Bitcoin price falls below $50K as investors rush to exit crypto markets on Biden's tax proposal

- Bitcoin price dipped below $50,000 after following the news that US President Joe Biden could increase capital gains taxes for the rich.

- The leading cryptocurrency fell in tandem with the US stock market as fears of a potential tax hike loom.

- While Bitcoin’s market share drops, miners have been accumulating BTC at a discount.

President of the United States Joe Biden is expected to propose a new top rate for capital gains tax rate for wealthy individuals. Subsequently, the cryptocurrency markets crashed as investors fear high taxes as a result of cashing out of digital assets.

Biden plans to tax the rich

The world’s largest cryptocurrency by market capitalization, Bitcoin, slumped to lows nearing $50,000, falling in tandem with the US stock market.

Investors seem to have reacted to President Biden’s plan to increase the capital gains tax rate to 43.3% for Americans with income exceeding $1 million. Targeting the wealthiest citizens in the US, Biden aims to roll out the biggest ever increase in levies on investment gains for funding in healthcare, pre-kindergarten education, and paid leave for workers.

The announcement comes after the effects of the COVID-19 pandemic widened the wealth gap, where financial fallout was concentrated among certain cohorts, including minorities, lower earners, and women.

Currently, American investors pay a 23.8% top rate on long-term capital gains including a 20% capital gains tax on assets held in taxable accounts for more than a year. The Biden administration plans to tax financial gains as ordinary income, with a top proposed rate at 39.6%, which applies to the wealthy with more than $1 million in annual income.

According to Bloomberg, with the Medicare surtax kept in place, the top long-term capital gains would result in 43.4%. Certain aspects of the plan remain unclear, as Biden is expected to release more details next week.

Prominent venture capitalist Tim Draper suggested the tax hike could mean a decline in job creation. He stated:

43.4% capital gains tax might kill the golden goose that is America/Silicon Valley. People need an incentive to build long-term startups of value. In California, that would be a 56.4% tax burden.

Bitcoin sheds bull rally gains

The Dow Jones Industrial Average fell 400 points when the news hit the US stock markets, as investors rushed for the exits.

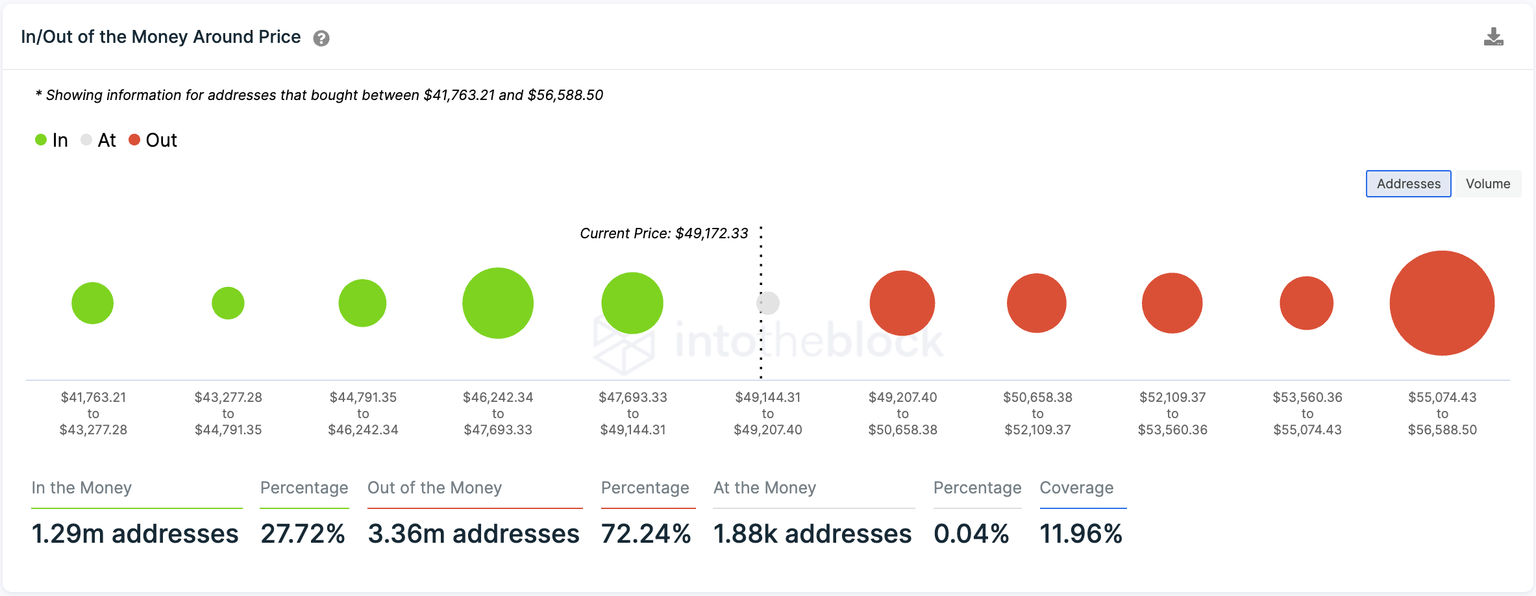

Likewise, Bitcoin price dropped below $50,000 and is now struggling to rebound. IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that the flagship cryptocurrency could plunge further towards support around $47,693, where around 400,000 addresses hold 130,000 BTC.

Bitcoin IOMAP

According to tax experts, the plan may exempt a portion of wealthy investors’ capital gains from higher tax. Certain taxpayers, including business owners, may also be exempt from the levy.

Only four years ago, the Trump administration cut taxes for many individuals, which indicates that conditions could change quickly. Jack Ablin, chief investment officer and founding partner of Cresset Capital Management, suggested:

I wouldn’t necessarily push the sell button on rumors. That doesn’t make a lot of sense to me. There will be plenty of time to plan and respond to any tax or tax proposal that’s ultimately in place.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.