Bitcoin mining emission approaches net carbon negative as Texas cancels mining curbing bill

- Bitcoin mining emissions have been reduced by over 50% in the span of three years.

- Texas recently struck down a state bill that would have limited BTC miners' participation in cost-saving grid programs.

- Bitcoin miner reserves are gradually recovering the losses from May to June 2022.

Bitcoin mining and the narrative around how Proof-of-Work being one of the most energy-consuming processes in the entire world is set to change. With more sustainable mining methods coming to light and awareness spreading, BTC is close to joining the league of blockchains that have achieved carbon neutrality.

Bitcoin mining becoming sustainable

According to reports, the global Bitcoin mining industry emissions over just the last three years have been reduced by more than 50%. Back in May 2020, BTC mining resulted in 601 g/KWh in emissions, which declined to 299 g/KWh around May 2023. "g/KWh" is a unit of measurement used to express the amount of carbon dioxide emissions (in grams) produced per kilowatt-hour of electricity generated. Lower values of g/KWh indicate lower carbon emissions and a cleaner energy generation process.

Bitcoin mining emission

In addition to this, Bitcoin mining is also rapidly approaching carbon neutrality and could end up being net carbon negative if it continues to go down this path. This achievement has been seen in very few blockchains in the past, such as Polygon and Solana.

If Bitcoin achieves this, it would certainly bring an end to the long-ongoing "BTC mining power consumption kills the environment" narrative. This discourse was the primary reason that led to Elon Musk canceling Tesla's acceptance of payments through BTC, which resulted in the crash of May 2021.

Earlier this week, a Texas state bill that would have limited bitcoin miners' participation in cost-saving grid programs failed to move past a committee in the state House of Representatives.

As per the program, miners are given credits in response to turning off their operations whenever the power grid notes a surge in demand. The bill would have limited the miners' participation to just 10% and, at the same time, also abolished the tax abatements.

“The defeat of this anti-Bitcoin mining legislation in Texas is a huge victory not only for Texas, but for the whole nation”. pic.twitter.com/LlGPcf4FDC

— Dennis Porter (@Dennis_Porter_) May 30, 2023

However, since the bill has been struck down, no major negative implication will be seen by the miners across the world.

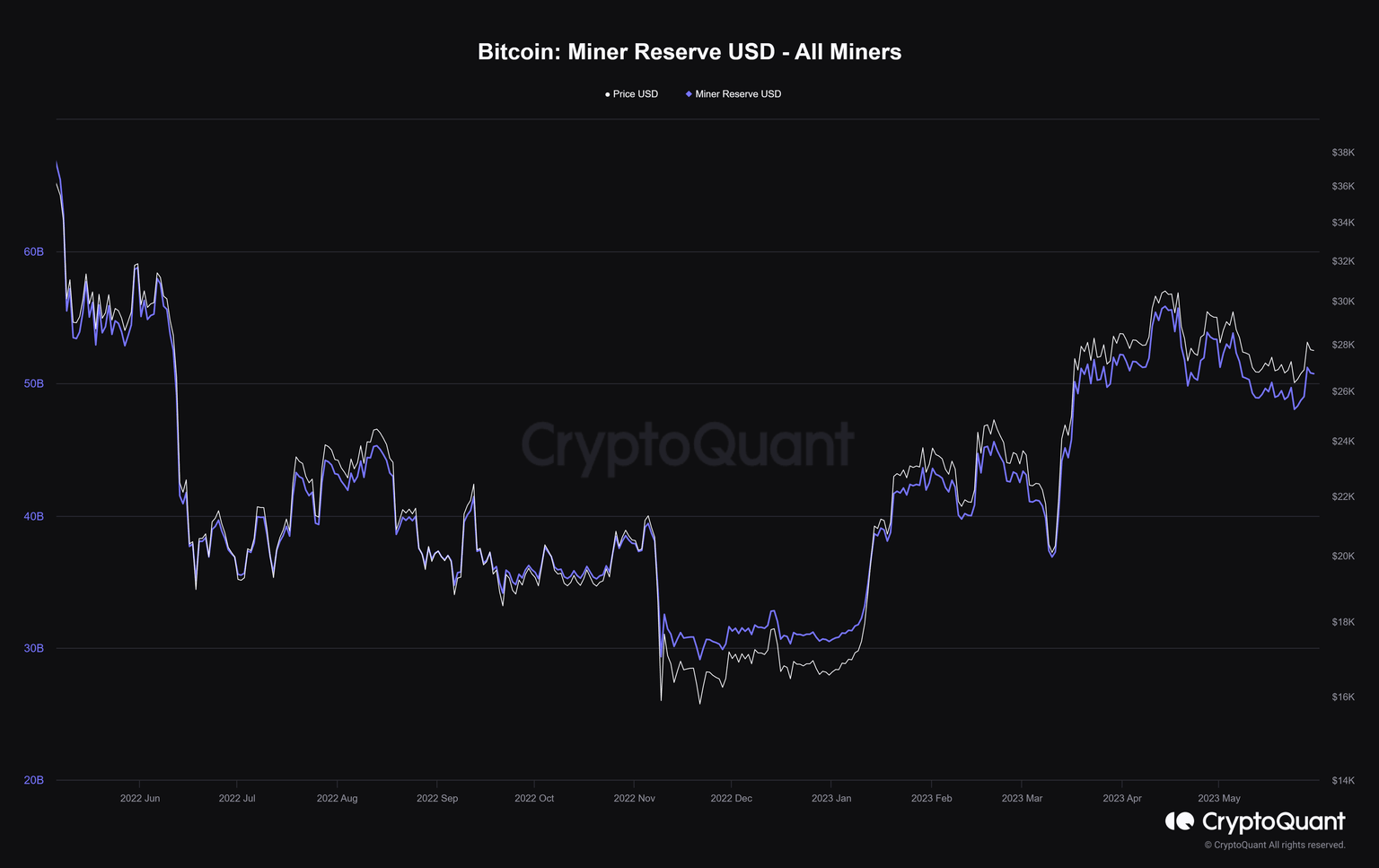

Bitcoin miners’ reserves are rising

Bitcoin miners' reserves are still recovering following the significant depletion observed throughout 2022 starting in May last year. The miners are still spending some of their balance in order to ensure their operations are not ceased. Just in the last month and a half, miners have sold nearly $5 billion worth of BTC from the reserves to power their mining rigs.

Bitcoin miners reserves

However, the Hash rate is still rising, which suggests that despite facing losses and even in the uncertainty of gains from Bitcoin price, miners are still keeping their systems up and running. They are sitting with the hopes of eventual gains, which could still be a while.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.