Binance Coin Technical Analysis: BNB/USD eying up $27 after another breakout to $23.54

- BNB/USD is up 4% in the last 24 hours and facing very little resistance to the upside.

- The 100-EMA and the 200-EMA crossed bullishly on August 1.

Binance Coin is currently in a sturdy daily uptrend after a significant indicator crossed bullishly. The 100-EMA and the 200-EMA crossed on August 1 for the first time since March 2019. BNB is currently trading at $23.54 and only faces a crucial resistance level at $27.19, the 2020-high.

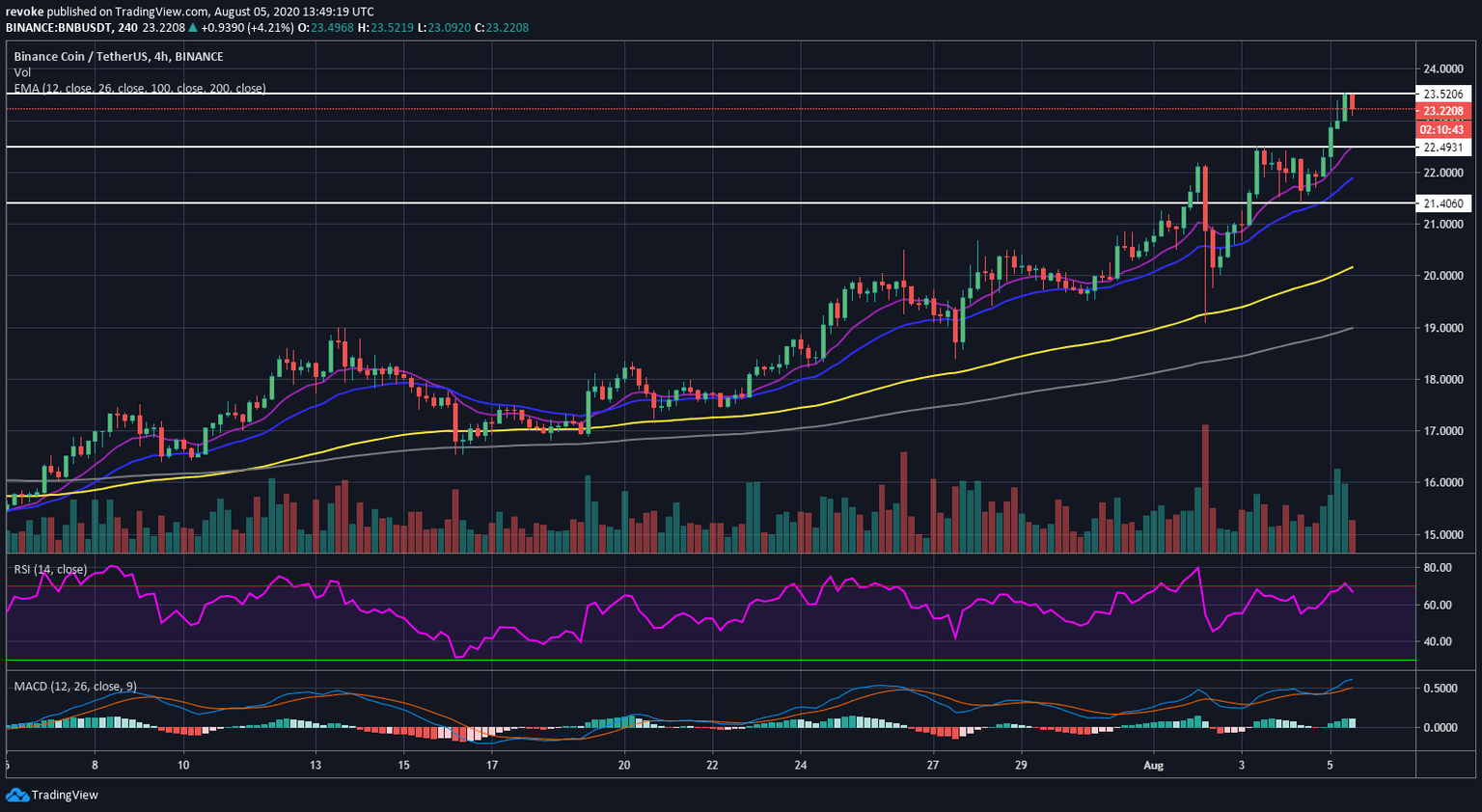

BNB/USD 4-hour chart

BNB was having a hard time breaking above $23 but the bulls managed to defend the 4-hour 12-EMA at $21.71 on August 4 and bounced above $23 peaking at $23.54 before a brief pullback. The RSI was slightly overextended while the MACD remained bullish.

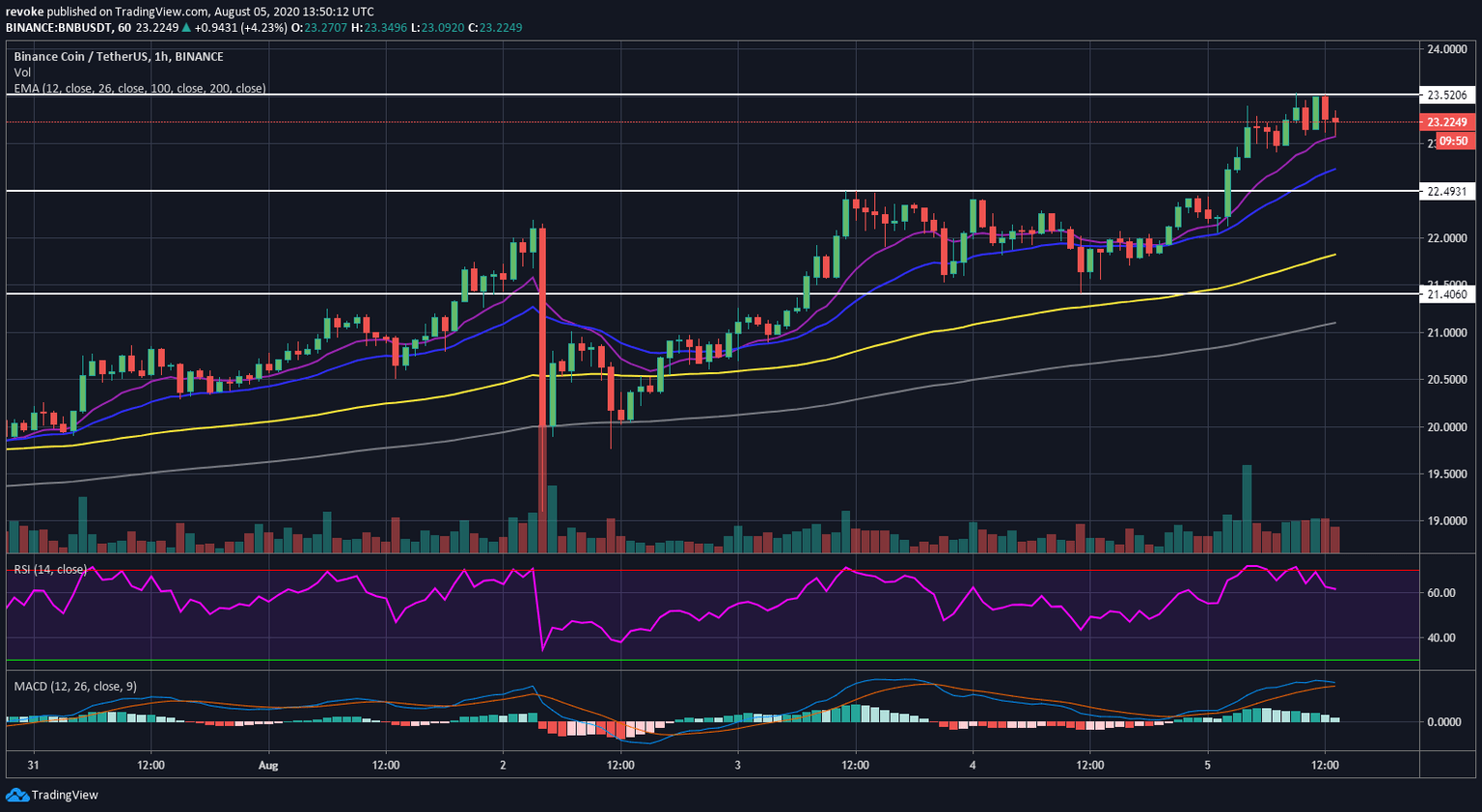

BNB/USD 1-hour chart

Buyers are defending the 12-EMA at $23.07 while the RSI is cooling off. The MACD is slowly turning bearish as BNB continues trading sideways.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.