Bitcoin trades weak after tuesday’s leverage washout, analysts see more price volatility ahead

Bitcoin remains on offer as market sentiment remains weak in the wake of Tuesday’s leverage-driven price slide, the dour mood in equity markets, and negative crypto newsflow.

The cryptocurrency is currently trading near $45,300, representing a 3% drop on the day. Prices fell by 11% on Tuesday and reached as low as $40,000 on some exchanges, reportedly due to the forced closure of long positions in the derivatives market and liquidity shortage caused by exchange downtimes and market makers going offline.

After a big decline and leverage washout, traders tend to be less confident or more risk-averse for some time. That often results in flat-to-negative market action we see at press time.

Additional bearish pressure could be stemming from the U.S. Securities and Exchange Commission’s (SEC) attempts to stop the Nasdaq-listed crypto exchange Coinbase from launching its lending program offering 4% annualized yields. That’s a significantly higher return than the 1.5% yield offered by the U.S. 10-year Treasury note and could bring strong inflows to the crypto market.

“U.S. authorities [are] standing in the way of innovation. $100 trillion of negative real yields on global bonds drives investors into high-yielding cryptocurrency,” Dan Tapiero, founder of DTAP Capital LLC, tweeted early today.

Lastly, risk-off in traditional markets could be keeping bitcoin bulls at bay. Major European equity markets are currently nursing a 1% loss on growth concerns, and futures tied to the S&P 500 are down 0.5%. Meanwhile, the U.S. dollar is gaining ground against major currencies.

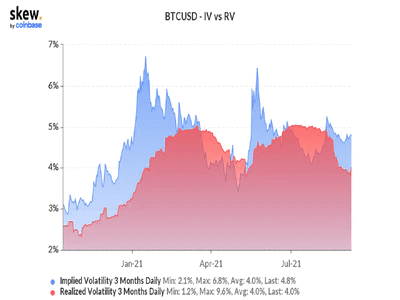

Bitcoin’s options market is signaling higher near-term price volatility relative to the volatility seen in recent weeks. The cryptocurrency’s three-month implied volatility (IV) or expectations for price turbulence over the next 12 weeks stands at 4.8% and realized volatility (RV) is seen at 4%.

The spread has narrowed slightly from 100 basis points to 80 basis points in the past 24 hours as realized volatility has increased from 3.8% to 4% following yesterday’s drop. Experts foresee more volatility ahead.

Bitcoin's implied volatility and realized volatility

“Gap between realized and implied volatilities has been quite large but typically that signals mean reversion which happened on Tuesday,” Shiliang Tang, chief investment officer of LedgerPrime, a $135 million crypto hedge fund, told CoinDesk. “I think that realized volatility will continue to tick higher going forward (since its look back data). Usually, a period of low realized volatility means a period of high volatility will follow.”

Babel Finance’s spokesperson said, “both realized volatility and implied volatility are likely to surge at this stage; it’s hard to tell which is going to fall first,” adding that in theory, implied volatility should fall if the market calms. Note that volatility only means price turbulence and doesn’t tell us anything about the direction of the impending price moves.

Indeed, there is plenty of room for a continued rise in both IV and RV, considering both metrics are still hovering well below the highs seen in January and May.

Savvy traders typically buy options (call and put) when volatility is expected to pick up and sell options when volatility reaches extremes, and the market is expected to take a breather. That’s because volatility has a positive influence on option prices.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.