Bitcoin holds support, next resistance at $50K

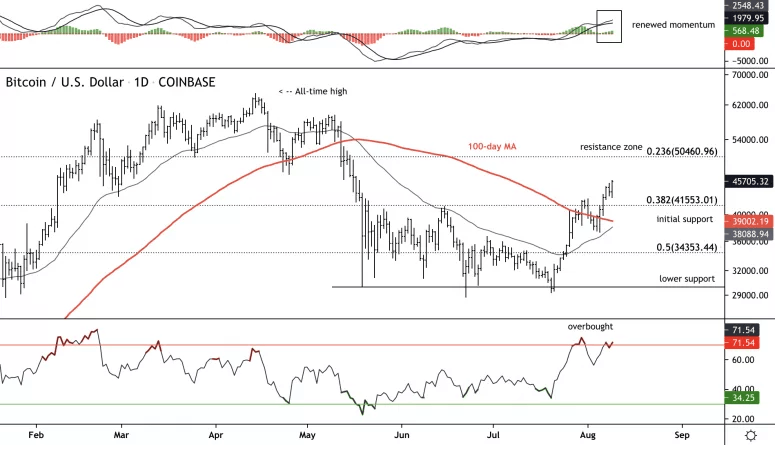

Bitcoin (BTC) rallied above $45,000 as upside momentum improved over the past two weeks. The next level of resistance is seen at $50,000, which could limit further upside given short-term overbought signals. Bitcoin is up about 2% over the past 24 hours – around $45,600 at press time and holding support above $40,000.

Bitcoin daily price chart shows support and resistance levels with MACD and RSI.

Source: TradingView

-

The relative strength index (RSI) on the daily chart is overbought for the second time since July 31, which preceded a near 10% price decline.

-

However, the weekly RSI is rising from neutral levels with a positive momentum signal for the first time since October 2020, which reignited the long-term uptrend.

-

Buyers could remain active on pullbacks this week as bitcoin cleared important technical levels such as the 100-day moving average.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.