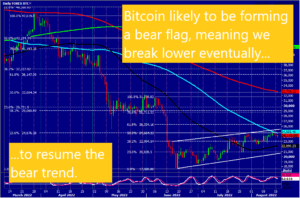

Bitcoin: A break above 25000 is a buy signal

Bitcoin holding very strong resistance at 24800/25000 & this does look like a large bear flag forming - so a break lower would be expected eventually.

Ripple is holding first support at 3650/3600, which gives some hope to bulls.

Ethereum must now hold first support at 1850/1800 to target 2000/2020 & 2100/2120.

Daily analysis

Bitcoin bounced to targets of 23400/500 & 24200/300 with very strong resistance at 24800/25000. A break higher is another buy signal targeting 26000, perhaps as far as 26300/400.

Shorts at very strong resistance at 24800/25000 target 23250/150. On further losses look for 22300/100, perhaps as far as the lower trend line of the bear flag at 21000/20900. A break below 20800 therefore is an important sell signal.

Ripple reverses from first resistance at 3800/50 but holds first support at 3650/3600. A break lower targets 3450/3400. Below here is a sell signal targeting 3200.

Holding first support at 3650/00 targets first resistance at 3800/50. A break above 3900 targets 4000 & 4100.

Ethereum beat strong resistance at 1820/50 & obviously bulls must hold prices above here to target 2000/2020 & 2100/2120. If we continue higher look for 2230.

Failure to hold above 1800 is a sell signal, initially targeting 1680/60 then strong support at 1530/1480.

Author

Jason Sen

DayTradeIdeas.co.uk