Bitcoin price could crash to $23,500 if this bearish fractal from April 2021 repeats

- Bitcoin price is hovering at the $28,800 mark after noting a 5% crash in the last 24 hours.

- While the bearish fractal suggests a 22% crash, the Net Unrealized Profit/Loss Ratio shows that the market is at a very neutral level.

- Whales holding 100 to 1,000 BTC have accumulated nearly half a billion worth of Bitcoin which could offset any potential bearishness.

Bitcoin price corrected for the first time after a little over a month and triggered the discourse of a “bear market”. Such is the fragility of the crypto market that even the slightest drops induce panic in investors, even when they are only describing a pullback.

Bitcoin price repeats history, but not really

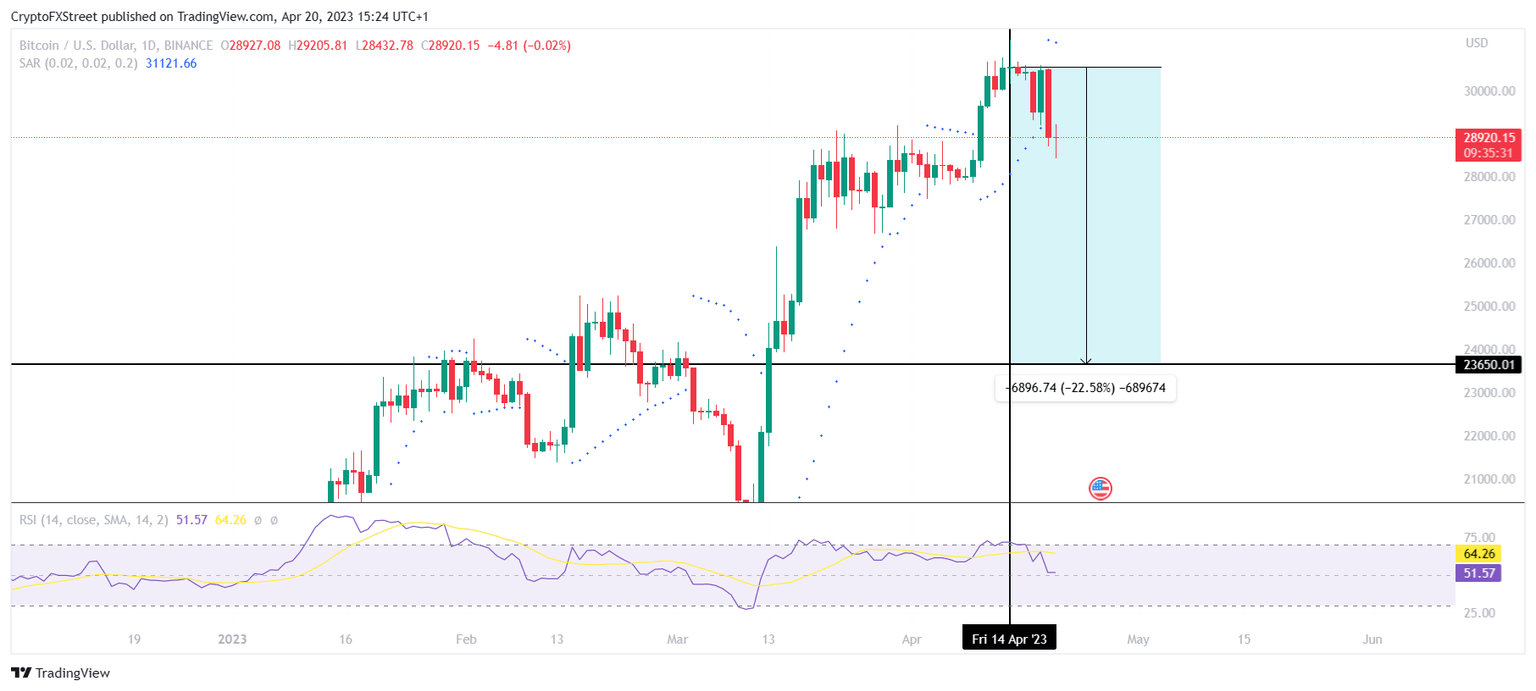

Bitcoin price slipped by 5.39% over the previous 24 hours to trade at $28,786, reminiscing a bearish fractal – a type of repeating market pattern – that was formed back on April 14, 2021. Surprisingly, the candlestick pattern noted on April 14 this year is akin to the one from two years ago.

Bitcoin bearish fractal from April 2021

A bearish fractal usually occurs when a high point is followed and preceded by lower highs which lead to further price falls. In the case of 2021, the subsequent decline in price led to a 22.5% crash that pulled BTC back below $50,000. If the same pattern plays out this time, Bitcoin price could see a drop to $23,650.

BTC/USD 1-day chart

However, this would not necessarily count as a bearish move, and the chances of an all-out crash are minimal. Bitcoin price is only correcting due to the market overheating caused by excessive bullishness over the past month, not because of a more fundamental reason. The Relative Strength Index (RSI) crossing the 70.0 mark is evidence of the same, which at the time of writing has returned to the neutral line at 50.0.

Further evidence is in the fact that volatility is currently at a two-month low which indicates that no major swings in price can take place. All the panic in the market is due to Bitcoin losing the psychological support of $30,000.

Bitcoin volatility

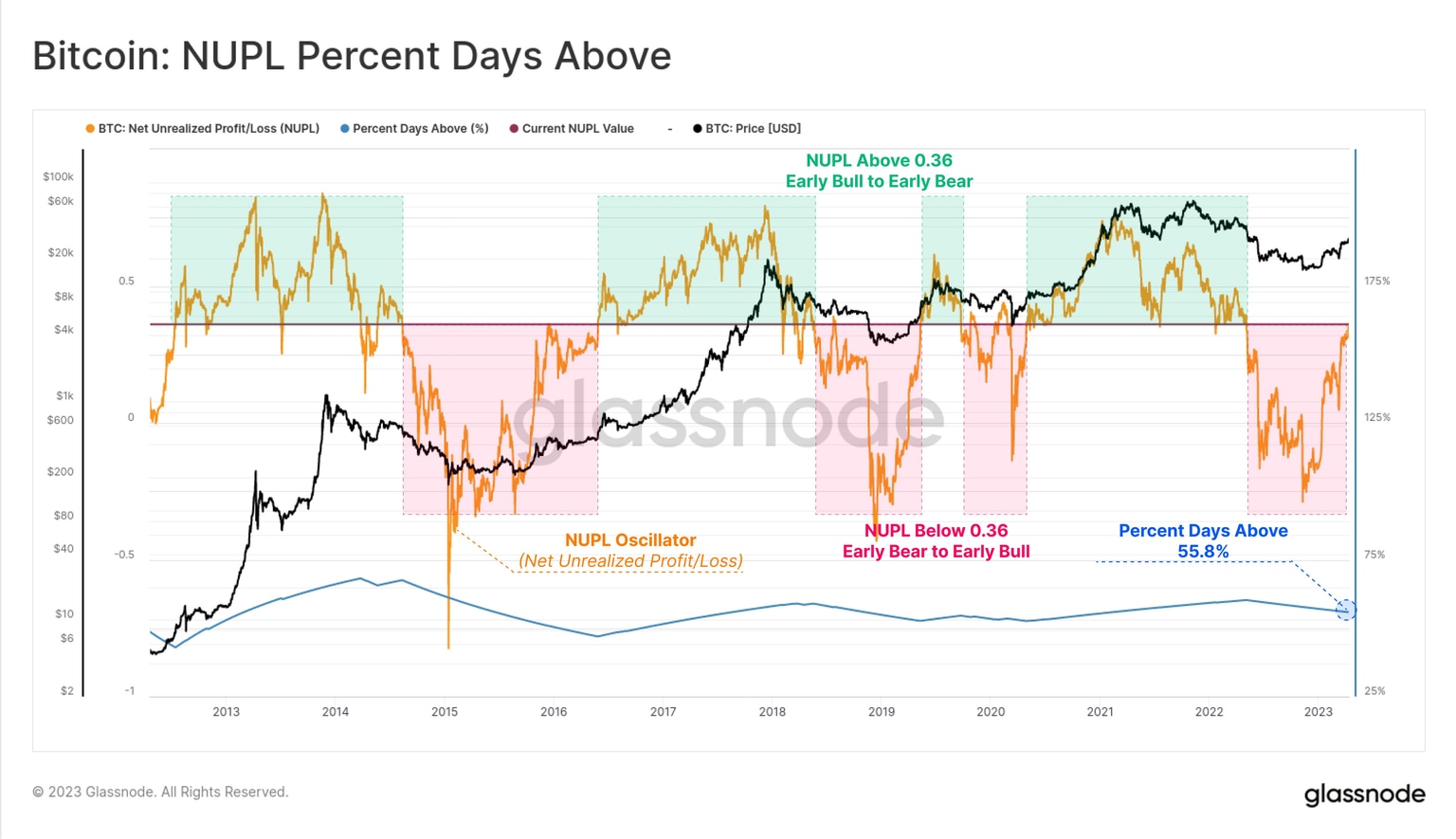

Moreover, the Net Unrealized Profit/Loss Ratio (NUPL) shows that the crypto market is at a very neutral level. Neither being heavily discounted nor being heavily overvalued suggests that Bitcoin price is safe from any sudden crashes.

Bitcoin NUPL ratio

Bitcoin whales are supplementing the neutral conditions by accumulating over the last few days. Cohorts holding 100 to 1,000 BTC have amassed 20,000 BTC worth $576 million in over four days to further offset any potential bearishness that may arise if the bearish fractal plays out.

Bitcoin whale accumulation

Thus, investors do not need to worry about a crash to $23,650 as the chances of that happening are pretty slim for the moment.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B19.36.56%2C%252020%2520Apr%2C%25202023%5D-638176030802844452.png&w=1536&q=95)

%2520%5B21.13.24%2C%252020%2520Apr%2C%25202023%5D-638176031421341934.png&w=1536&q=95)