Bitcoin Price Prediction: BTC/USD volatility kick starts rally to $10,400 – Confluence Detector

- Bitcoin embraces the return of volatility with a falling triangle breakout.

- BTC/USD technical picture remains positive even as consolidation starts to take root.

- Bitcoin buyers to face the strongest resistance at $9,417 in preparation for lift-off to $10,400.

After many weeks of relatively little no Bitcoin price action, the leading cryptocurrency finally embraced a breath of fresh bullish air on Tuesday. Bitcoin’s volatility had fallen to a two-year low as reported but just like, the CEO of Binance, Changpeng Zhao told Bloomberg on Monday, a breakout came into the picture.

Bitcoin scaled several resistance levels that had proved impenetrable over the last weeks including $9,300 and $9,400. Unfortunately, the rally was cut short before taking down the seller congestion at $9,500.

A retreat occurred with BTC diving back into the $9,300 range. At the time of writing, BTC/USD is teetering at $9,368. The prevailing trend is strongly bearish amid higher intraday volatility levels. In other words, the path of least resistance is downwards as Bitcoin seeks formidable support from which it will stage the next attack on $9,500; a move that is likely to pave the way for massive gains targeting $10,400.

Looking at the daily chart, Bitcoin already confirmed a triangle breakout. The only thing delaying a rally is the lack of enough volume. The immediate upside is capped by the 50-day SMA. Gains above $9,400 are anticipated in the course of the trading on Wednesday if not consolidation will take precedence as observed with the sidelong moving RSI and MACD.

BTC/USD daily chart

%20(1)-637309861583848413.png&w=1536&q=95)

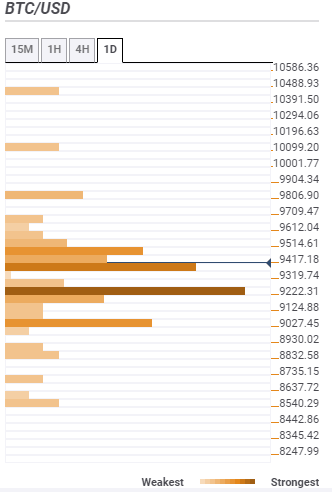

Bitcoin confluence resistance and support levels

Resistance one: $9,417 – This is the initial but strongest resistance zone. It hosts the Fibo 23.6% one-day, the SMA 50 15-minutes, the previous high 15-minutes and the SMA ten 1-hour indicators among others.

Resistance two: $9,514 – The second hurdle as highlighted by the pivot point one-week resistance two, the Bollinger Band 1-hour upper curve and the previous high one-day.

Resistance three: $9,806 – Stands out as the third key seller congestion zone that is home to the pivot point one-day.

Support one: $9,319 – This is the first support but it’s important to note that it is weak. It is highlighted by the Bollinger Band 1-hour lower curve.

Support two: $9,222 – The strongest support zone as shown by the SMA 50 14-hour, the SMA 200 1-hour, the Bollinger Band 4-hour and the pivot point one-day support one.

Support three: $9,027 – Highlighted by the SMA 100 daily, the Fibo 161.8% daily, the previous week low and the Bollinger Band lower curve.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren