Bitcoin Reversal Day

Yesterday Bitcoin(+3.55) had a perfect reversal day from the $7,700 lows driving the crypto sector gains. The 24H heat map shows the majority of the cryptocurrencies are in green, with ATOM(+8.95%) and EOS (+6.28%) leading the gains. On the token side Link(+3.09%) continued climbing, joined among others by MKR(+5%) , ZRX(+11.15%) and the PPT(+35%) and IOTX(+50.6%).

The Market capitalization moved 4.32% in the last 24 hours and has surpassed the $220 billion, while the 24H traded volume changed 36.75% to $32 billion. Finally, the dominance of the bitcoin moved again, just slightly below 70%.

Hot news

Executives of Bitwise Asset Management stated they are optimistic and "closer than we've ever been" to a Bitcoin ETF approval by the SEC. Oct 13 is the deadline for the SEC to release his report on this product.

Valdis Dombrovskis, the EU nominee as Financial Commissioner, said that he plans to propose a unified Cryptocurrency regulatory legislation. "Europe needs a common approach to crypto-assets such as Libra. I intend to propose new legislation on this."

Liechtenstein has published the act on Tokens and Entities Providing Services based on Trusted Technologies, also called the Blockchain Act creating a comprehensive regulation of the token sector starting from January 2020.

Technical Analysis

Bitcoin

Yesterday, Bitcoin bounced off near its $7,700 critical level, making an engulfing candlestick on a bit higher volume that drove its price back above the $8,000 level and topping slightly above $8,300. Right now, it bounced back from this high and is below the $8,200. The daily chart also shows a potential MACD bullish crossover that must be confirmed. Also, we can see that the price is again inside the mid-term pennant structure whose lower trendline we have drawn in amber. As a final observation, we see that, although the price is below the 200-day MA, the MA slope is still trending up, which still shows the case for bulls is not over.

The 4H chart shows that the price has made a potential lower high, so now BTC seems to move in a range still with a slight negative bias. On the positive side, the price moves near the +1SD Bollinger line, and MACD has turned to a bullish phase. Also, the 50-period MA slope is turning to positive, and the price is slightly above it.

Our key levels today are 8,200 and 8000. If the price goes back above 8,200, the buying interest will rise, while a new drop below 8,000 would increase the selling pressure.

Ethereum

Ethereum went down to touch the $168 level, then, bounce off and move above the descending channel it was moving in. We now saw the price reached its 200-period MA line and retraced slightly above $180.

There seems ETH has made a double top at about $186. Therefore we should watch this level for potential bull continuations. Also, $176 appears to be the natural support for the price to retrace and bounce in search of new highs.

Ripple

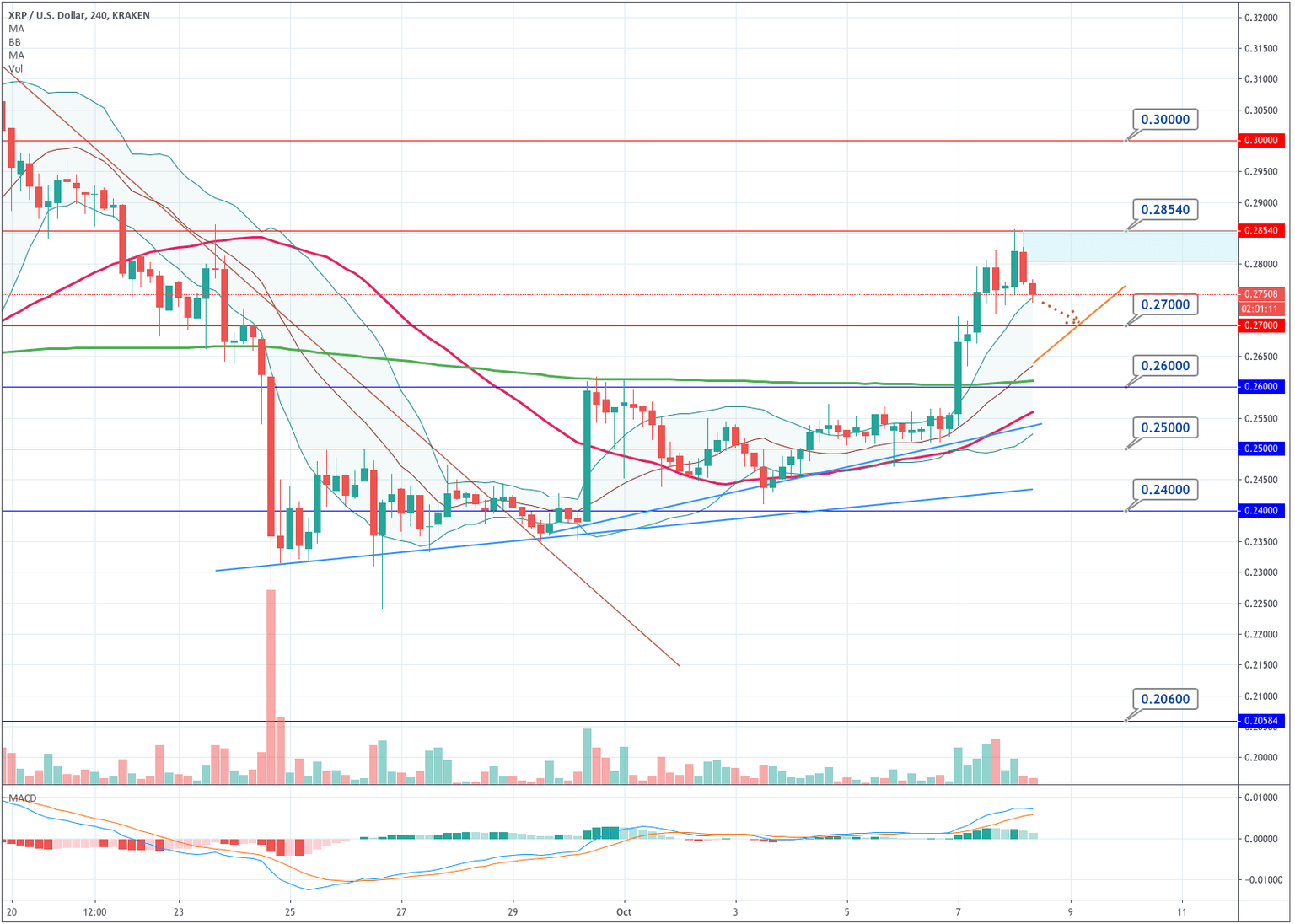

Ripple has reached our target yesterday and then, got rejected by the $0.385 level, made a harami figure, and another candlestick, which is moving slightly below the lows of the last bullish candlestick. Although the technical indicators are bullish, we see the price pulling back from oversold levels, so we think it will continue doing that unless there is a sudden buying pressure affecting BTC and cryptos in general.

The key levels to observe are:

Supports: 0.27, 0,26

Resistances: O,285, 0.3

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and