Bitcoin to 70k in October?

-

Bitcoin rose 7% in September, a historically bearish month.

-

October is a traditionally bullish month with average gains of 22%.

-

Macro factors support further gains in Bitcoin.

-

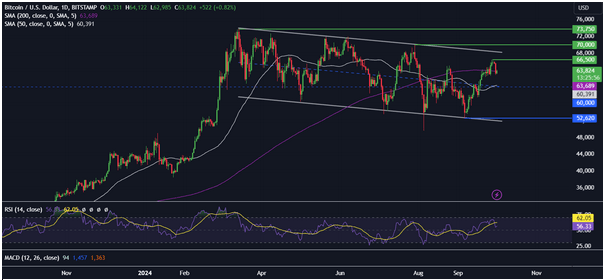

Bitcoin tests 200 SMA support.

Bitcoin is holding steady at 64k at the start of October, a historically bullish month for the world's largest cryptocurrency.

Bitcoin is heading into October after one of its best Septembers yet, defying historical trends of negative returns in the month. Bitcoin rose to a two-month high of 66.5k and gained 7% in September, adding to only two prior instances of positive growth since 2013. September is historically one of the most bearish months for Bitcoin, with an average decline of 6.5%.

Source: Coinglass

In contrast, October has only seen two negative returns since 2013, meaning that according to historical data, October favors Bitcoin. Meanwhile, on average, since 2013, Bitcoin has seen gains of 22% in the month, with gains reaching a high of 60% in 2013.

Why might this October be bullish for Bitcoin?

Current macro market conditions and US politics suggest Bitcoin’s bullish trend could continue, potentially pushing BTC toward $70,000.

The Federal Reserve started its interest rate-cutting cycle with a bumper 50 basis point cut in September. While Fed chair Jerome Powell reined in market expectations of another outsized 50-point cut in November, the Fed is still expected to continue cutting rates methodically. Powell pointed to two 25 basis point reductions between now and the end of the year.

A loser monetary policy in the US combined with a vast stimulus package announced in China last week, including a reduction in interest rates and supportive lending measures, points to a supportive environment for riskier assets such as Bitcoin and stocks. The risk-on mood is evident in the broader financial market, with US equities trading reaching record highs on numerous occasions last week. Given the elevated correlation coefficient between the S&P500 and Bitcoin, this bodes well for further gains in the cryptocurrency.

Even the US political stage is looking less risky after Kamala Harris, who has a razor-thin lead in the polls, signaled support for the growing crypto industry in the US.

Bitcoin technical analysis

Bitcoin’s technicals have also become more supportive. While Bitcoin has been trading in a descending channel since March, the price has recovered from a lower band, rising above the 50, 100, and, most recently, the 200 SMA. A rise above the 200 SMA usually means that the assets are moving into a longer-term uptrend.

The price is testing the 200 SMA support today. Should buyers successfully defend this level, that could be considered a bullish signal, and the price could take out 66.5k, creating a higher high towards 70k.

A break below the 200 SMA could open the door to 60k, the 50 SMA, and the psychological level.

Start trading with PrimeXBT

Start trading with PrimeXBT

Author

Matthew Hayward

PrimeXBT

Matthew Hayward is a Senior Market Analyst at PrimeXBT, a global cryptocurrency broker. He has over five years of expertise in both Fundamental and Technical Analysis, focusing on Cryptocurrency, Foreign Exchange, Indices, and Commodities.