Bitcoin Elliott Wave technical analysis [Video]

![Bitcoin Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/BTC-bearish-animal_XtraLarge.png)

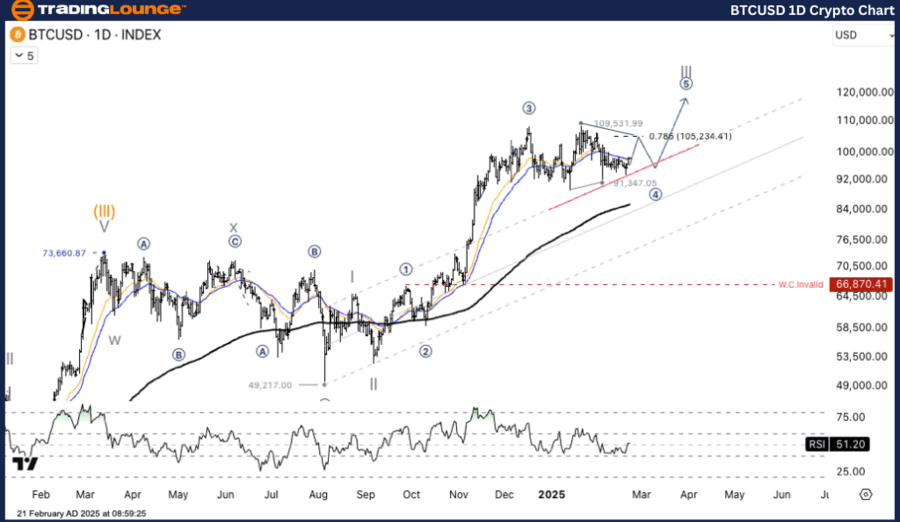

Elliott Wave Analysis TradingLounge Daily Chart.

Bitcoin/U.S. Dollar (BTCUSD).

BTC/USD Elliott Wave technical analysis

-

Function: Counter-Trend.

-

Mode: Corrective.

-

Structure: Flat.

-

Position: Wave (C).

-

Next higher degree direction: Wave ((4)).

-

Invalidation level:

Bitcoin/U.S. Dollar (BTCUSD) Trading Strategy:

BTC/USD is approaching the final phase of its Wave C correction, with key support positioned at $86,439.58. If the price rebounds and surpasses $97,198.26, it could indicate a bullish reversal. Conversely, a breakdown below $86,439.58 could signal a continuation of the downward trend.

Trading strategies:

-

Strategy:

-

Long Strategy:

-

Wait for a Buy Dip:

-

• If BTC holds above the $86,439.58 support level and shows a reversal signal, it may present a buying opportunity.

-

• The initial target is $97,198.26; if surpassed, BTC may advance towards higher resistance levels.

-

-

-

-

Risk Management:

-

If BTC/USD breaks below $86,439.58, it could extend losses toward deeper support levels in the $83,000 - $81,000 range.

-

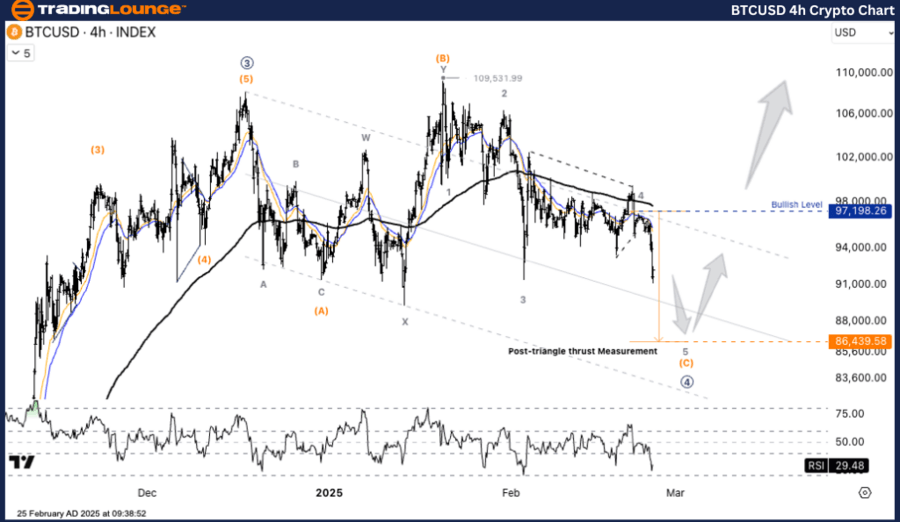

Elliott Wave Analysis TradingLounge H4 Chart.

Bitcoin/U.S. Dollar (BTCUSD).

BTC/USD Elliott Wave technical analysis

-

Function: Counter-Trend.

-

Mode: Corrective.

-

Structure: Flat.

-

Position: Wave (C).

-

Next higher degree direction: Wave ((4)).

-

Invalidation level:

Bitcoin/U.S. Dollar (BTCUSD) Trading Strategy:

BTC/USD is nearing the completion of its Wave C correction, with strong support at $86,439.58. If the price bounces and clears $97,198.26, a bullish reversal may follow. However, if BTC falls below $86,439.58, it could indicate further downside movement.

Trading strategies:

-

Strategy:

-

Long Strategy:

-

Wait for a Buy Dip:

-

• If BTC stays above the $86,439.58 support level and provides a reversal signal, it may be a good entry point.

-

• The first target is $97,198.26; a breakout beyond this level could push BTC toward higher resistance zones.

-

-

-

-

Risk Management:

-

If BTC/USD declines below $86,439.58, it may continue falling to deeper support areas between $83,000 - $81,000.

-

TradingLounge analyst: Kittiampon Somboonsod, CEWA.

BTC/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.