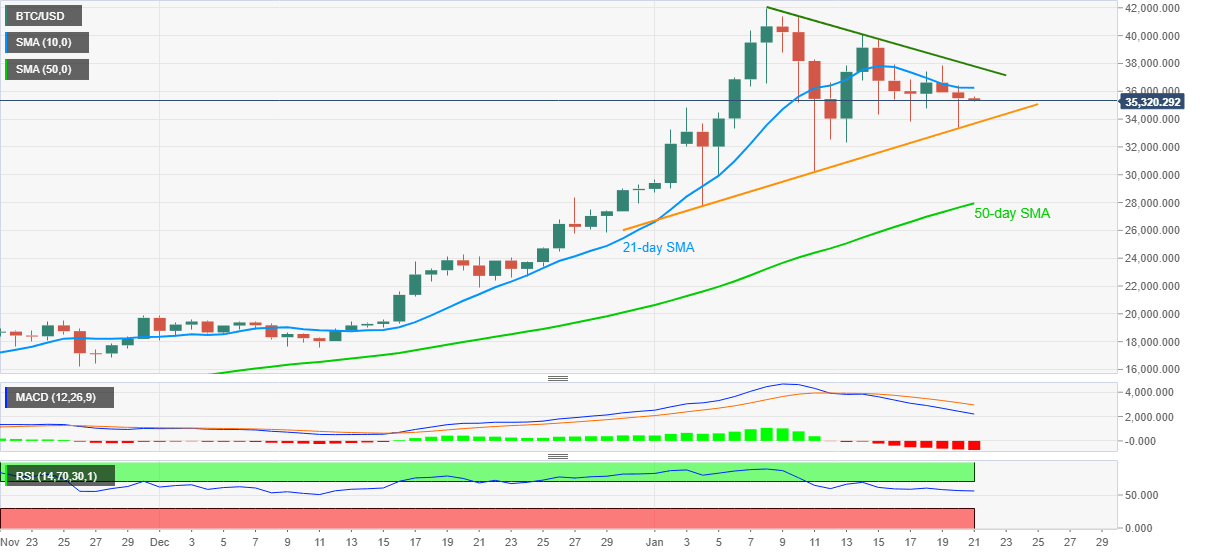

Bitcoin Price Analysis: BTC bulls stay hopeful above 13-day-old support line

- BTC/USD fades corrective pullback from short-term support line.

- Bearish MACD, 21-day SMA probe the bulls eyeing two-week-long resistance line.

- Sellers can target 50-day SMA on breaking the key support trend line.

BTC/USD drops to $35,400 during early Thursday’s trading. In doing so, the crypto major fizzles the previous day’s bounce off the key support line from January 04.

Considering the quote’s inability to extend the corrective pullback beyond 21-day SMA, coupled with bearish MACD, BTC/USD is expected to print a three-day losing streak.

However, the anticipated downside momentum could be less damaging to the overall bullish sentiment unless breaking the stated support line, at $33.680 now.

In a case where the BTC/USD bears dominate past-$33,680, the $30,000 threshold can offer an intermediate halt during the fall to the 50-day SMA level of $27,957.

Alternatively, an upside clearance of 21-day SMA, at $36,267 now, will recall the BTC/USD buyers targeting a short-term resistance line currently around $37,800.

During the quote’s further rise above $37,800, the $40,000 round-figure and previous week’s peak surrounding $40,115 can act as buffers before challenging the record top of $41,987.

BTC/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.