Bitcoin on the brink: Bulls must defend $100,990 to avert deeper sell-off

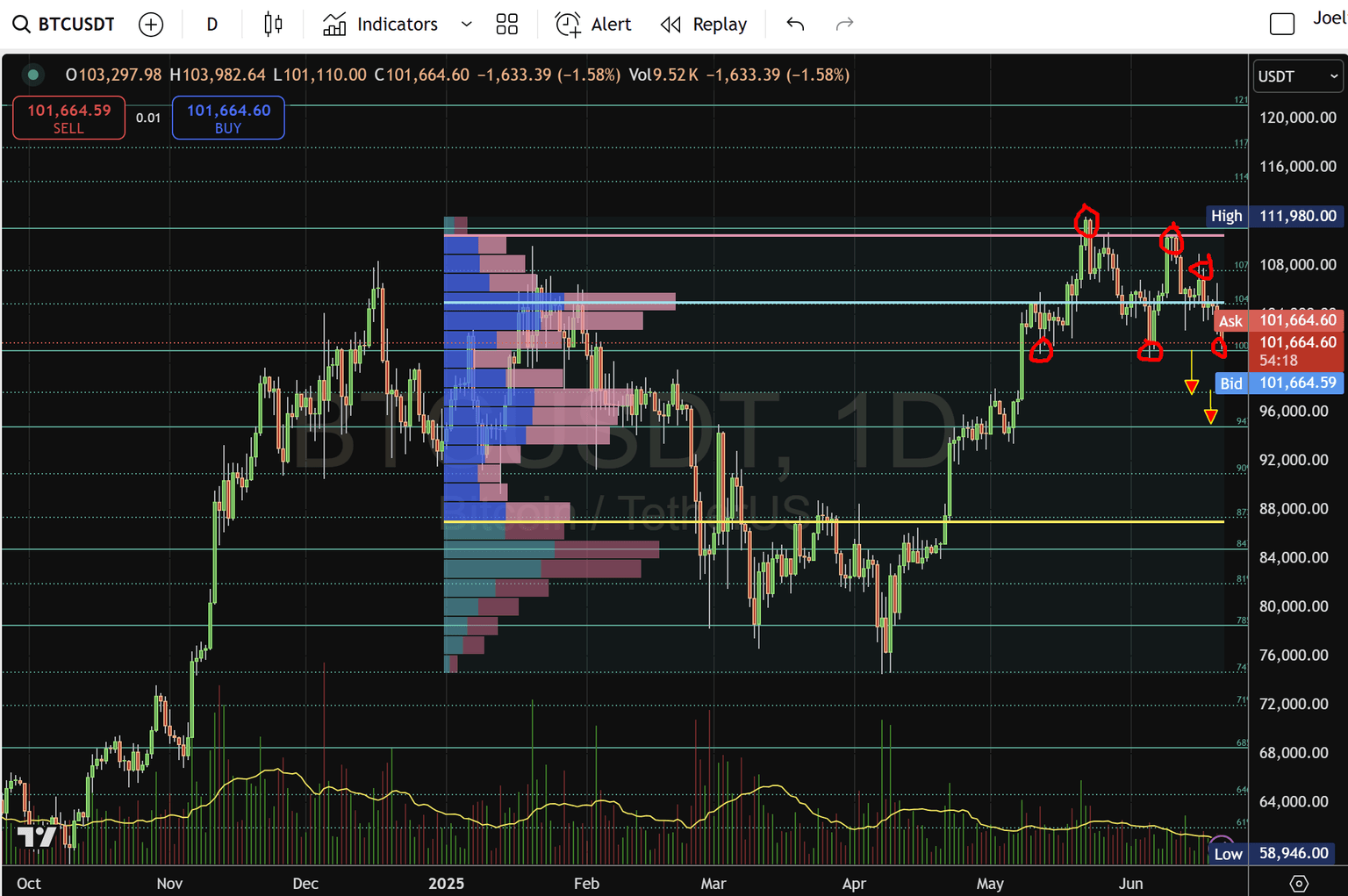

BTC/USDT slips below its Point of Control at $104,825 and now clings to early-May/June support at $100,990—failure here risks a slide into the $97,600–$94,800 zone.

Analysis:

On the daily timeframe, BTC/USDT is trading around $101,622, down roughly 2% from recent highs. The pair has relinquished its Volume Profile Point of Control (POC) at $104,825, signalling that the distribution of traded volume is shifting lower.

Since early May and again in June, $100,990 has acted as a critical demand zone (circled), absorbing selling pressure and triggering short-covering rallies. Those rebounds have formed a series of lower highs—first at $111,030, then at $107,556, and most recently near $104,825—which together construct a bearish trend channel.

- Immediate support: $100,990 (tested May and June)

- Key resistance: $104,825 (former POC)

- First downside target: $97,596

- Secondary downside target: $94,785

As highlighted in our prior XRP/USDT analysis, XRP’s failure to hold the $2.00 demand zone on its head-and-shoulders breakdown added to the risk-off sentiment across the crypto space. That weakness in XRP underscores the broader downside pressure on BTC and suggests bulls may face an uphill battle defending critical support.

Conclusion

The next 48–72 hours are pivotal. Bulls must demonstrate conviction at $100,990 or risk accelerating the sell-off toward $95K. A clear break above $104,825 would alleviate near-term bearish pressures and set the stage for a recovery leg; otherwise, the path of least resistance remains to the downside.

This analysis is for informational purposes only and should not be considered trading advice. Always perform your own due diligence and consult a financial professional before making any trading decisions.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.