Bitcoin and Ethereum slow down as transaction values and fees plunge 70%

Bitcoin (BTC) and Ether (ETH) appear to be experiencing something of a slowdown, as on-chain data shows a dramatic decrease in the U.S dollar value of coins being sent across both blockchains in the past week. At the same time, transaction fees for both chains have receded from recent highs, or in Ethereum’s case, an all-time high.

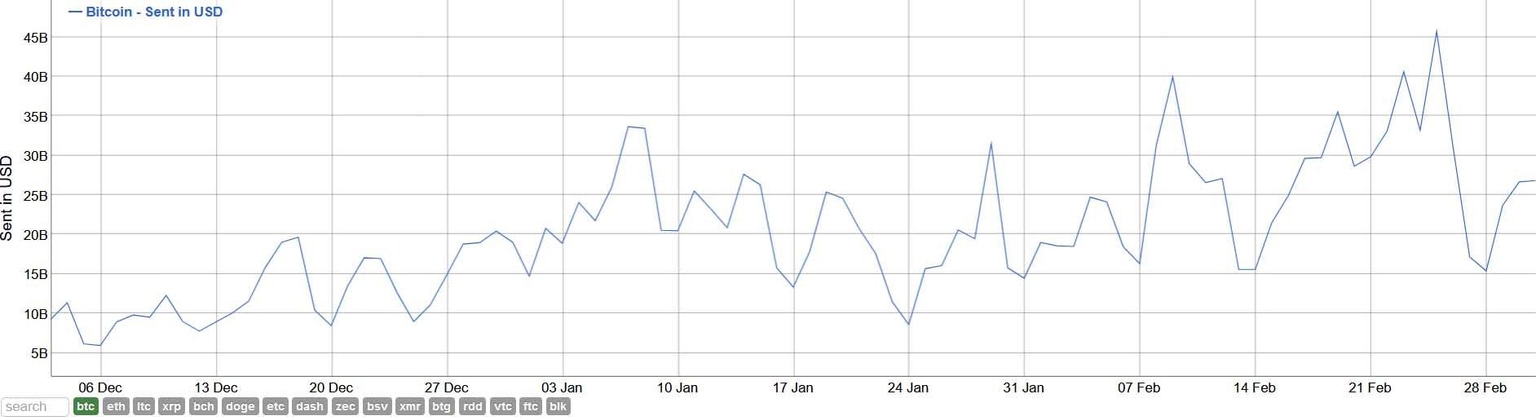

Data from Bitinfocharts shows $46.68 billion worth of BTC was sent across the Bitcoin blockchain on Feb. 25. For some context, that’s around 5% of the total Bitcoin market cap, which stands at $925 billion at time of writing.

Bitcoin sent in U.S. dollars. Source: Bitinfocharts.com

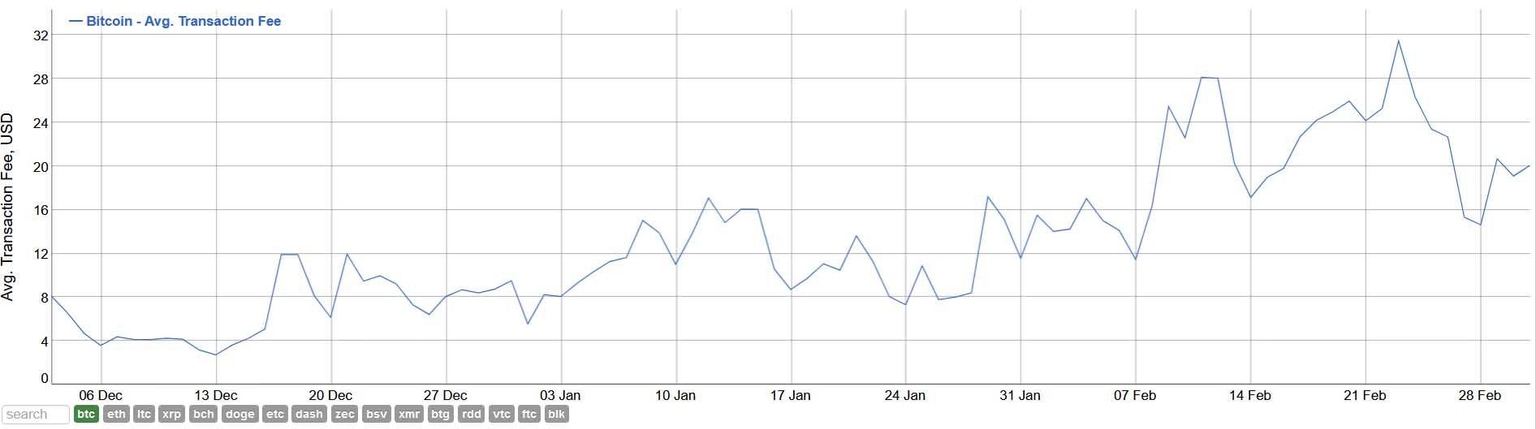

By three days later, on Feb. 28, the U.S. dollar value of Bitcoin being sent had fallen to $15.38 billion — a 66% drop off. At the same time, the average transaction fee for Bitcoin users fell by 53% — from $31.47 to $14.63. For context, the highest average fees ever recorded for Bitcoin came in December 2017 when BTC fees exceeded $55, marking the end of the coin’s bull run for that period.

Bitcoin average transaction fee. Source: Bitinfocharts.com

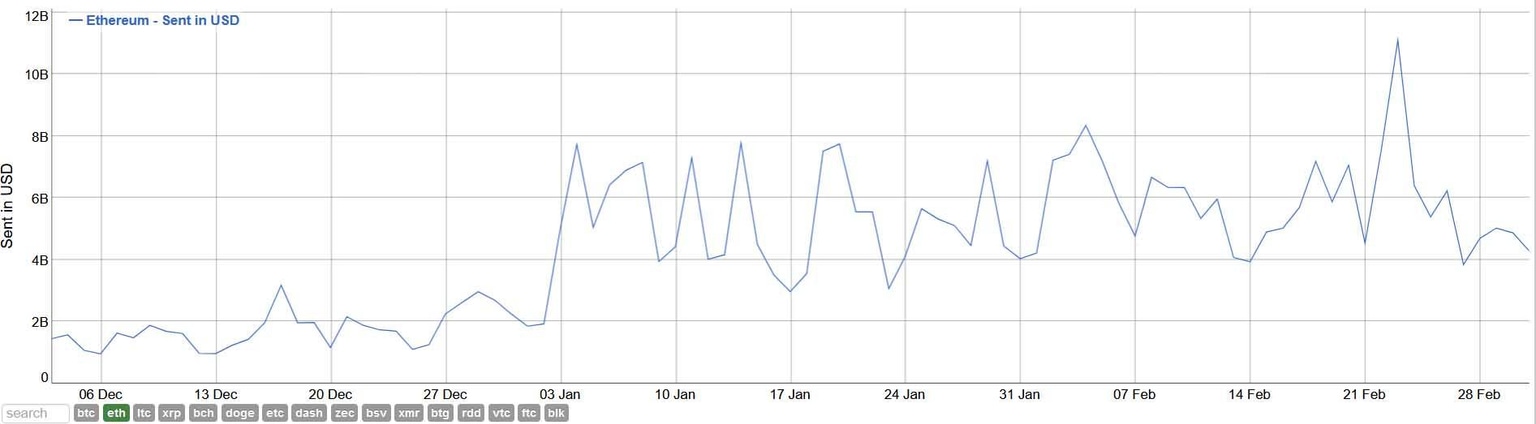

Over on Ethereum, the slowdown was equally pronounced. In the four days between Feb. 23–27, the total value of coins sent across the Ethereum blockchain fell 65% from $11.1 billion to $3.84 billion.

Ether sent in U.S. dollars. Source: Bitinfocharts.com

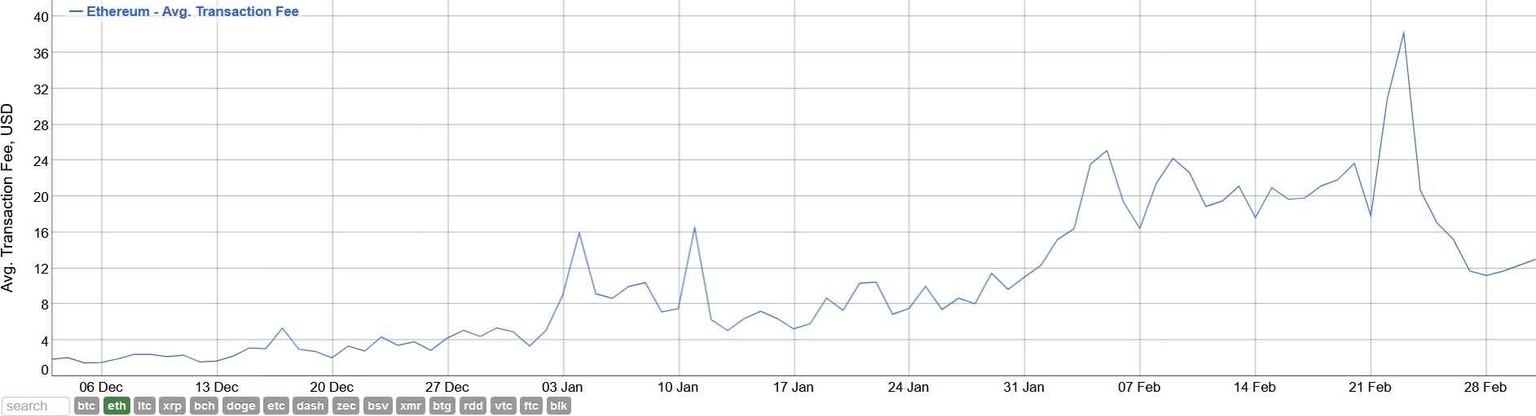

Meanwhile, average Ethereum transaction fees, which had soared to an all-time high of $38.21 by Feb. 23, dropped 70% down to $11.21.

Ethereum average transaction fee. Source: Bitinfocharts.com

The average fee statistic can often be misleading, as it is heavily weighted by the mass of large transactions that incur super-high fees. The typical Ethereum user may be more interested in the median transaction fee value, which also fell 72% down to $5.23. For context, the recommended fee for making a “rapid” Ethereum transaction is currently around $2.80 according to GasNow.org.

Such a sizable slowdown in activity on both blockchains could be interpreted by some as a sign that the current bull run is grinding to a halt. Yet a glance at the recent history of both chains shows that such pullbacks are not uncommon.

In January, the dollar value of Bitcoin transactions fell 72% over a two-week period, before picking back up again to soar even higher in February. Likewise, the average Bitcoin transaction fee dropped 58% in the same time period. The same general pattern was observed on Ethereum.

With this in mind, it is in all likelihood too early to assume that the current slowdown is indicative of the end of the crypto bull run, at least based on these metrics alone. Indeed, in the seven days since these metrics bottomed out, they have since begun to rise once more, as the ebb and flow of the cryptocurrency market continues.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.