Bitcoin price is positioned for a crash below $30,000

- Bitcoin price is threatening new 2022 lows as it closes in on a nearly 10% daily loss.

- A major bear trap could be developing if sellers fail to capitalize on crypto weakness.

- Retail volume increasing at critical price levels.

Bitcoin price hammered lower with stocks and other risk-on markets. After a major rally yesterday, all of those gains have been eliminated. Bears may be attempting to push BTC to new 2022 lows.

Bitcoin price action may be on the road to a capitulation move below $30,000

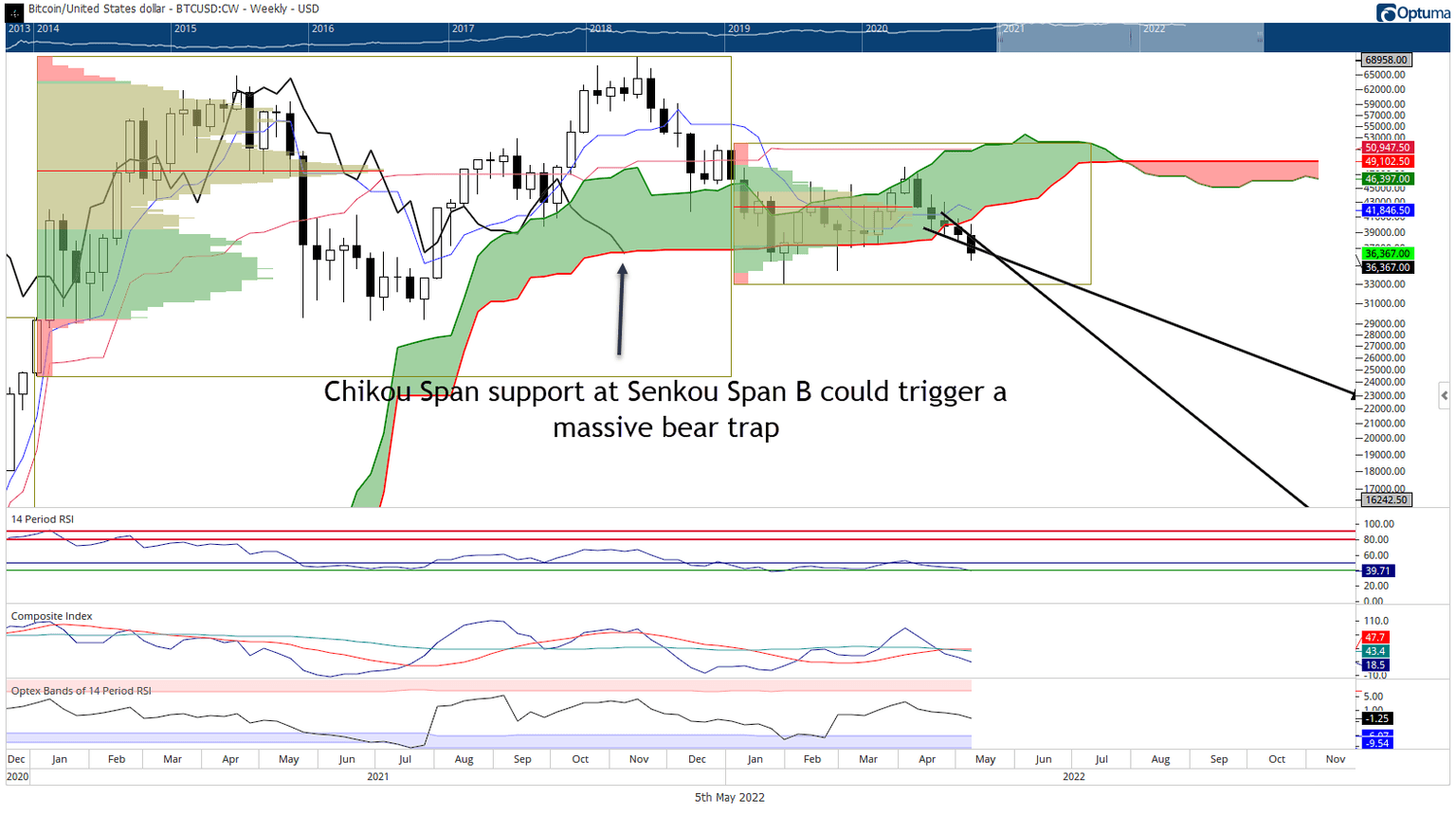

Bitcoin price action on the weekly Ichimoku chart is positioned for the single most bearish setup since November 2018. Bitcoin is in a confirmed Ideal Ichimoku Bearish Breakout - a condition that warns of prolonged bearish price action. While these events have happened in the past, the current setup is slightly different.

One of the rarer but more powerful signals within the Ichimoku Kinko Hyo system that a bear market is likely to be extended is when all conditions for an Ideal Bearish Ichimoku Breakout exist, but with one additional requirement: The Chikou Span closes below the Ichimoku Cloud.

When this occurs, the probability of a sustained sell-off and capitulation move is extremely high - the highest within the Ichimoku system. If bulls fail to keep Bitcoin price above $36,465, a capitulation move towards the $18,000 value area is likely.

BTC/USD Weekly Ichimoku Kinko Hyo Chart

However, bulls shouldn’t lose hope. One peculiar and less known behavior within the Ichimoku system is that the Chikou Span reacts to the same support and resistance levels as the current close. The Chikou Span is sitting right on top of the strongest level of support/resistance, Senkou Span B.

Bitcoin price and the entire cryptocurrency market may be prepping for one of the biggest bear traps in cryptocurrency history.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.