Bitcoin price sink or swim: BTC hits six-month high despite decline in whale holdings

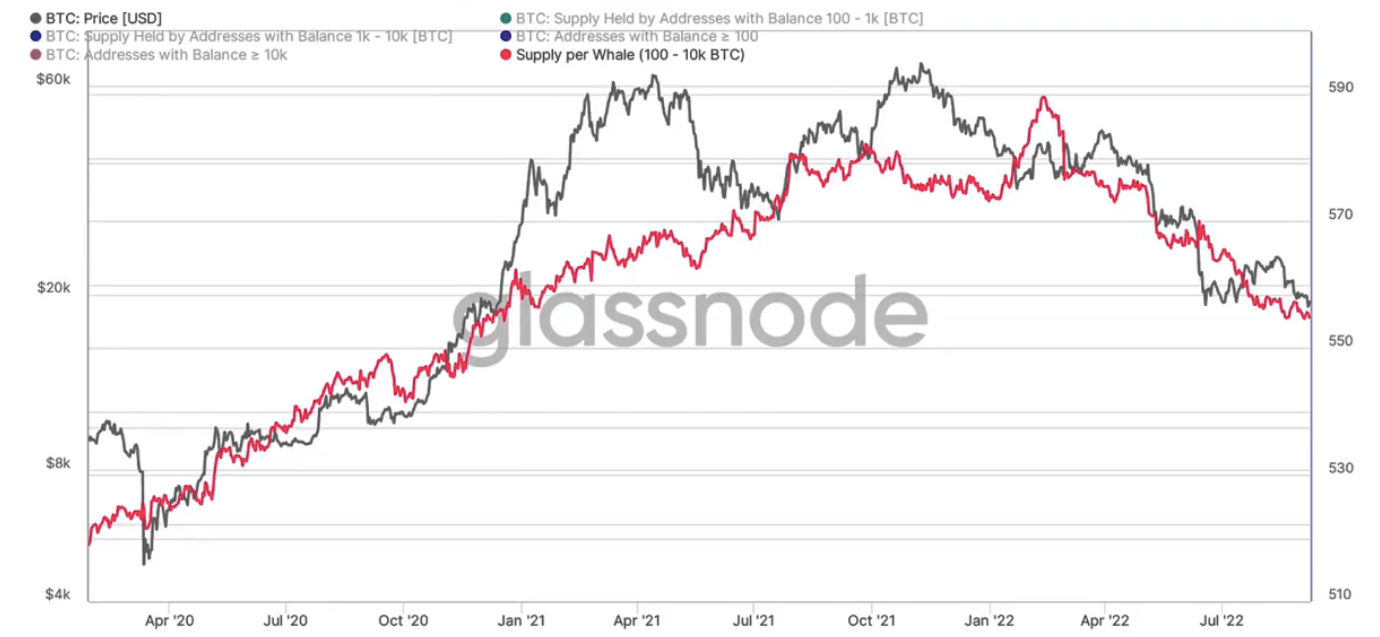

- Bitcoin’s supply per whale nosedived to its lowest level since December 2020 indicating large wallet investors have shed their BTC holdings.

- Analysts consider the decline in whale holdings an indicator of a bearish trend reversal in Bitcoin despite the current price rally.

- Bitcoin price hit its six-month high amidst speculation of Federal Reserve’s reversal on monetary policy tightening.

Bitcoin supply per whale declined despite the BTC price rally. Analysts believe the probability of a bullish revival in Bitcoin is low in the near term. The asset hit a six-month high earlier today amidst speculations surrounding the Federal Reserve’s decision.

Also read: Bitcoin Price: Whales flood exchanges with BTC, what's next?

Whales shed BTC holdings, what’s next?

Bitcoin supply of large wallet investors dropped to its lowest level since December 2020. This indicates that the probability of a bullish revival in Bitcoin is low. Typically when large wallet investors hold Bitcoin or scoop up BTC across exchanges it fuels a rally in the asset. Similarly, decrease in whale wallet holdings signals an increase in BTC holdings across exchanges, and a rise in selling pressure on Bitcoin.

Despite decline in supply held by whales, Bitcoin price increased, hitting a six-month high.

Bitcoin supply per whale

Despite moves by large wallet investors Bitcoin posted its highest daily gain in six months. BTC price surged past $20,000 amidst speculation of a reversal of monetary-policy tightening by the Federal Reserve.

The Federal Reserve could quickly pause or reverse its tightening measures on the US economy as it slides into recession. This could result in higher capital inflow in Bitcoin, increase in demand for the asset and a price rally.

Analysts believe Bitcoin is in its accumulation phase

Crypto Wolf, a pseudonymous crypto analyst and trader believes Bitcoin bottom is in. The last parameter to be met is the weekly MACD crossover and there would be a third confirmation in the asset’s price rally. This marks a three-month long accumulation phase. Investors who scooped up Bitcoin in the last 90 days are likely to yield gains from the asset.

BTC-USD price chart

According to the analyst, Bitcoin price could witness a rally in the short term after completion of the intial accumulation phase that lasted three months.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.