Bitcoin price will hit $100,000 by April 2021, suggests historical data

- Bitcoin halving has always had a massive impact on the price, leading to incredible gains in the succeeding year.

- If history repeats, Bitcoin does not have long before it hits $50,000 and begins the grand journey to $100,000.

- The short-term analysis shows that BTC must find a higher bottom to secure the recovery to $40,000.

Bitcoin, for the first time in history, hit a record high of around $42,000. However, extremely high volatility saw Bitcoin plunge to $30,000. Several hurdles currently hamper the flagship cryptocurrency recovery to $40,000.

On the bright side, on-chain data, as discussed, suggests that BTC is still in the race to $50,000. Similarly, historical data related to Bitcoin's halving implies that Bitcoin is yet to hit its potential and could soon breakout to $100,000.

Bitcoin needs to rally 700% to hit $100,000

The Bitcoin network has undergone three halvings since its creation. Halving is a process that takes place every four years. It refers to reducing the reward (coins) miners earn as they process transactions on the blockchain. The most recent halving took place in 2020, with the miners' reward sliced by half from 12.5 to 6.25 BTC.

Halving attracts investor interest because of the impact it has had on the price in the past. There is a high chance of a bull run erupting following the halving process. The logic behind this reasoning stems from the concept of supply and demand. For instance, reduced reward translates to a decrease in supply. If demand remains the same or increases, the price of Bitcoin begins to rise tremendously.

Understanding Bitcoin halving and its impact

We have established why Bitcoin trends to rally every time it undergoes the halving process. The chart below shows that Bitcoin took approximately 126 days to rally by 740% following the first halving. Moreover, the pioneer cryptocurrency soared by over 8,000% in the halving wake, where it topped out at $$1,126 in November 2013.

BTC/USD weekly chart

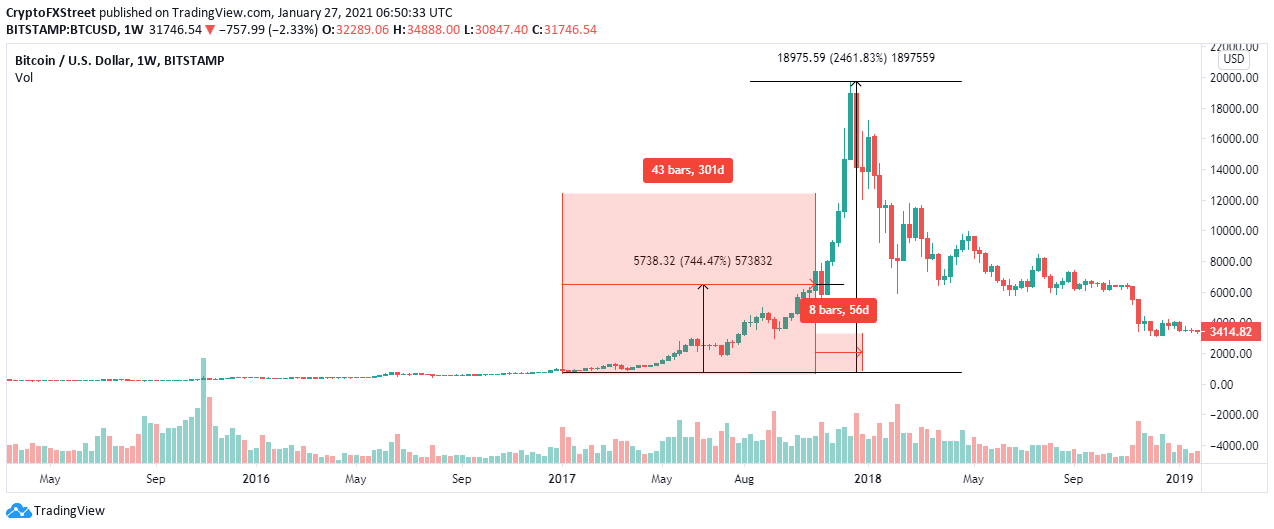

Simultaneously, Bitcoin's second halving in 2016 gave way for the historical rally in 2017, where the price nearly hit $20,000. The crypto took about 300 days to rise 740%, brushing shoulders with $6,000. The bull run did not stop here as Bitcoin took approximately 56 days to hit the record high in 2017, as illustrated in the chart.

BTC/USD weekly chart

The most recent halving, the third to be precise, took place in May. Since then, Bitcoin has rallied by nearly 650% to the new all-time high at $42,000. If history is anything to go by, BTC's rally is still a long way from hitting 740%, probably in April. This will place Bitcoin above $50,000, but the parabolic price movement's last leg may send it to $100,000 by September 2021.

BTC/USD weekly chart

The bullish outlook has been reiterated by Cathie Wood, the chief executive of Tesla, a global leader in electric car production. In her opinion, more companies are preparing to add Bitcoin to their portfolio. She was speaking to Yahoo Finance before the much-awaited “Bitcoin corporate strategy” summit to be held in February.

I think we're going to hear about more companies putting this hedge [Bitcoin] on their balance sheet ... particularly tech companies who understand the technology and are comfortable with it.

I believe there is no better hedge against inflation than bitcoin.

Bitcoin continues to hunt for a formidable support

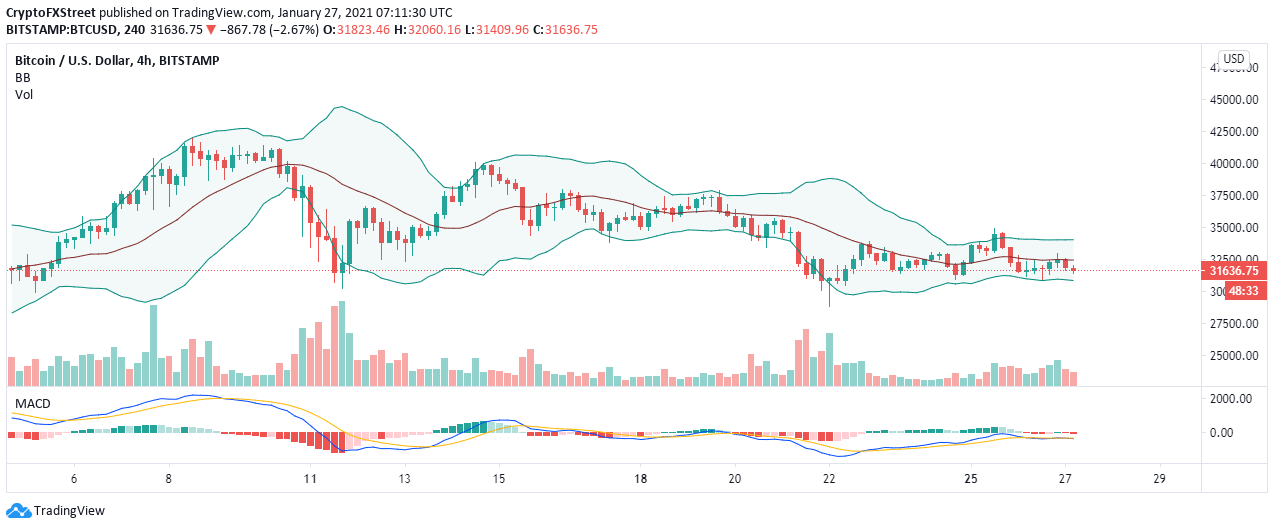

BTC is trading at $31,733 during the European session on Wednesday. Bears seem to be gaining traction as selling pressure increases under the Bollinger Band middle boundary. Support at $31,000 plays a vital role in keeping Bitcoin away from losses that could retest areas under $30,000.

Following the ongoing consolidation, Bitcoin may restart the uptrend first to $40,000 and later extend to $50,000. Hence the need for the bulls to secure a higher bottom, allowing them to shift the focus to these higher price levels.

BTC/USD 4-hour chart

It is worth mentioning that the bullish outlook will be invalidated if Bitcoin dives under $30,000. We expect the former support at $28,000 to come in handy. However, investors are likely to panic-sell for profit if the market turns slightly bearish than it is at the moment. Critical areas to have in mind include $25,000 and $22,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren