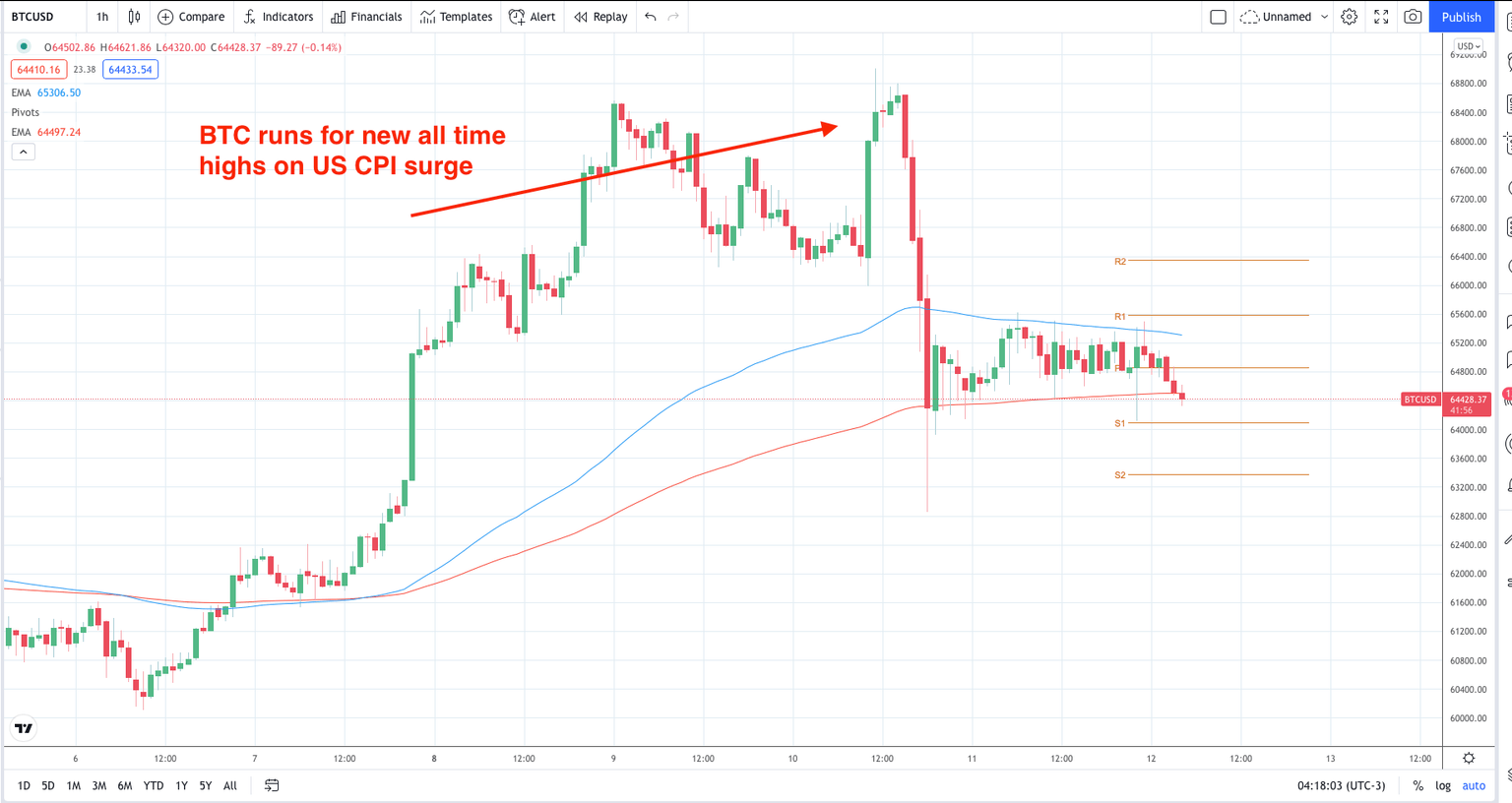

Bitcoin: The inflation buster?

One of the strong arguments Bitcoin advocates have made is that Bitcoin provides a good hedge against inflation. However, what are the pros and cons of the argument? Last week a Bloomberg piece put up a few of these arguments and it is worth looking at them here.

The pros

Recency

US CPI surged last week and this sent Bitcoin higher along with gold prices. Surely this is proof enough that Bitcoin is an inflation hedge.

Supply

Bitcoin has a maximum supply of 21 million or so coins. So, unlike traditional currencies, it can’t be de-valued by just ‘creating more coins’. It is a natural store of value. Paul Tudor Jones has expressed interest in BTC in part, for this reason, seeing it as a store of wealth.

Look here at the Fed’s balance sheet expansion versus the amount of Bitcoin in circulation to illustrate this point

Growing inflation fears

Bloomberg economists with Bloomberg Economics put forward that around 50% of Bitcoin’s recent returns can be explained by inflation fears:

“Our model shows that for Bitcoin, the importance of inflation and hedging against uncertainty become more important drivers over time, accounting for 50% of price moves in the latest cycle relative to 20% in 2017.”

The cons

Recency

Too early to say that Bitcoin is in an inflation hedge. It sits firmly in gold’s shadow in that regard.

Speculative nature

Around March of 2021 BTC lost around 50% of its value. This is speculative volatility.

The takeaway

BTC volatility appears to be falling. However, the speculative nature of BTC is a compelling argument to watch out for any risk-off moves to hit BTC prices. It is hard to choose BTC over gold just because gold has such a long track record. Will people feel confident doing that for a large portfolio? No, probably not, except under the category of speculative asset. At these prices, the value is limited apart from entering the smartest of technical areas.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.