Bitcoin soars to $57,000 blowing $100 million BTC shorts out of the water

- Bitcoin price tagged $57,000 for the first time since December 2021.

- This move comes after BTC rose by 5.31% on Monday and nearly 5% in the early trading session on Tuesday.

- Investors must be cautious of this volatility as it could see a significant sell-off.

Bitcoin price does a full 180 as it ends the low volatility period that lasted between February 15 and 25 by hitting the $57,000 mark for the first time in more than two years. To be specific, BTC hit $57,073 on Binance, one of the largest exchanges in the world. This development comes roughly a week after the Nvidia frenzy ended, with the earnings released on February 21.

Also read: GBTC hits lowest-ever $22M outflow, raising hopes for end to Bitcoin bleed

Bitcoin price hits $57,000

Bitcoin price has hit a new yearly high of $57,000 for the first time in more than two years. The bull run that began in 2023 is still going strong and shows no signs of stopping. The nearly 5% upswing noted on Tuesday and Monday's 5% has made this move possible.

BTC/USDT 1-day chart

Read more: Bitcoin price peaks at $54,910 as BlackRock spot BTC ETF, IBIT, trades above $1 billion on Thursday

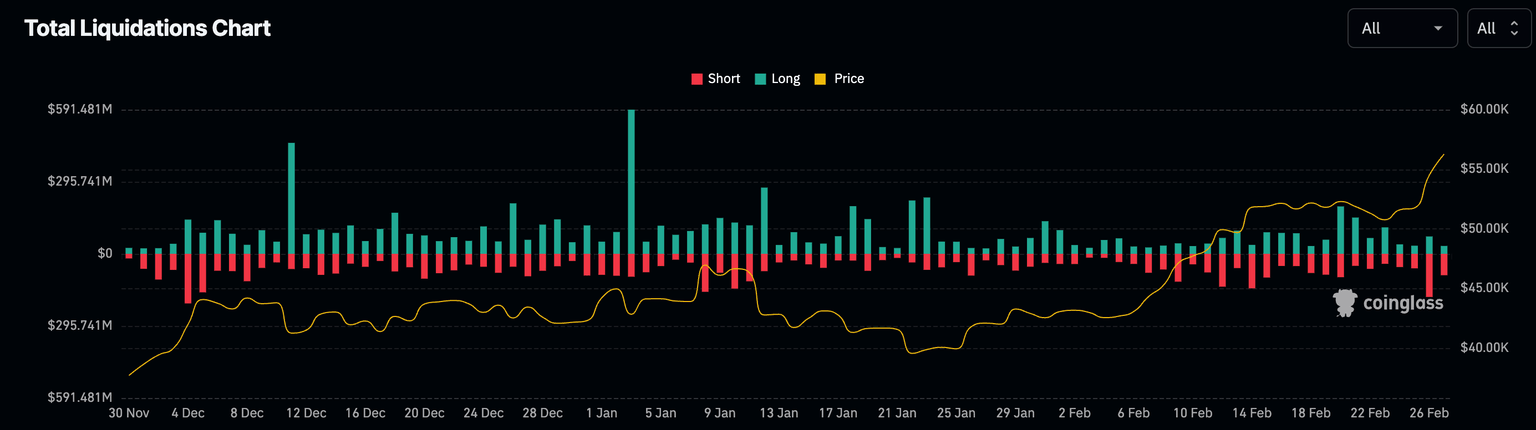

According to data from CoinGlass, this explosive move has liquidated nearly $250 million worth of positions on Monday, with $150 million liquidated as of February 27.

BTC liquidations

Read more: BTC ETF AUM could surpass Gold, expert says, amid enthusiasm for new investment funds

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.