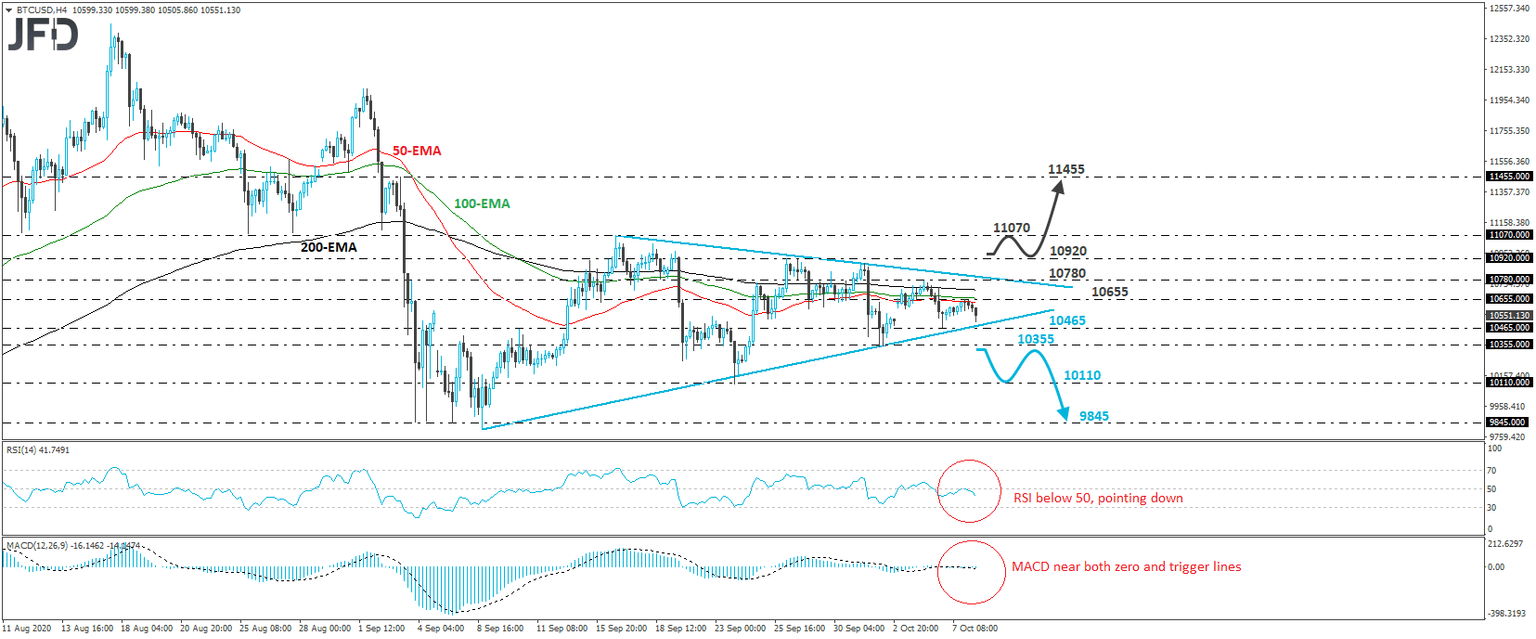

Bitcoin trades within a triangle

BTC/USD traded lower on Thursday, after it hit resistance at 10655 on Wednesday. Overall, the crypto has been trading within a symmetrical triangle formation since September 8th, and thus, despite the price’s proximity to the lower end of the triangle, we will hold a flat stance for now.

We will start examining the bearish case only if we see a clear dip below 10355. Such a move could also confirm the break below the lower end of the triangle and may initially pave the way towards the low of October 2nd, at around 10110. If that barrier is not able to halt the slide, a move lower may see scope for extensions towards the 9845 zone, which provided strong support on September 4th, 7th and 8th.

Turning our gaze to our short-term oscillators, we see that the MACD is flat, running very close to both its zero and trigger lines, something that enhances our choice to stay sidelined until the crypto exits the triangle. That said, the RSI lies below 50 and points down, indicating that there are more chances for a downside exit rather than an upside one.

In order to start considering the upside scenario, we would like to see a strong break above the 10920 resistance zone, marked by the high of September 28th. The next stop could be the peak of September 16th, at 11070, the break of which could carry larger bullish implications, perhaps paving the way towards the high of September 3rd, at 11455.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD