Bitcoin incomplete bullish sequences calling the rally

In this technical article we’re going to take a quick look at the Elliott Wave chartsof Bitcoin (BTC/USD). Bitcoin is showing impulsive bullish sequences in the cycle from the 25068 low. BTC/USD ended wave (4) correction at the 56628 . Now, the crypto is showing impulsive bullish sequences in the cycle from the May 1st low. Consequently we expected more strength in short term. In further text we are going to explain wave forecast.

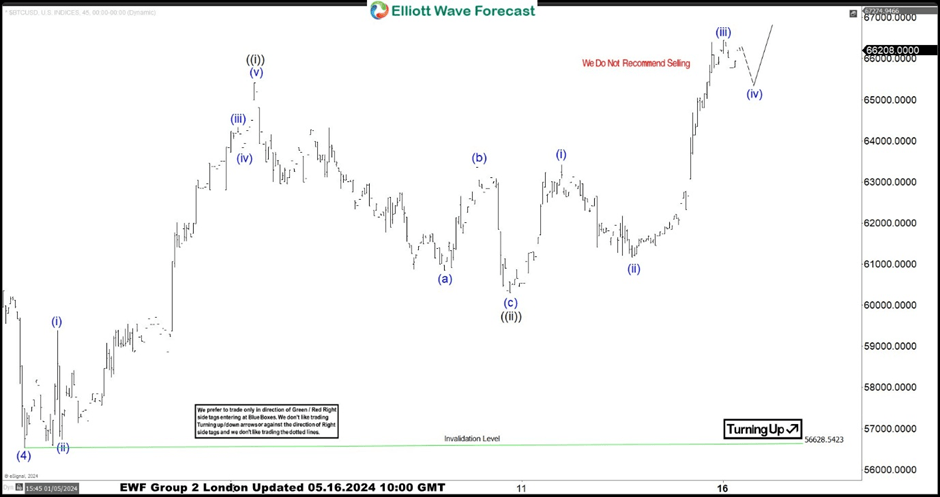

BTC/USD H1 London update 05.16.2024

BTC/USD has broken above May 6th peak, which makes cycle from the May 1st low incomplete. Now, the crypto is showing higher high sequences, calling for further rally toward 69274-71331 area. We don’t recommend selling and favor the long side against the 60294 pivot. We expect Bitcoin to keep finding intraday buyers in 3,7,11 swings.

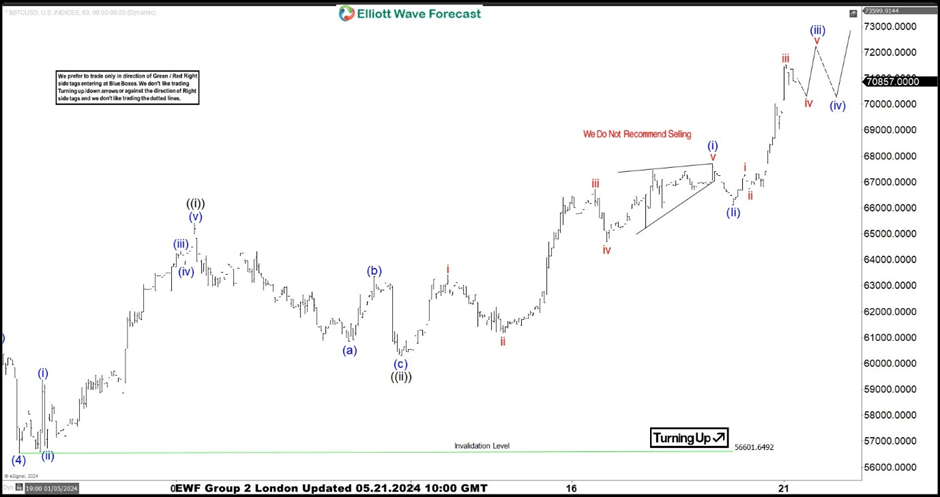

BTC/USD H1 London update 05.21.2024

Bitcoin made further rally as expected. It has reached our first target zone at 69274-71331, as expected. From there we can see intraday pull back again. We don’t recommend selling BTC/USD in any proposed pull back and favor the long side.

Remember, the market is dynamic, and the presented view may have changed in the meantime.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com