Bitcoin ASIC miner prices hovering at lows not seen in years

Bitcoin ASIC miners — machines optimized for the sole purpose of mining Bitcoin — are currently selling at bottom-of-the-barrel prices not seen since 2020 and 2021, in what is being viewed as another sign of a deepened crypto bear market.

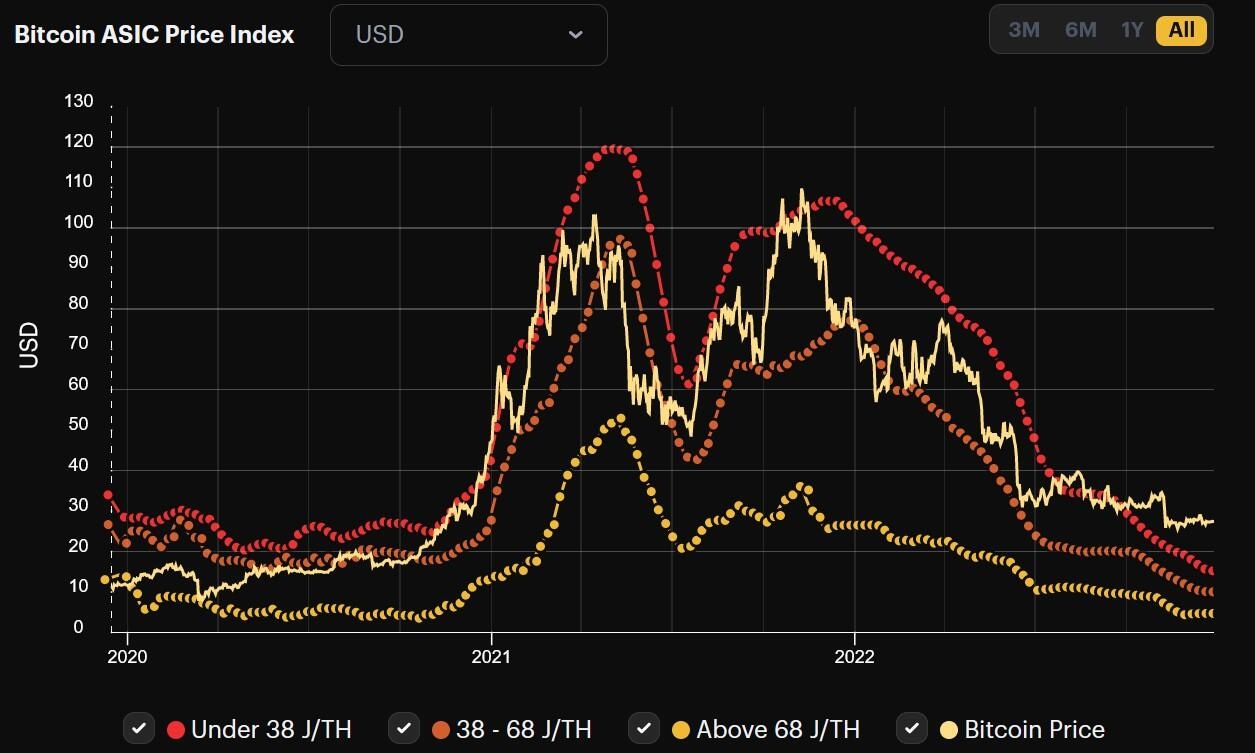

According to the latest data from Hashrate Index, the most efficient ASIC miners, those generating at least one terahash per 38 joules of energy, have seen their prices fall 86.82% from May. 7, 2021 peak of $119.25 per terahash down to $15.71 as of Dec. 25.

Miners in these category include Bitmain’s Antminer S19 and MicroBTC’s Whatsminer M30s.

The same statement holds true for the mid-tier machines, with prices now averaged out at $10.23 after falling a massive 89.36% from its peak price of $96.24 on May. 7, 2021.

However, the least efficient machines, ones that require more than 68 Joules per TH, are now priced at $4.72, a 91% drop from its peak price of $52.85. The last time it was priced near this was around Nov. 5, 2020.

Bitcoin ASIC Miner Price Index for machines with varying levels of efficiency. Source: Hashrate Index.

The fall in prices has largely been attributed to large Bitcoin mining companies that have struggled to remain profitable throughout the bear market, with many either filing for Chapter 11 bankruptcy, taking on debt, or selling their BTC holdings and equipment in order to stay afloat.

Among the firms to have done that include Core Scientific, Marathon Digital, Riot Blockchain, Bitfarms and Argo Blockchain.

But the steep price fall has been met with some keen buyers. Among those include many Russian-based mining facilities like BitRiver who are able to capitalize on relatively low electricity costs, with some up-to-date hardware capable of mining one Bitcoin (BTC) at about $0.07 per kilowatt-hour in the energy-rich nation.

While it’s hard to predict what price direction ASIC miners will head toward next, Nico Smid of Digital Mining Solutions pointed out in a Dec. 21 tweet that ASIC miner prices bottomed at Bitcoin’s last halving cycle in May. 11, 2020 and moved up aggressively shortly after — something which could play out in Bitcoin’s next halving cycle which is expected to take place on Apr. 20, 2024.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.