Bitcoin price prediction: Will Trump’s 100-Day speech propel BTC above $100,000?

- Bitcoin price bounces above the $95,490 as markets await Trump’s 100-day speech.

- Cryptocurrency-related policies dominated Trump’s but marketsterm; still await definitive updates on the Bitcoin strategic reserve proposal.

- Investors moved BTC worth $4 billion from exchanges since Trump launched controversial calls for rate cuts last week.

Bitcoin rebounds as high as $95,490 on Monday, as Trump’s 100-day speech dominates macro news. On-chain data shows BTC deposits on exchanges declined by $4 billion in the past week. Here’s how these insights could impact Bitcoin $100,000 breakout prospects in the near-term.

Bitcoin (BTC) retakes $95K as market awaits Trump’s 100-day speech

Bitcoin posted strong gains as crypto markets turned cautious ahead of Trump’s 100-day on Monday. Crypto-related policies have featured prominently so far in Trump’s second-term presidency, but markets await clarity on the Bitcoin strategic reserve proposal.

On-chain data shows investors moved over $4 billion in Bitcoin off exchanges since Trump’s controversial call for a rate cut last week.

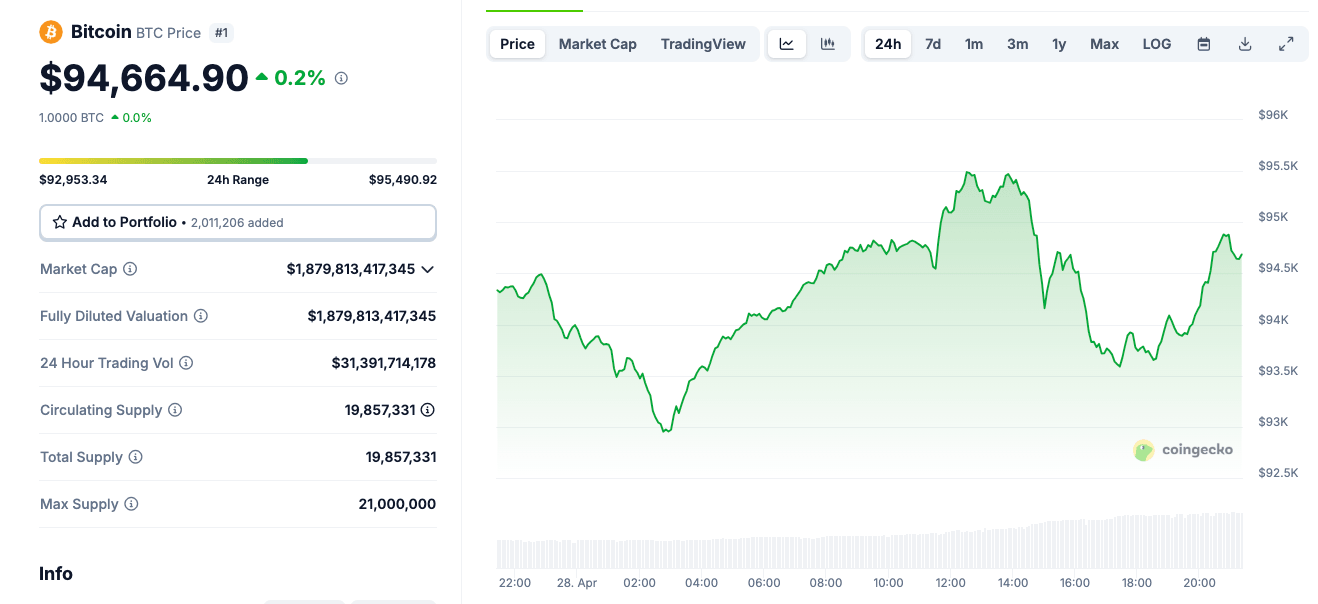

Bitcoin price action, April 28, 2025 | Source: Coingecko

Bitcoin (BTC) rose above $95,490 on Monday as investors reacted to fresh market catalysts on Monday. Bitcoin rose 0.8% over the last 24 hours, reaching $95,490.92, according to CoinGecko data.

As seen above, BTC traded between $92,953.34 and $95,490.92 during the session. Weekly performance remains positive, with Bitcoin up 8.9% from last Monday and 15.0% higher over the past 30 days.

100-day review: Impact of Trump’s policies on Bitcoin price

Bitcoin’s rally mirrors gains in U.S. equities, with top technology stocks rising ahead of Trump's speech. Market participants are closely watching for crypto-specific regulatory updates.

A definitive announcement on a Bitcoin strategic reserve could trigger a parabolic move towards $100,000. However, renewed focus on tariffs or aggressive budget cuts could weigh on broader markets and cap Bitcoin’s upside in the short term.

- Declining inflation

Since Trump’s inauguration, US inflation has declined steadily. According to TradingEconomics data, inflation has flattened from a 9.1% peak in 2022 to 2.4% in March 2025. Trump has claimed victory over inflation but continues to advocate tariffs, a move economists warn could reignite price pressures.

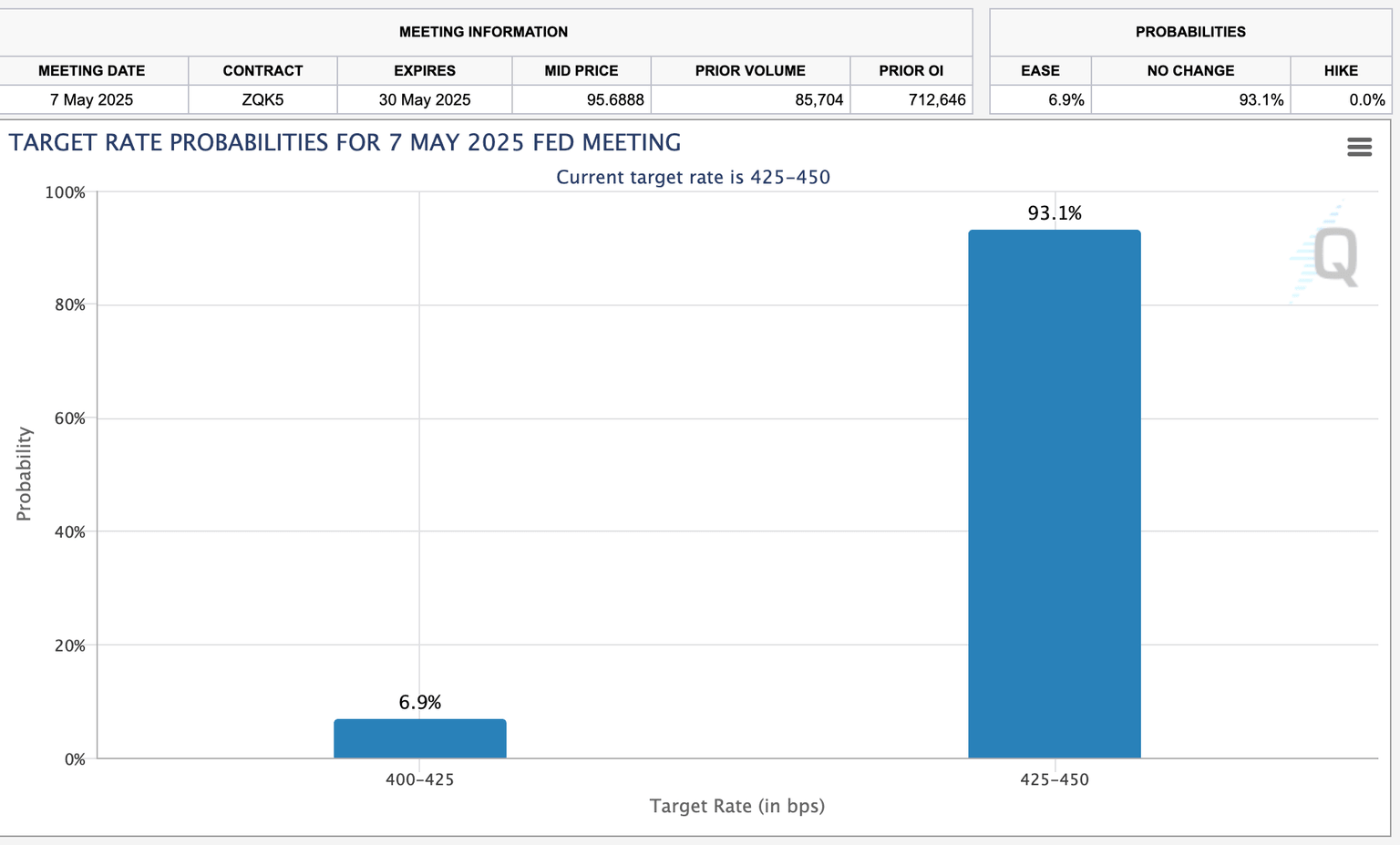

CME Group FedWatch Tool hits 9% chance of rate cut, April 28, 2025 | Source: CMEGroup

In reaction, Trump's recently intensified calls for a rate cut, threatening to replace Federal Reserve Chair Jerome Powell. While this sparked speculations, CME FedWatch data indicates 90.1% likelihood of another rate pause at the next May 7 FOMC meeting slated for May 7.

- Tariffs overhang on US Stocks drives Bitcoin inflows

President Trump has consistently expressed support for tariffs, viewing them as a tool to address trade imbalances. His stated intention to "impose across-the-board tariffs on most foreign-made goods" has created uncertainty in U.S. stock markets.

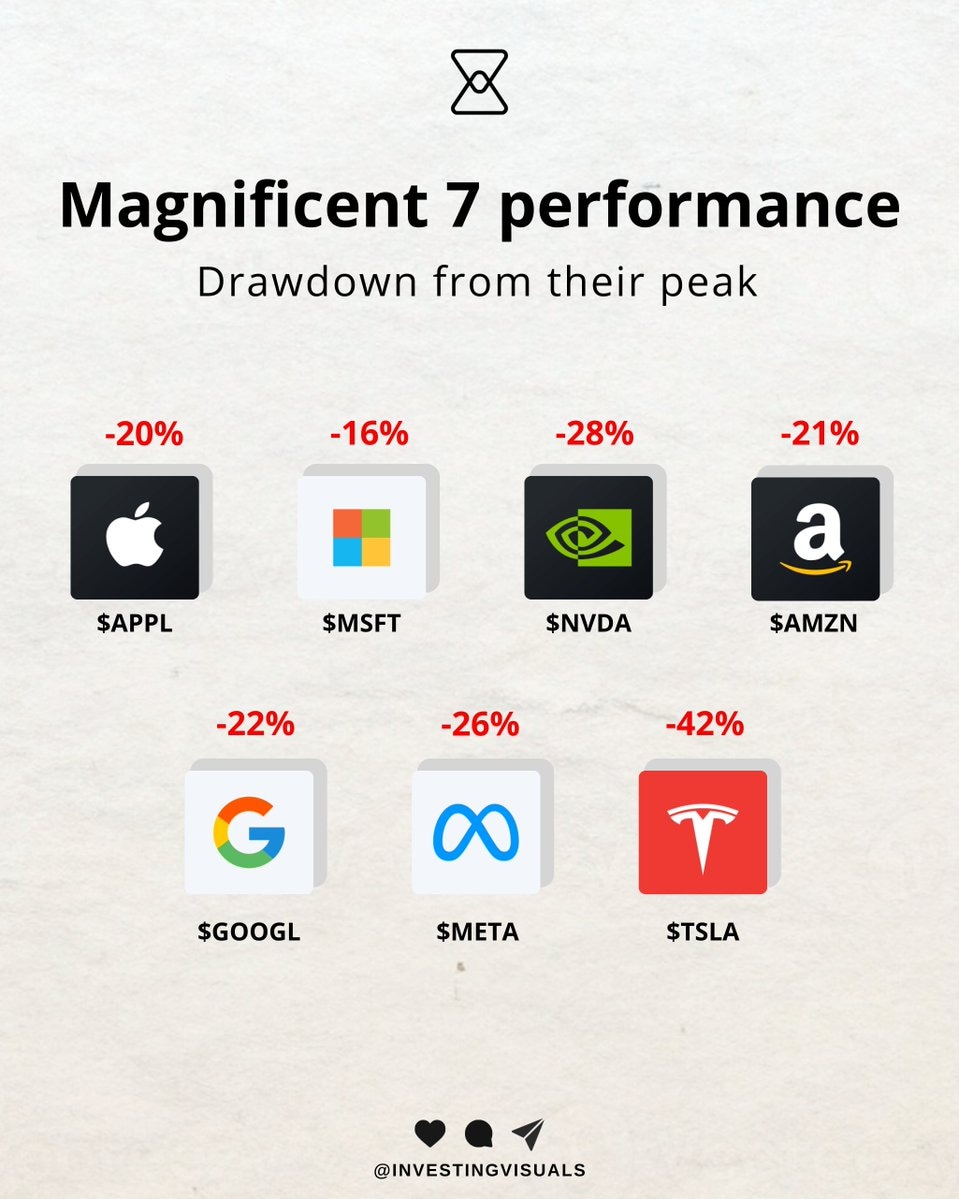

Magnificent 7 (US Big Tech Stocks) | Source: x.com/InvestingVisual

This uncertainty appears to be benefiting Bitcoin, which is increasingly seen by investors as a safe-haven asset, insulated from geopolitical risks and disruptions to global supply chains. For context, Bitcoin price is currently posting 5.6% year-to-date, while Nasdaq’s S&P 500 and Dow Jones index are down 5% within the same period.

Bitcoin’s relative resilience positions it to receive more capital inflows if Trump’s policies continue to overheat global TradFi markets in Q2, 2025.

Looking ahead: What’s next for Bitcoin price action this week?

Geopolitical tensions and market instability during Trump's first 100 days have boosted Bitcoin's appeal as a safe-haven asset.

With Bitcoin shielded from these geopolitical risks and global supply chain vulnerabilities, its resilience above the $90,000 level signals the potential for continued upward momentum.

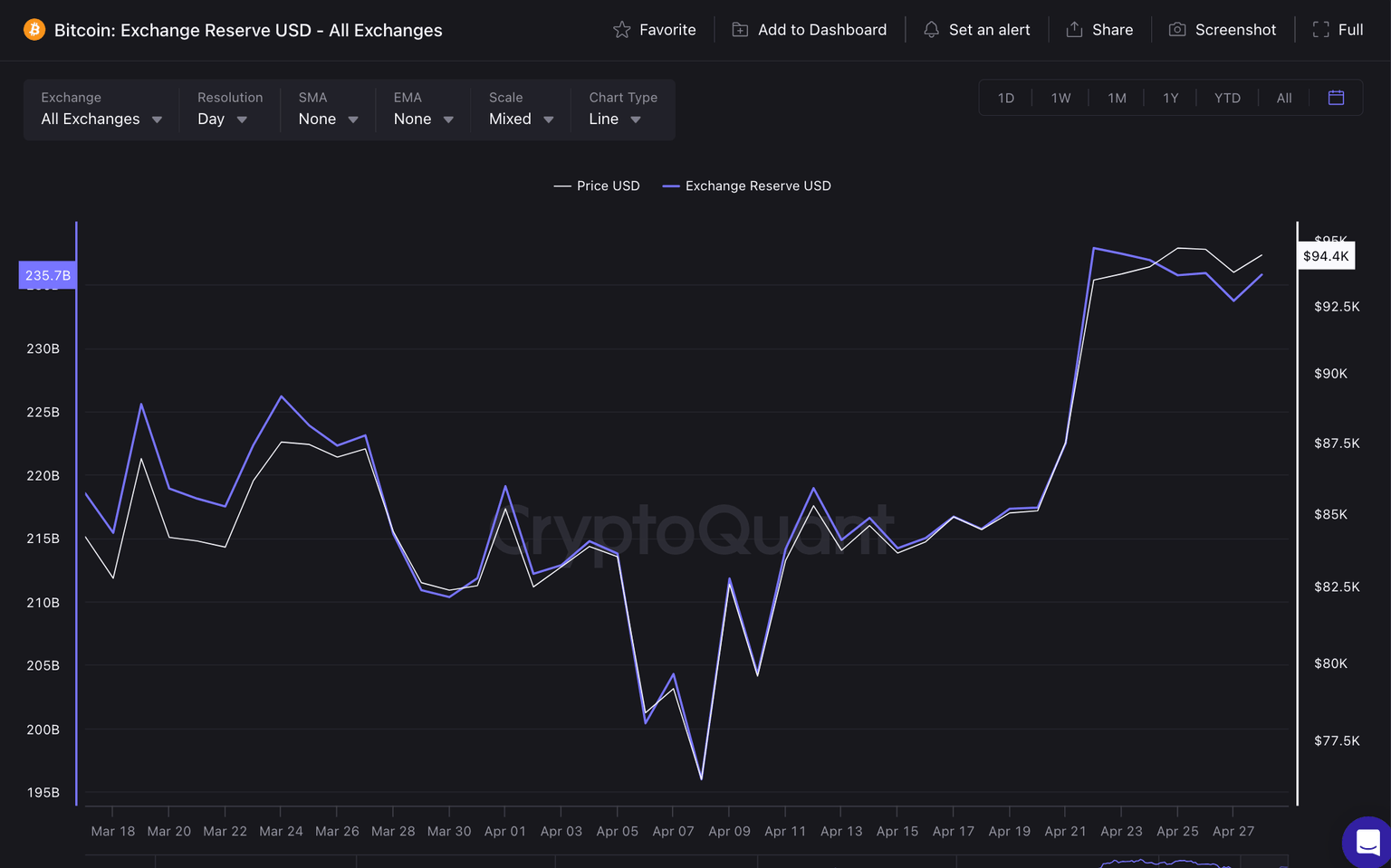

Bitcoin exchange reserves vs. BTC price | Source: CryptoQuant

On-chain data reinforces this outlook, with CryptoQuant's exchange reserve charts indicating a significant outflow of Bitcoin from trading platforms.

Investors have withdrawn over $4 billion worth of Bitcoin from exchanges since Trump's recent calls for rate cuts, with total exchange deposits falling from $237.8 billion on April 22 to $233.8 billion at the time of writing.

With demand triggers still active, the sustained drawdown in available exchange supply strengthens the case for a Bitcoin breakout towards the $100,000 milestone in the near term.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.