Bitcoin price at make-or-break point: $29,000 or $21,000?

- Bitcoin price shows a lack of directional bias as it approaches the $24,655 resistance level.

- A lack of buying pressure could send BTC down to the immediate support level at $21,430.

- A daily candlestick close that flips the $24,655 level into a support floor will invalidate the bearish thesis.

Bitcoin price has shown a resurgence of bulls that have pushed it higher over the last 48 hours. However, this move could halt and reverse if certain resistance levels are not breached. Therefore, investors need to pay close attention to how the price action develops in the next few hours.

Bitcoin price arrives at an inflection point

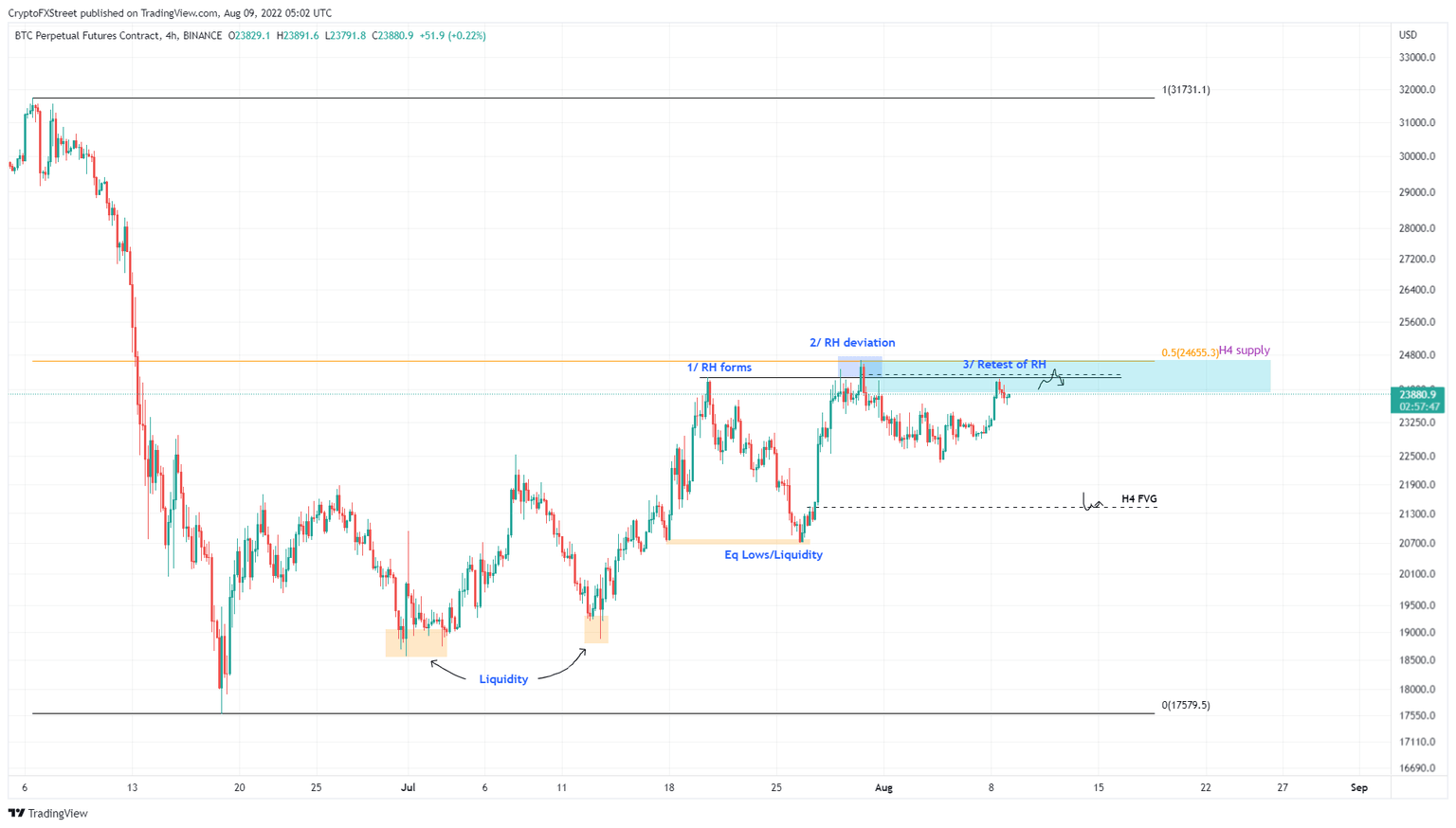

Bitcoin price faces rejection at the four-hour supply zone, extending from $23,932 to $24,722. In addition, BTC is close to retesting the midpoint of the 42% crash at $24,655, making this level a tough one to surpass.

Furthermore, the triple tap, aka top reversal pattern, has also formed, adding credence to a downside move in the near future.

Moreover, there are inefficiencies and liquidity to the downside that have to be collected. All of these considerations suggest that a downswing seems plausible, at least until invalidated.

Investors can expect Bitcoin price to sweep the $24,655 level again, triggering a sell signal. The resulting downswing could knock BTC down to the four-hour fair value gap, aka price inefficiency, at $21,430.

This is just the first move from bears as Bitcoin price could slide lower to collect the sell-side liquidity resting below the equal lows formed at roughly $20,750.

These levels are likely the target of market makers and whales and BTC is likely to form a base here. However, in an extremely bearish case, Bitcoin price could sweep the range low $17,579 and trigger a crash to $13,000, where a macro bottom could form.

BTC/USDT 4-hour chart

While things are looking up for Bitcoin price, a daily candlestick close that flips the $24,655 level into a support floor will invalidate the bearish thesis. In such a case, BTC could trigger a run-up that could retest the $28,000 to $29,000 level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.