Bitcoin bulls need $48,000 to survive while BTC bears need $44,500 to gain control

- Bitcoin price action finds near-term support, but the bias remains mixed.

- BTC is between two key zones that will dictate the future trend.

- Primary resistance and support are located nearby BTC price.

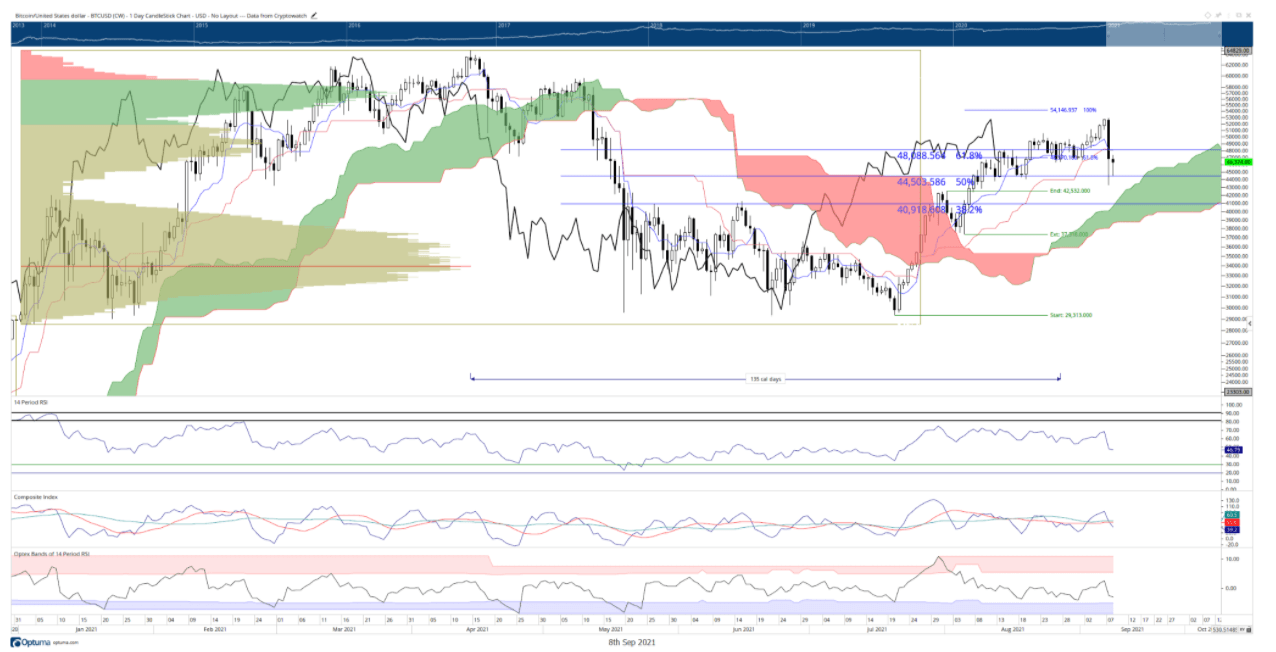

Bitcoin price remains capped after the spectacular flash crash on Tuesday but well off the lows found near the $43k value area. Two primary Fibonacci retracement levels are contributing to some sideways price action for Bitcoin.

Bitcoin price action remains weighted to the downside, but bears should be cautious

Bears will need to push Bitcoin price below the 50% Fibonacci retracement at $44,500 to stay in control. The weekly Tenkan-Sen in the Ichimoku system shares the same value area as the 50% Fibonacci retracement. The Volume Profile shows a massive volume trough between $45,000 and $40,500. This means that if bears push Bitcoin below $45,000, there will likely be a rapid fall towards the top of the next high volume node at $40,500. In other words, it is easier for Bitcoin to move lower than higher.

Expect strong support between $40,000 and $41,000 as those levels contain the top of the Cloud (Senkou Span A) and the 38.2% Fibonacci retracement.

BTC/USD Daily Chart

Bulls will need to push the Chikou Span back above the candlesticks, which means a close above (at least) $49,500. This would also put Bitcoin price above the daily Tenkan-Sen, Kijun-Sen and the 61.8% Fibonacci retracement level. If bulls generate a close above the aforementioned $49,500 price level on Wednesday, there will be a high probability of a bear trap and short squeeze opportunity for bulls.

Bears should be cautious of the 4-hour chart, as Bitcoin is heavily oversold on the Relative Strength Index, Composite Index and OPTEX Bands.

On the flip side, Bitcoin bulls should be cautious of further downside pressure, as the Relative Strength Index, Composite Index, and OPTEX Bands have yet to all trigger an oversold condition.

Author

FXStreet Team

FXStreet