Bitcoin Price Forecast: BTC upward movement inhibited by $11,700 resistance line

- Breaking past the $11,700 resistance will encourage a move into the $13,000 zone.

- BTC is presently sitting on top of a stack of support levels.

The premier cryptocurrency has been on a major upswing since September 23, as it has gone up from $10,225 to $11,285, since then. Of late, the price movement has become a little lethargic. However, it should be noted that this is probably a short-term retracement before the price resumes its upward movement.

The technical outlook

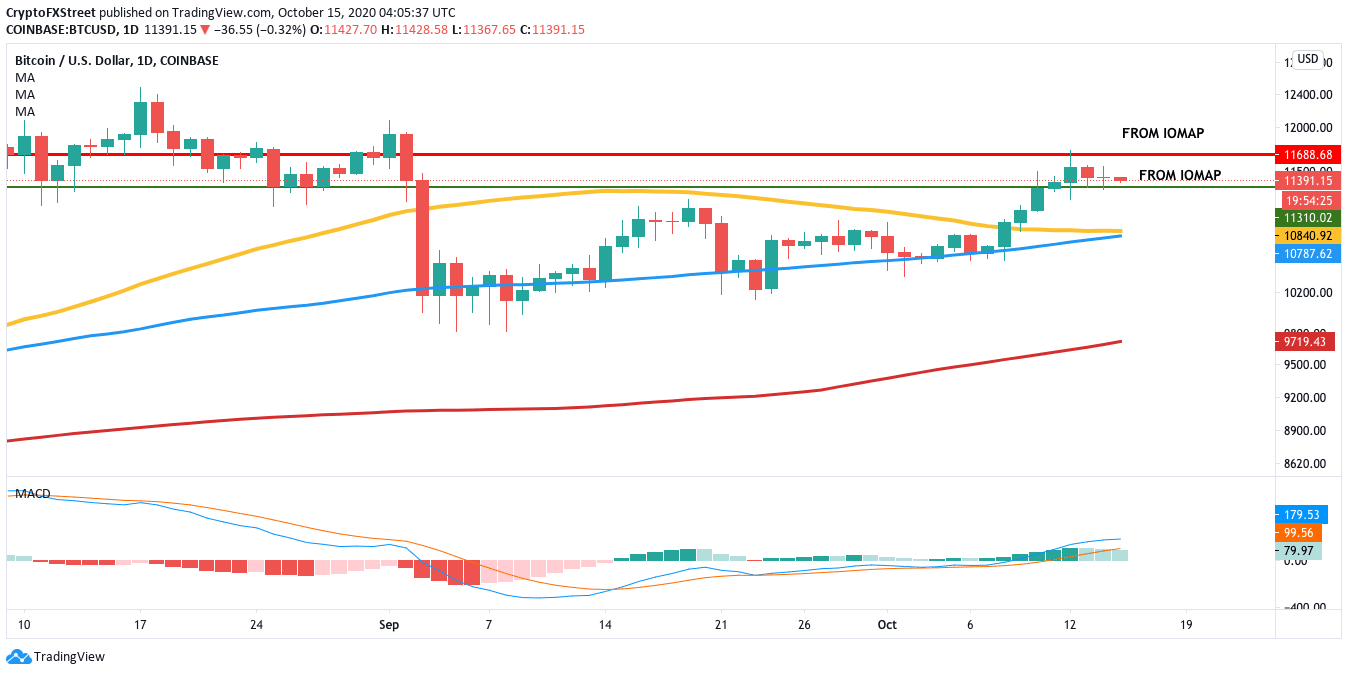

After six consecutive bullish days, the price has encountered resistance at the $11,700 line. Following the rejection, the price has dropped towards the $11,300 support wall. The MACD shows increasing bullish momentum, so the price will likely bounce back and break past the $11,700 resistance.

BTC/USD daily chart

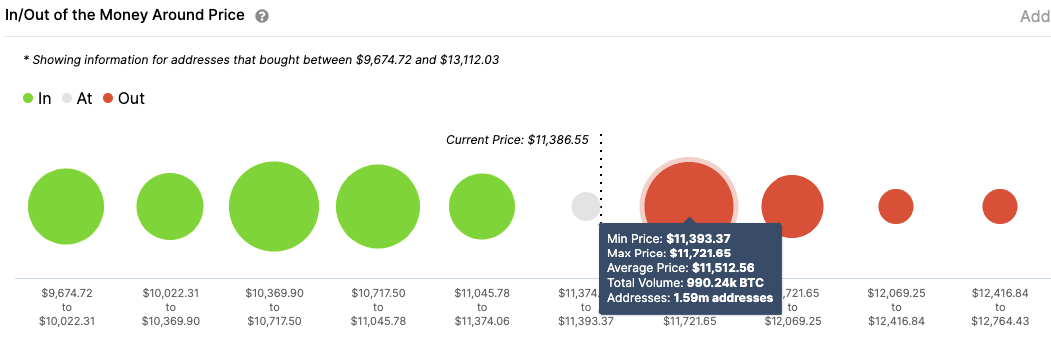

As per IntoTheBlock’s IOMAP, previously, 1.6 million addresses had purchased 990,000 BTC at $11,700. While it looks like this level should be strong enough to absorb a lot of buying pressure, it should also be noted that if they manage to break past this obstacle, the buyers will have the firepower to aim for the $13,000 zone.

Bitcoin IOMAP

The Flipside: Can the sellers change the overall outlook?

The bears can change this overall bullish outlook provided they manage to break below the certain key levels. As per the IOMAP, there is a healthy support stretch between $10,717.50 and $11,045, which coincides with the 50-day SMA and 100-day SMA. If the bears manage to break past this barrier, another strong support wall at $10,500 should prevent any further downward movement. It looks like the whales are also applying a sharp selling pressure on Bitcoin.

Bitcoin holders distribution

As per Santiment’s holder distribution chart, there has been a sharp decline in the number of addresses holding 1,000-10,000 and 10,000-100,000 BTC. In the former bracket, the number of addresses dropped from 2,113 on September 3 to 2,078 on October 15. Similarly, the number of addresses in the 10,000-100,000 BTC fell from 111 on October 2 to 106 on October 15. If the whales are going to be dumping their coins, this is a hugely negative sign for the benchmark cryptocurrency.

Key price levels to watch

The bulls need to overcome the $11,700 resistance and break into the $13,000 zone. They should also make sure that the $11,300 support remains strong to prevent any downward movement.

The bears face several robust support walls down below, which are strong enough to absorb immense amounts of selling pressure. The downside for BTC is capped off at the $10,500, as per the IOMAP.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

%20%5B09.59.39%2C%2015%20Oct%2C%202020%5D-637383353679827590.png&w=1536&q=95)