Bitcoin Price Forecast: BTC sandwiched between strong resistance and support levels – Confluence Detector

- Grayscale investment firm has bought 17,100 Bitcoin in the past week.

- BTC faces a strong resistance level at $10,800, as per the daily confluence detector.

Grayscale buys yet another $180M worth Bitcoin

Investment management firm Grayscale has recently resumed its acquisition of Bitcoin. The firm has increased its assets under management (AUM) by over 17,100 Bitcoin ($180 million) in the past week. The total digital assets under management have now surged to 449,900 (a whopping $5 billion).

Grayscale appears to have control over nearly 2.5% of the Bitcoin supply. Grayscale is not the only company that has bought a large portion of Bitcoin. According to an earlier FXStreet report, MicroStrategy purchased an additional 16,796 BTC ($175 million) a few days back.

On September 14, 2020, MicroStrategy completed its acquisition of 16,796 additional bitcoins at an aggregate purchase price of $175 million. To date, we have purchased a total of 38,250 bitcoins at an aggregate purchase price of $425 million, inclusive of fees and expenses.

— Michael Saylor (@michael_saylor) September 15, 2020

Barry Silbert, the CEO of Grayscale, took to Twitter to say that there’s an ongoing “race” between the two firms.

Apparently there is some kind of bitcoin buying race between MicroStrategy and @Grayscale

— Barry Silbert (@barrysilbert) September 15, 2020

Game on

Grayscale has reported $5.8 billion worth assets under management. These assets include Ethereum, Bitcoin Cash and Ethereum Classic, among many others.

09/25/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

— Grayscale (@Grayscale) September 25, 2020

Total AUM: $5.8 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/FtGxWWnKhE

This sort of institutional attention is highly bullish for Bitcoin.

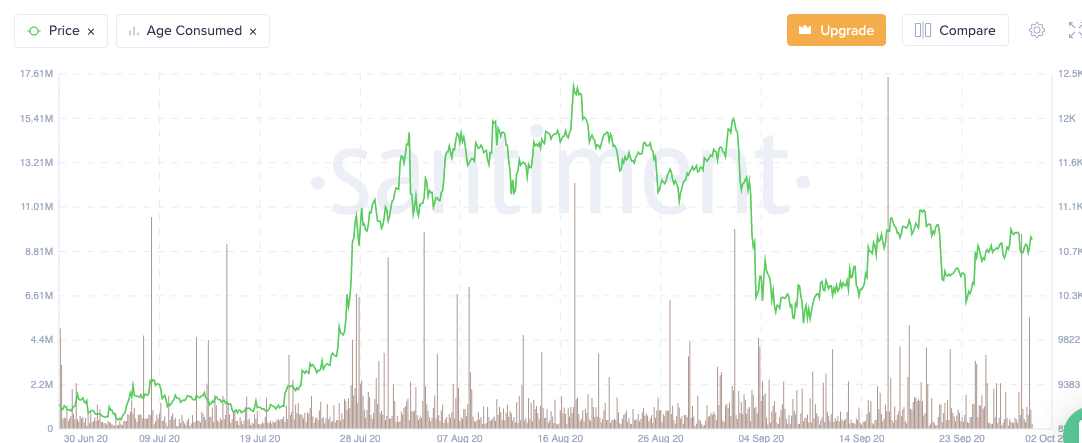

BTC Age Consumed

Age consumed tracks the movement of previously idle BTC tokens. The metric shows the amount of BTC changing addresses daily multiplied by the number of days since they last moved. Spikes indicate a significant amount of previously idle BTC tokens moving between addresses. A spike usually preceded wild price movements. There was a wild spike on 17.44 million in the three-month period, following which the price went up. Recently, there was a spike of 9.68 million this Tuesday, which will trigger a sharp movement.

Let’s look at the daily confluence detector to see where the price is going to go.

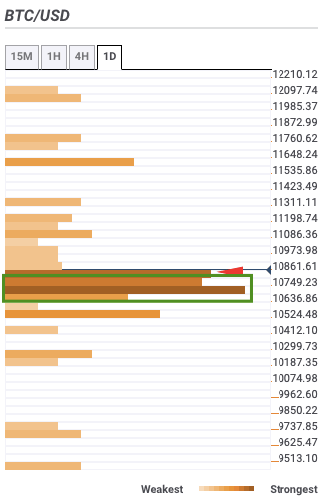

Bitcoin daily confluence detector

Bitcoin is currently sandwiched between a strong resistance ($10,800) and a healthy stack of support ($10,700 - $10,765). The support stack has the one-day Previous Low.

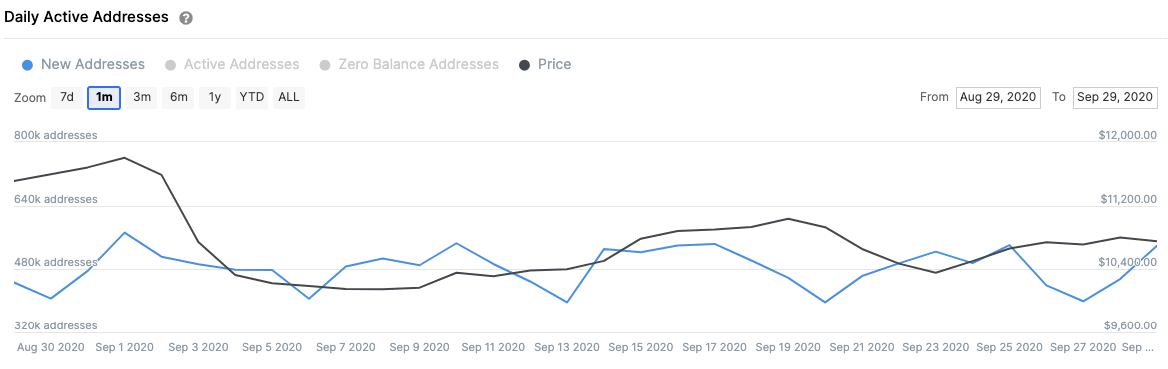

Bitcoin new addresses

As per IntoTheBlock, the number of new addresses entering the protocol rose from 455.6k to 539.45k over the last two days. This is s bullish sign for the network since it shows that it is organically growing. However, it should be noted that the number of new addresses entering has been pretty much consistent over the last month.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.