Bitcoin Cash Market Update: Иitcoin Cash perpetual swaps launched on BitMEX

- BCH perpetual swaps are now available at BitMEX.

- BCH/USD is supported by thechnical barriers clustered around $235.00.

BitMEX, one of the leading trading platforms for cryptocurrency derivatives, added Bitcoin Cash perpetual swap contracts to the list of available instruments. The launch was announced earlier this year. Also, the platform supports Ethereum and XRP.

BitMEX users will be able to trade BCH with leverage of up to 25 times. Moreover, according to the contract specification, there is no need to own BCH to trade the contract.

Traders who use the BCH/USD perpetual swap will see their Bitcoin balance grow or decrease accordingly.

The CEO of BitMEX Arthur Hayes announced the launch and asked the community which coin they would like to see next.

BCHUSD perp swap is now live. Which shitcoin should @BitMEXdotcom list next?

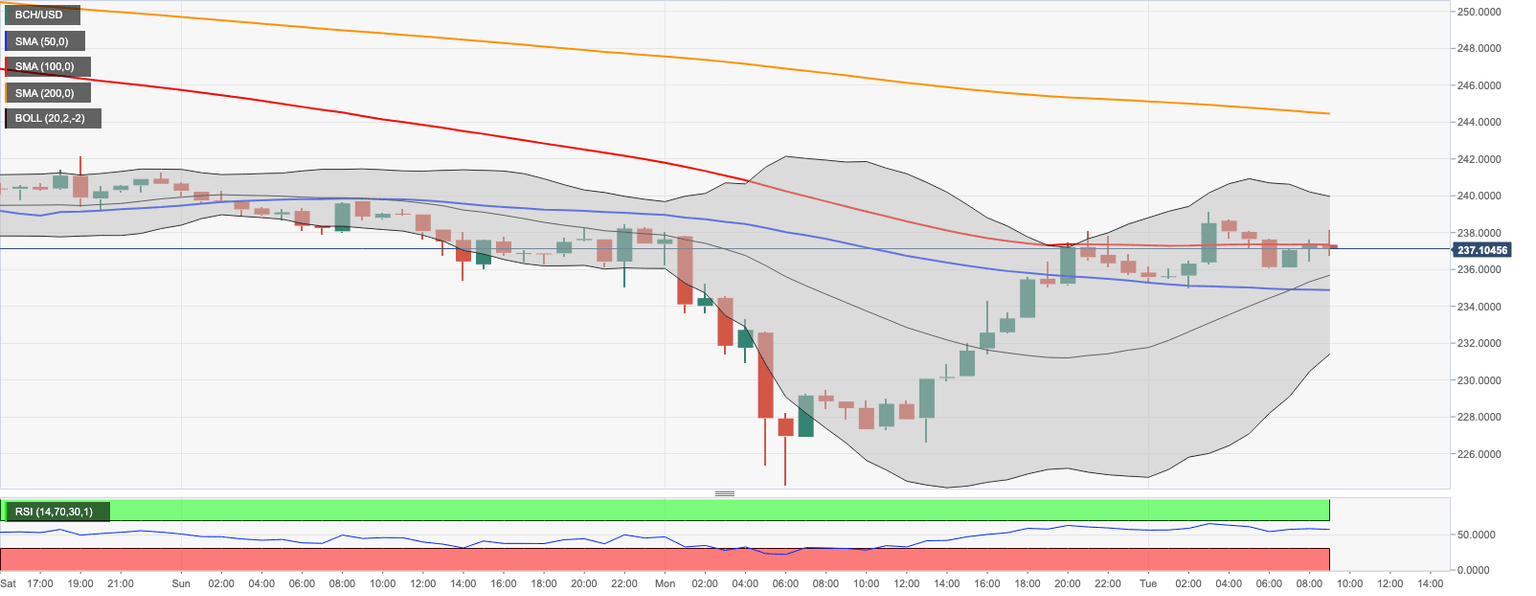

BCH/USD: Technical picture

At the time of writing, BCH/USD is changing hands at $237.20, mostly unchanged since the beginning of the day. The coin has gained 3.5% of its value on a day-to-day basis; however, the short-term trend remains bearish.

The local support is created by a combination of 1-hour SMA50 and and the middle line of the 1-hour Bollinger Band around $235.00. Once it is out of the way, the sell-off may continue to $230.00 and May 15 low of $224.29. This barrier is likely to stop the decline and trigger an upside correction.

On the upside, the critical resistance is created by $240.00. A sustainable move above this area is needed for the upside to gain traction towards $244.45 (1-hour SMA200).

BCH/USD 1-hour chart

On a daily chart, the above-mentioned support of $235.00 is also reinforced by daily SMA100. It means that this area may serve as an effective backstop for the sellers in the short-run. The resistance on a daily chart is created by SMA50 at $244.00 and confirms the short-term picture.

BCH/USD daily chart

Author

Tanya Abrosimova

Independent Analyst

-637278987116348308.png&w=1536&q=95)