Bitcoin ETFs net $867 million as Strategy scoops up additional $1.3 billion worth of BTC

- Bitcoin ETFs recorded $867 million in net inflows last week, with their all-time cumulative inflows hitting $62.9 billion.

- Strategy revealed it purchased 13,390 Bitcoin for $1.3 billion last week.

- Bitcoin Magazine CEO David Bailey has agreed to merge holding company Nakamoto with healthcare firm KindlyMD.

Bitcoin (BTC) briefly crossed $105,450 before declining to $101,400 on Monday as CoinShares' report revealed that Bitcoin exchange-traded funds (ETFs) recorded $867 million in net inflows last week. Meanwhile, Strategy increased its Bitcoin holdings after purchasing 13,390 BTC for $1.3 billion last week.

Bitcoin products record inflows as Strategy increases BTC holdings

Crypto products witnessed a fourth consecutive week of net inflows last week, totaling $882 million, with year-to-date (YTD) inflows climbing to $6.7 billion, according to CoinShares.

The inflows stemmed from a mix of stagflationary risks, a global rise in M2 money supply and several US states approving Bitcoin as a strategic reserve asset.

US spot Bitcoin ETFs recorded the highest inflows, netting $867 million and pushing its cumulative inflows to $69.2 billion, the highest since they first launched in January 2024. The growth points to increased acceptance of Bitcoin products among US investors. This follows a settlement between the US and trade partners — particularly the UK and China — which triggered BTC's rally above $100,000 for the first time since February.

Bitcoin hit a high of $105,450 early Monday before retracing to $101,400 at publication time. Despite the slight drop, BTC is still up 7.3% on the weekly timeframe.

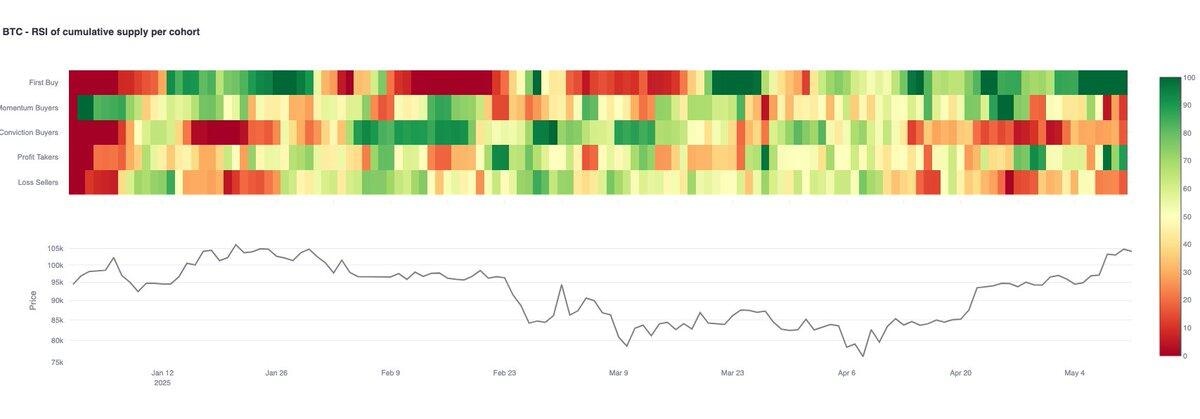

Bitcoin's Supply Mapping indicates consistent new demand, as the First-Time Buyers Relative Strength Index (RSI) has stayed at a strong 100 throughout the week, noted Glassnode analyst in an X post on Monday. This suggests fresh buyers are still entering the market as prices push higher.

BTC - RSI of cumulative per cohort. Source: Glassnode

However, the demand from momentum buyers is still at low levels. Without sustained capital inflows, the profit-taking activity could lead to a consolidation in Bitcoin's price, the analysts noted.

Meanwhile, business intelligence firm Strategy revealed that it has stacked an additional 13,390 Bitcoin for $1.3 billion, at an average price of $99,856 per coin. This brings its total acquisition to 568,840 BTC worth $39.42 billion.

More companies are replicating Strategy's Bitcoin playbook, paving the way for wider crypto adoption among corporate entities.

Bitcoin Magazine CEO David Bailey revealed a merger between holding company Nakamoto and healthcare data firm KindlyMD. The company also secured $710 million in funding to establish a Bitcoin treasury-backed company.

David Bailey will serve as CEO of the combined company, while Tim Pickett will continue to run the operation for KindlyMD. Other board members will be selected at the close of the merger.

KindlyMD's stock price skyrocketed over 600% from just under $4 to $28 following the announcement of the merger, but has since retraced to around $15 at the time of writing.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi