Binance could be in trouble as European regulators are examining the exchange

- Binance is reportedly under a potential investigation by European regulators for its stock token offering.

- Binance has recently started to offer trading in stock tokens to users.

- Other exchanges like FTX and Bittrex already offer the option to trade stock tokens.

Binance is reportedly under scrutiny for offering stock trading through cryptocurrencies even though other exchanges have done it before through the same platform, CM-Equity.

Binance under investigation but probably not in trouble

Binance started to offer its users the ability to trade stock tokens earlier this month through the German financial services firm, CM-Equity. The exchange started with Tesla and has recently introduced COIN, the stock of Coinbase. Changpeng Zhao, CEO of Binance commented on the official release stating:

Stock tokens demonstrate how we can democratize value transfer more seamlessly, reduce friction and costs to accessibility, without compromising on compliance or security.

According to Binance, stock tokens on the exchange do not have the same weight as normal stocks as they do not give users voting rights. Additionally, these tokens are not transferable to other customers and are only settled in BUSD, a stablecoin, which is not fiat.

It is also important to note that FTX and Bittrex Global already offer practically the same service through the same company and had no trouble. Sam Bankman-Friend, CEO of FTX, stated:

No regulators anywhere have ever reached out to investigate FTX for anything.

Binance Coin price seems unfaced despite the news

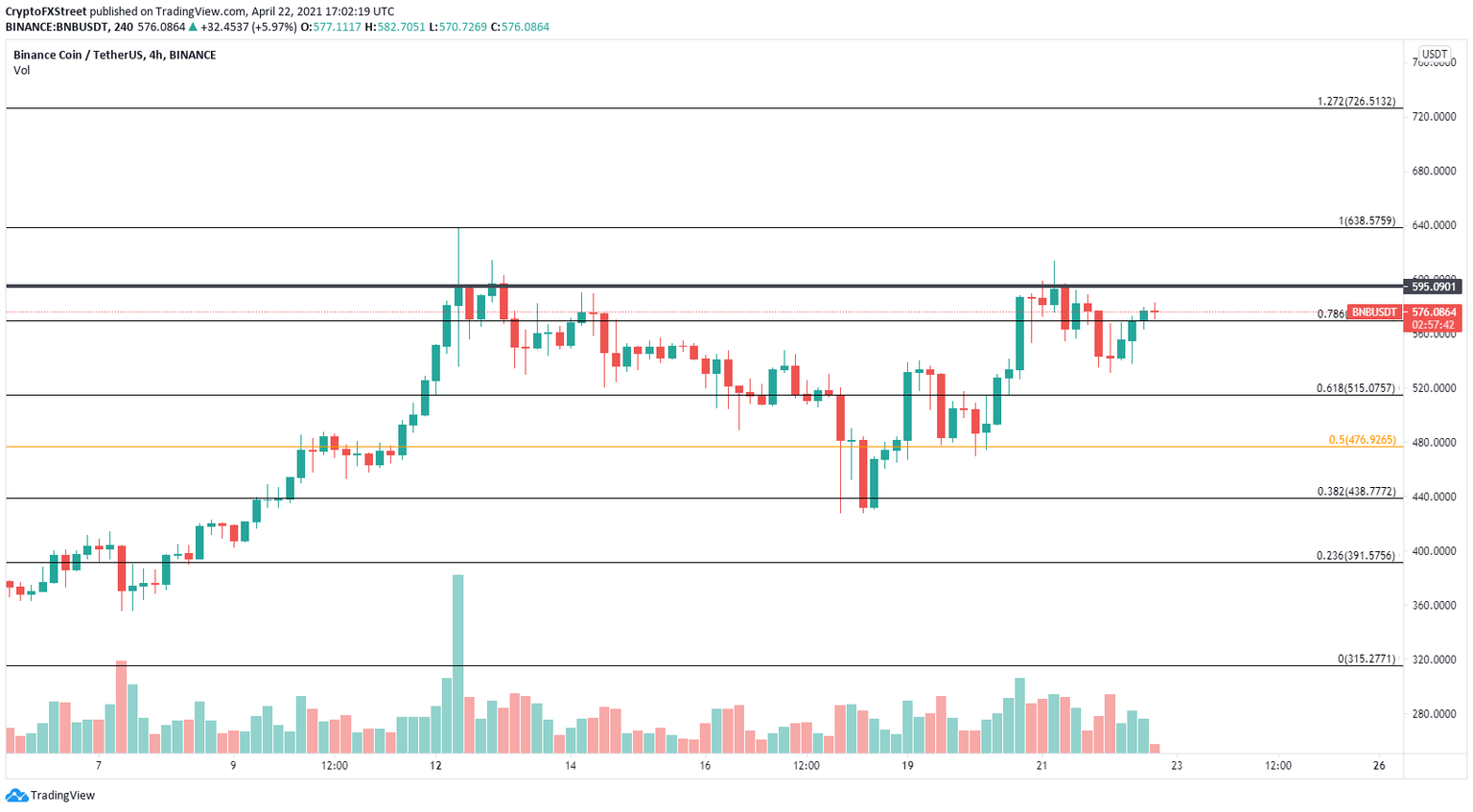

BNB is trading at $575 at the time of writing and has crossed above the 78.6% Fibonacci retracement level at $569.

BNB/USD 4-hour chart

The most significant resistance level is $595, which formed a potential double top. However, a breakout above this point can quickly drive the digital asset toward the previous all-time high of $638 and as high a $726 to the 127.2% Fibonacci level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.