Binance follows circle and drops USDC support on Tron

Crypto exchange Binance will cease deposit and withdrawal support for TRC-20-based USD Coin (USDC $1.00) tokens in under two weeks.

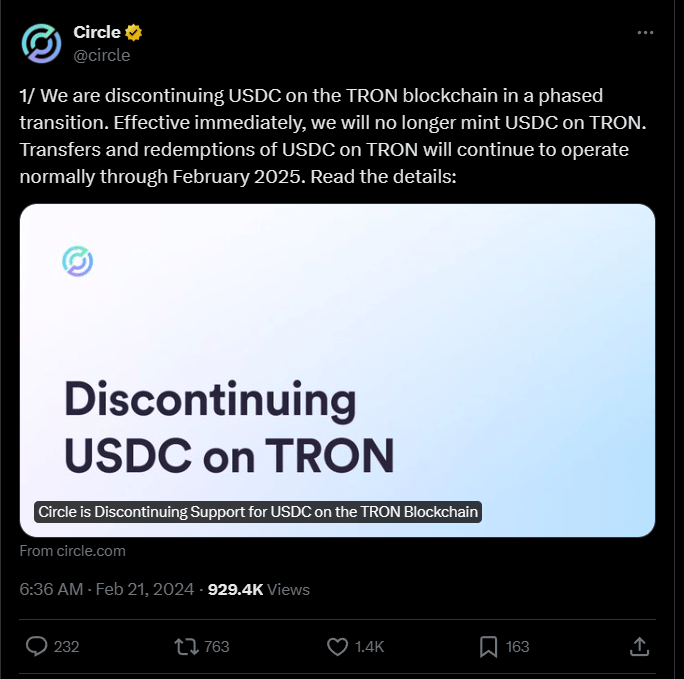

On Feb. 20, USDC issuer Circle announced plans to discontinue support for the stablecoin over the Tron blockchain, stating that the decision aligns with “efforts to ensure that USDC remains trusted, transparent and safe.”

Circle also stopped minting USDC on Justin Sun’s Tron blockchain on the same day and said it would gradually phase out support for the blockchain network entirely.

Source: Circle

Circle’s decision to discontinue support for USDC on Tron had a domino effect, as Binance — the crypto exchange with the highest trading volume — followed suit.

On March 25, Binance announced its decision to cease support for Tron’s TRC-20-based USDC deposits and withdrawals from April 5.

Crypto investors using Binance have been given 12 days to convert, transfer or cash out their TRC-20 USDC tokens from Binance. However, the exchange will continue to allow USDC trades after the deadline.

USDC deposits and withdrawals on other supported blockchains will not be affected. The crypto community on X largely supported Binance’s decision.

Source: Binance

However, Circle did not give a reason for stopping support for Tron, only saying it “continually assesses the suitability of all blockchains” as part of its risk management process.

Source: Tron DAO

Speaking to Cointelegraph at the time, a Tron spokesperson said that Tron did not receive further information from Circle on why it pulled support and was not notified in advance.

Layer-1 blockchain Tron is considering a Bitcoin (BTC $67,263) layer-2 solution that would support a “wrapped” version of Tether (USDT $1.00).

“This integration will not only link Tron directly with Bitcoin but also facilitate access to over $55 billion in value to the Bitcoin network, thereby injecting financial vitality into Bitcoin,” said Sun while announcing a roadmap for Tron’s Bitcoin layer-2 solution, which aims to allow stablecoins and tokens to move between Tron and Bitcoin.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.