Bitcoin Price Analysis: BTC bulls need to crack $33K to revive the upside momentum

- BTC/USD struggles between key HMAs on the road to recovery.

- RSI points higher, now eyeing to reclaim the bullish region.

- Acceptance above $33K is needed to extending the bounce.

Bitcoin (BTC/USD) is making minor recovery attempts on the $31K level, having dipped to fresh daily lows sub-$30K threshold.

The no. 1 coin remains pressured so far this Tuesday, consolidating the corrective slide from record highs of $34,799 reached Sunday. The bears have failed to find acceptance under the $30K mark, keeping the upside bias intact in the most favorite digital asset.

BTC/USD: Hourly chart

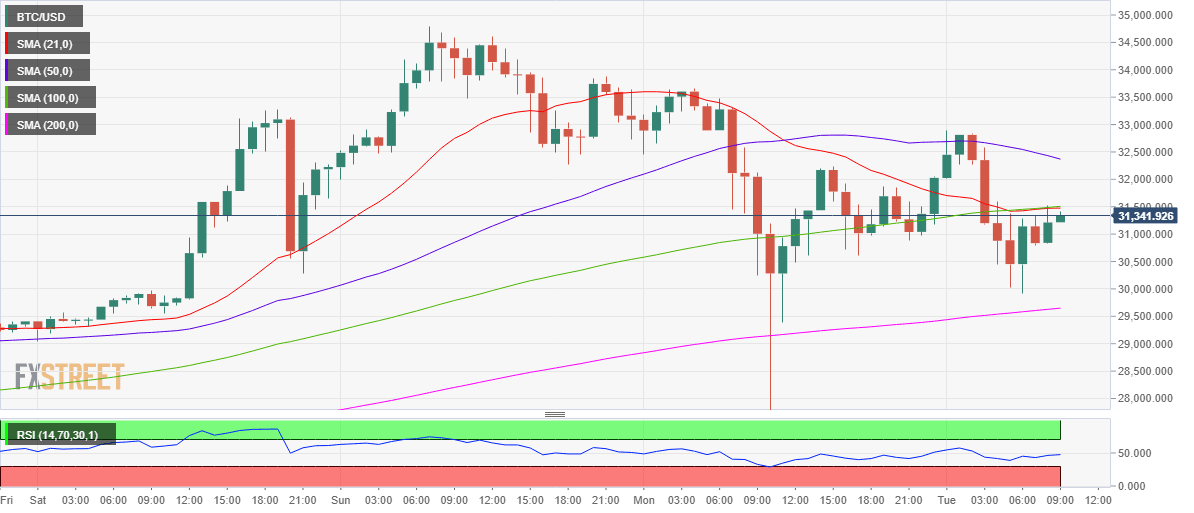

As observed in the hourly chart, the Bitcoin buyers are trying hard to recapture the critical barrier around $31,480, which is the confluence of the horizontal 21 and 100-hourly moving average (HMA).

Acceptance above the latter could put the $32K hurdle at risk once again. A sustained break above that level could expose the 50-HMA at $32,368.

The bulls need to clear the above resistance in order to regain the $33K mark. The recent bullish momentum is likely to resume only on a breakthrough the latter, opening doors for a retest of the record highs.

The hourly Relative Strength Index (RSI) is inching higher, looking to enter into the bullish territory above 50.00.

Alternatively, the $30K cushion could once again come to the bulls’ rescue, failure to resist it could threaten the upward-sloping 200-HMA support at $29,649.

Bitcoin: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.