Bitcoin Price Prediction: Bitcoin climbs above $10,600 aiming for $12,000 again

- Bitcoin is currently trading at $10,693 after a strong breakout.

- The CME Futures gap at $9,600 hasn’t yet been filled.

Bitcoin has been trading sideways for the past 10 days and formed a symmetrical triangle pattern on the 4-hour chart. After an initial fakeout, Bitcoin bulls did eventually manage to crack the upper trendline and see a real breakout.

BTC/USD daily chart

Bitcoin’s momentum has clearly shifted in favor of the bulls, however, the CME futures gap at $9,600 wasn’t really filled. We know there is a strong area of support around $10,000 and the 100-SMA has also been acting as a support level. The bounce seems to be quite healthy and Bitcoin’s price is facing very little resistance to the upside as the last crash left practically no resistance levels on the way down.

If Bitcoin closes strong in the next few hours, the next level to beat would be $10,831, the 0.382 Fibonacci retracement level. Before $12,000, there is also another retracement level at $11,460.

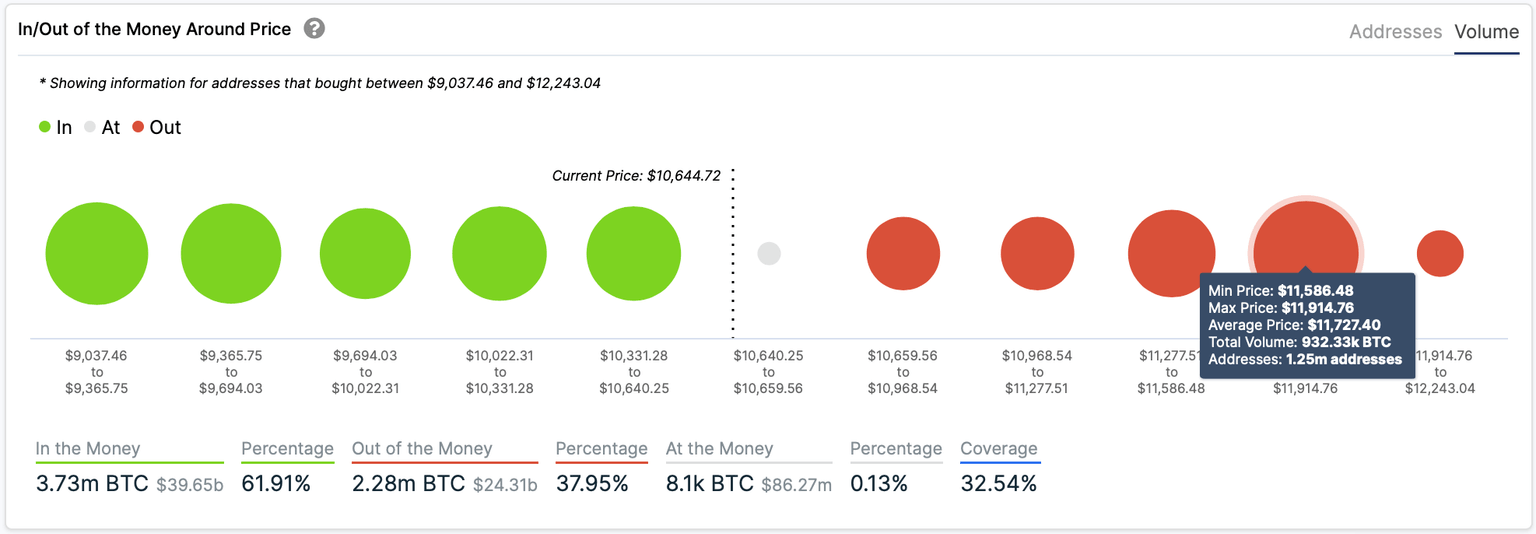

This seems to coincide with the IOMAP chart that shows the next significant barrier is sitting at $12,000. The Bitcoin Stock-to-Flow Model also seems to be in favor of Bitcoin going up. PlanB, the creator of the model stated:

I would be surprised if Sep close dot would be lower than Aug close. 16 days to go.

BTC/USD 4-hour chart

The 4-hour chart has flipped in favor of the Bitcoin bulls which were able to establish a clear higher low and two higher highs. Bitcoin price is now right at the 100-SMA at $10,724 which seems to be acting as a resistance level. The increase in bullish trading volume also shows that the breakout from the symmetrical triangle is real.

Flagging$ETH$BTC pic.twitter.com/ijJgMqVUj1

— Peter Brandt (@PeterLBrandt) September 8, 2020

Not everyone is so bullish on the flagship currency, back on September 8, Peter Brandt, a well-known trader stated that Bitcoin created a bear flag. The most bearish scenario would take Bitcoin at least down to $9,600 to fill its CME’s futures gap.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637357046647040236.png&w=1536&q=95)

-637357046770634261.png&w=1536&q=95)