Bitcoin dominance slips below 60% as Ether fuels crypto rally and US stocks hit fresh highs

- Bitcoin’s market capitalization stands at $2.39 trillion, total crypto exceeds $4 trillion for the first time, and Ether tops $4,700.

- For the first time since Feb. 1, bitcoin’s market-cap dominance has fallen beneath 60%, reflecting its portion of total cryptocurrency value.

- ETH’s surge above $4,700 has fueled the rally, and the last time bitcoin’s dominance dropped to this point, BTC was under $100,000.

- U.S. markets are rising alongside crypto, with the S&P 500 and Nasdaq 100 both posting record highs.

- The dollar index (DXY) has slipped back below 98, bolstering risk appetite, as markets price in an almost certain Sept. 17 Fed rate cut that would lower the federal funds rate to 4.00%–4.25%.

Technical analysis perspective:

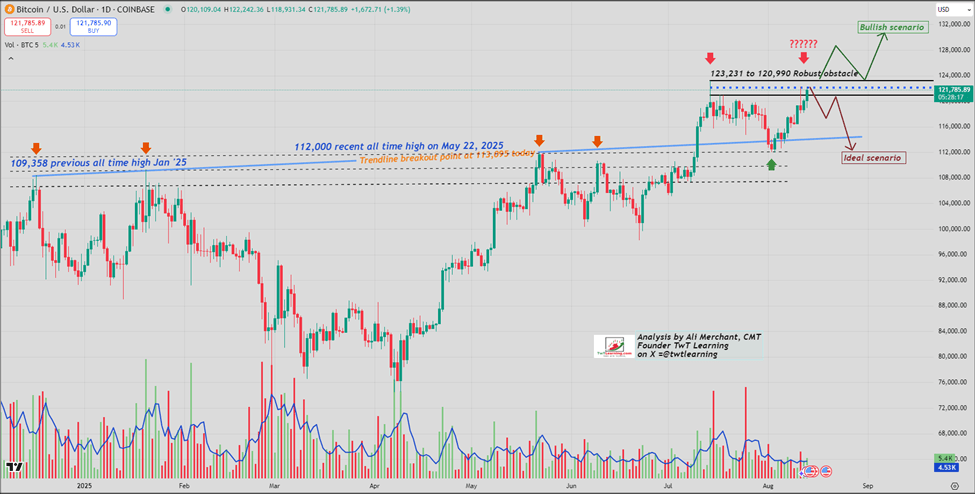

Bitcoin / US Dollar:

- On July 10, 2025, BTC pierced the May 22 high of $112,000.

- Bitcoin hit a new all-time high on July 14 at $123,231.07.

- BTC/USD retested the prior $112,000 level early last week.

- Prices are trading into a strong resistance band between $120,990 and $123,231.

- Bear case: a rejection of that zone would likely send BTC down toward $116,500–$115,000 (the preferred pullback scenario).

- Bull case (alternate): a sustained break above $123,231 would clear the path for fresh all-time highs.

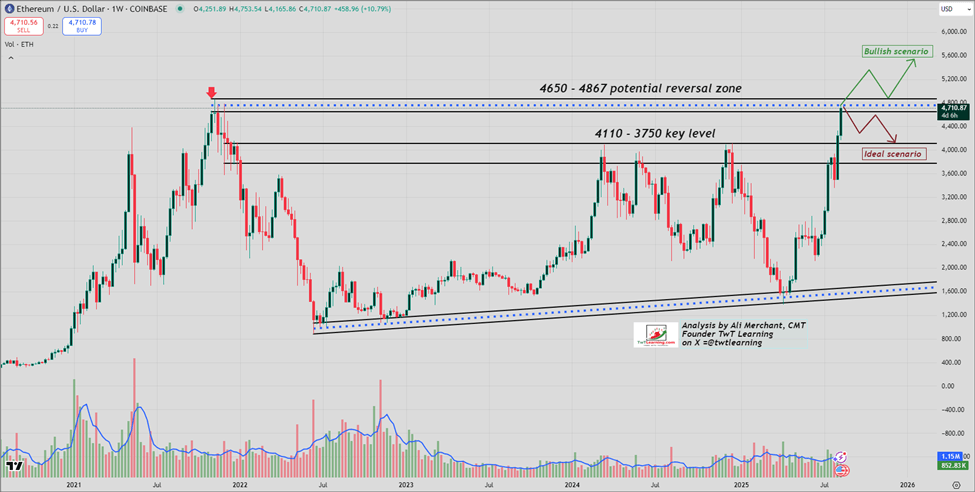

Ethereum / US Dollar:

- ETH pierced March 2024 high of $4,410.

- Prices are targeting all-time high of $4,867 from November 2021.

- The $4,650–$4,867 area could stall the rally and an initiate a corrective decline.

- Bear case (ideal scenario): A rejection of $4,650–$4,867 band triggers unwinding of longs, targeting $4,110–$3,750 support.

- Bull case (alternate): A sustained break and hold above $4,867 would confirm continuation to fresh highs.

Author

Ali Merchant, CMT

TwT Learning

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, & Fund Management, He has been trading FX, FX options, US stock