is the 78.6% Fib level. Below this support, the next point is located at $36,000, which coincides with the 12-EMA.

The most significant support level is $28,989, which coincides with the 50% Fib level and the low of January 18. Anything above this level will be considered a higher low and a potential continuation of the current uptrend.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.07.10%2C%252019%2520Feb%2C%25202021%5D-637493587953579405.png&w=1536&q=95)