Binance stays put despite FCA warning, while BNB price eyes 18% upswing

- Binance is in the spotlight as FCA announced that the exchange has no permission to offer crypto products in the UK.

- The crypto exchange did not change its offering and put out statements backing up its stance.

- BNB price is contemplating a move higher but might sweep the lows before an upswing.

Binance, one of the world’s largest crypto exchanges, received a warning from the UK’s Financial Conduct Authority (FCA). While this news was blown out of proportion, Binance explained why it had not changed its stance despite the warnings.

On the other hand, BNB price continues to range, hinting that it might climb above the 50% Fibonacci retracement level.

FCA warns Binance against offering crypto in UK

Binance received a warning from the UK watchdog, the Financial Conduct Authority (FCA), on June 26. The announcement mentioned that “Binance Markets Limited (BML),” part of the wider Binance Group, has not taken any permissions to offer crypto-related services and products in the UK. Therefore, the FCA added that BML was “not permitted to undertake any regulated activity in the UK.”

The caution message from the regulatory body further adds,

No other entity in the Binance Group holds any form of UK authorisation, registration or licence to conduct regulated activity in the UK. The Binance Group appear to be offering UK customers a range of products and services via a website, Binance.com

Moreover, the FCA clarifies that while they do not regulate cryptocurrencies, they do, however, regulate certain products like crypto derivatives and futures that are considered “securities.”

Binance responded to this message in a tweet yesterday, noting that BML is a separate entity from Binance and does not offer any crypto-related products or services. The crypto exchange further adds,

The FCA UK notice has no direct impact on the services provided on Binance.com. Our relationship with our users has not changed.

Binance Coin price eyes higher high

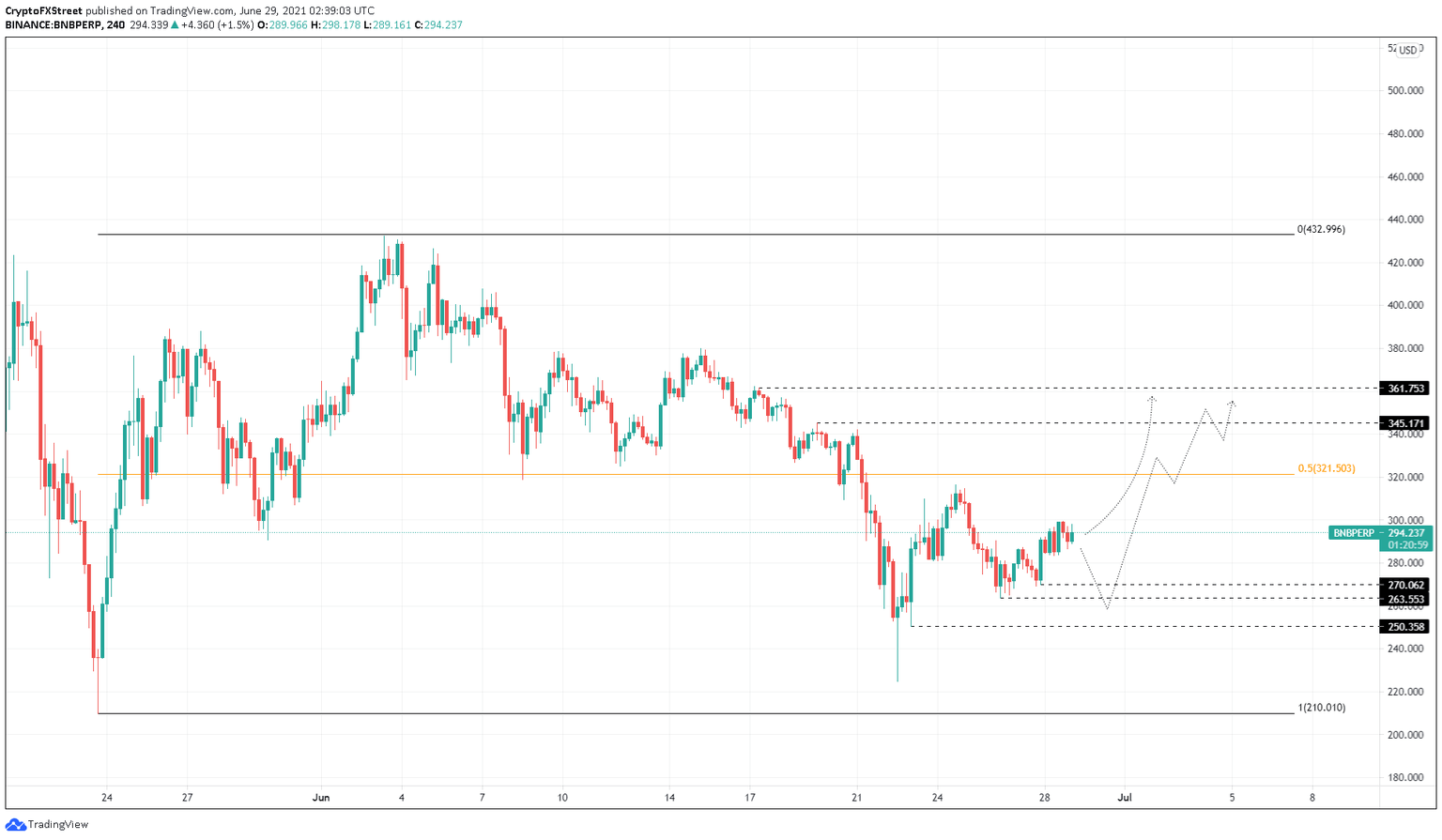

Binance Coin price shows a slow but steady climb attempting to breach the 50% Fibonacci retracement level at $321.50 after the previous failed try on June 24. While this consolidation continues, BNB is looking to ascend.

However, this move will not be straightforward. In fact, the likely course of action would be a dip below the recent swing lows at $270.06 or $263.55, followed by an uptrend. This downswing collects liquidity, allowing the market makers to push Binance Coin price higher. The likely target would be an 18% upswing to retest the midpoint of the range at $321.50.

If the bullish momentum persists, BNB might continue its rally to tag $345.17 and $361.75.

BNB/USDT 4-hour chart

On the flip side, if Binance Coin price fails to recover above $270.06 or $263.55, it will reflect the affinity to go lower.

In such a case, BNB might find support at $250.36, but a breakdown of this barrier will invalidate the bullish outlook and trigger a potential downswing to the May 22 swing low at $224.87.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.