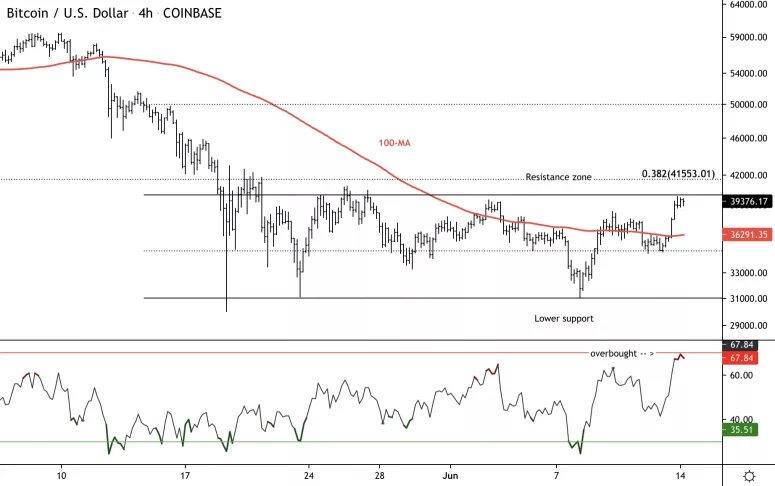

Bitcoin attempts range breakout, faces resistance at $42k

Bitcoin (BTC) held support around $34,000 over the weekend and is approaching resistance around $40,000-$42,000. The world’s largest cryptocurrency has been consolidating for nearly a month as buyers established a solid base around $30,000.

A breakout from the range would yield further upside towards $50,000. However, sellers remain in control given strong overhead resistance.

Bitcoin was trading around $39,300 at press time and is up about 9% over the past 24-hours.

-

The short-term trend is improving as price returned above the 100-period moving average on the four-hour chart.

-

There is immediate resistance at $40,000 which could limit upside, especially as the relative strength index (RSI) appears overbought on the four-hour chart.

-

Minor support is seen around $34,000 which is the mid-point of the short-term range. If support holds, a decisive breakout above $42,000 could shift the downtrend from May.

Bitcoin four-hour chart shows short-term support and resistance levels with RSI.

Source: TradingView

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.