Bitcoin price to revisit Monday’s low as BTC woes multiply

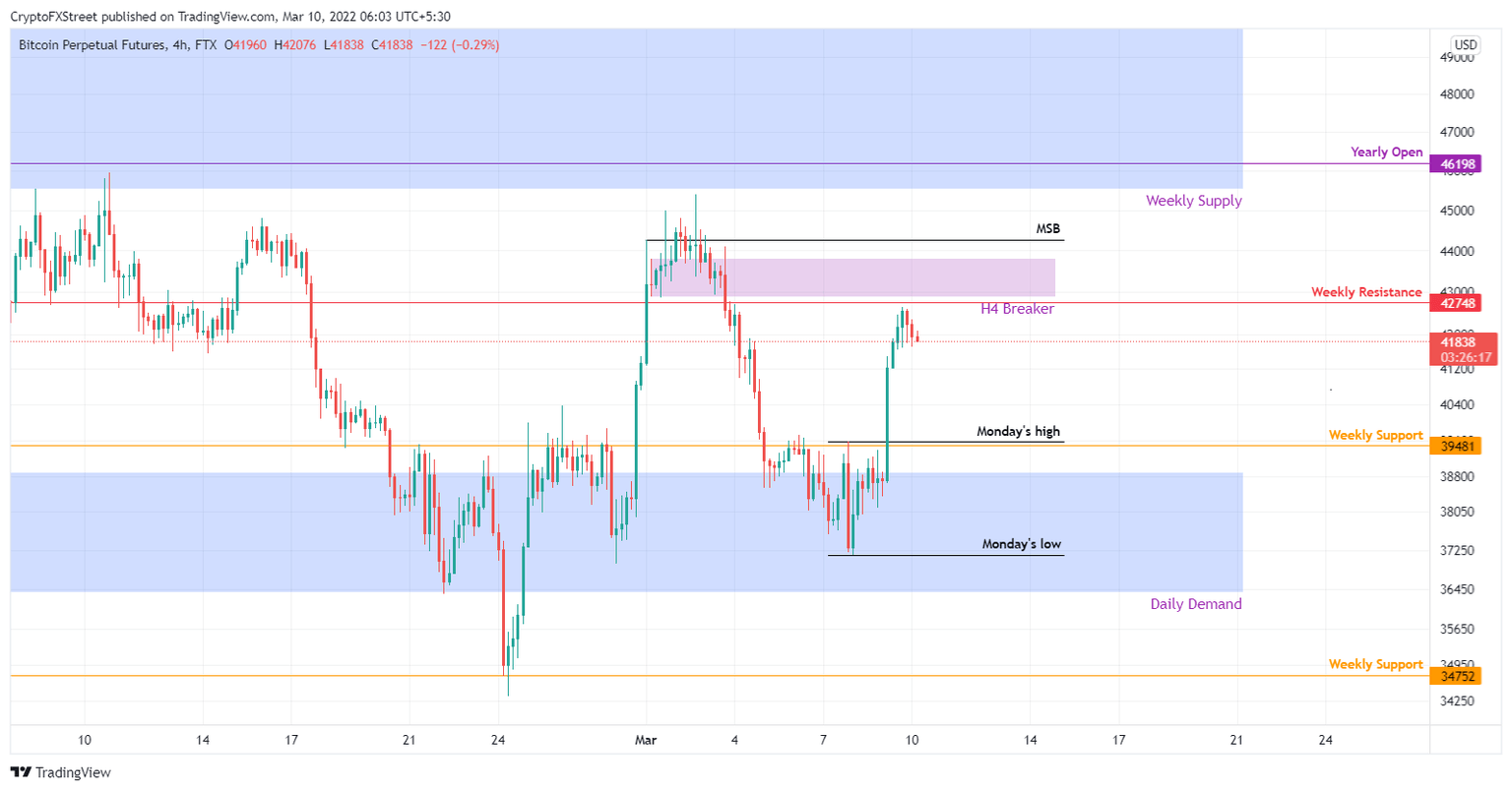

- Bitcoin price rallied 14% on March 9 but is currently facing resistance around the $42,748 hurdle.

- A rejection around the breaker, extending from $42,894 to $43,800, will crash BTC down to $37,154.

- A four-hour candlestick close above $43,800 will invalidate the bearish outlook.

Bitcoin price shows restraint as it approaches a confluence of strong resistance barriers, indicating that the bulls are unable to push through. A rejection here could arrive and crash BTC to levels last seen on March 7.

Bitcoin price at inflection point

Bitcoin price experienced an impulse move on March 9, clocking in the daily return at 14%. This uptrend currently faces rejection below the weekly resistance barrier at $42,748, which coincides roughly with a bearish breaker, ranging from $42,894 to $43,800.

Due to this confluence, the chances of BTC heading higher are slim. Therefore, a rejection around this level will likely knock Bitcoin price down to the weekly support level at $39,481, which coincides with Monday’s high.

While this is an initial support level, it is unlikely to absorb the incoming selling pressure and will most likely cave in. Such a development will push the big crypto down to Monday’s low at $37,154.

In most cases, a sweep of this low is likely. Since this barrier is present inside the daily demand zone, extending from $36,398 to $38,895, a recovery bounce seems plausible. Regardless, the critical thing to focus on is the 13% correction that is yet to occur.

BTC/USD 4-hour chart

While things are looking up for Bitcoin price, the confluence around $42,748 is a significant blockade. A four-hour candlestick close above $43,800 will invalidate the bearish breaker and reject the possibility of a correction.

In such a case, investors can expect BTC to continue this uptrend and make a run at the yearly open at $46,198.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.