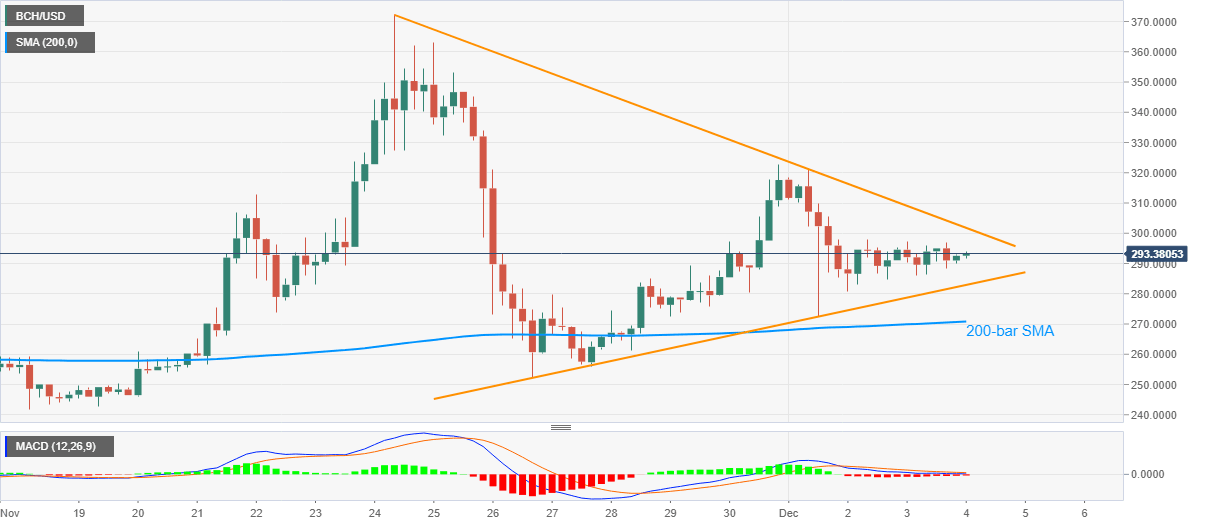

Bitcoin Cash Price Analysis: BCH consolidates above 293.00 inside symmetrical triangle

- BCH/USD wavers inside a range below 298.00 amid bearish MACD.

- 200-bar SMA adds to the downside filters, eight-day-old triangle restricts immediate moves.

BCH/USD rises to 293.83, up 0.50% intraday, during early Friday. Even so, the crypto pair keeps the two-day-old trading range below 298.00 while also respecting a short-term symmetrical triangle formation established from November 24.

Although bearish MACD suggests another failure by the BCH/USD buyers to cross the 298.00 round-figure, any further upside will be challenged by the stated triangle’s resistance line, at 301.80 now. Also acting as an immediate upside barrier is the 300.00 threshold.

In a case where the quote rises past-301.80, a November-end top near 322.63 will gain the market’s attention.

On the contrary, 284.50 and the triangle’s support around 282.90 can challenge the pair’s short-term downside ahead of a 200-bar SMA level of 270.80.

While BCH/USD bears can eye for the late-November low near 252.40 on the downside break of the stated triangle, multiple supports around 250.00, 241.00 and the previous month’s low near 231.00 can challenge the quote’s additional weakness.

BCH/USD four-hour chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.